USD/CAD Rebounds From Weekly Low, 20 & 50 EMAs Lurk In The Background As Markets Eye U.S. Retail Sales Data

- USD/CAD rebounds from a one-week low and is supported by a combination of factors

- Rising crude oil prices combined with a slew of positive Canada macroeconomics data gets overshadowed by firm hawkish fed expectations

- Markets keenly await the release of the U.S. Retail sales data, expected to show increased consumer spending in April

The USD/CAD pair attracted some buying during the mid-Asian sessions and rebounded modestly from the vicinity of the 1.34627 level/ weekly low last touched earlier in the session. As per press time, the shared currency trades in modest gains above the mid-1.34000s and looks set to maintain its bid tone heading into the European session. The U.S. dollar (USD) remained under heavy bearish pressure on Tuesday, marking a second successive day of heavy losses around the safe-haven currency as the risk of a U.S. default following a standoff between Democrats and Republicans over raising the debt ceiling showed few signs of being resolved.

Apart from this, a fresh leg down in Treasury bond yields and a weaker risk tone undermined the greenback. Signs of stability in the U.S. equity markets also contributed to driving flows away from the safe-haven greenback. Further contributing to the mood surrounding the USD/CAD pair was the goodish pickup in crude oil prices as the U.S. announced plans to purchase oil for the Strategic Petroleum Reserve, or SPR, while raging wildfires in Canada fueled supply worries. In turn, this lent support to the commodity-linked-Loonie.

A Canada Statistics report on Monday showed Wholesale sales in Canada eased by 0.1% month-over-month to CAD 86.5 billion in March of 2023, less than previous estimates of a 0.4% contraction but extending the 1.7% decline in the last month. A Monday's Canadian Mortgage and Housing report showed that housing starts in Canada rose by 22% over a month earlier to 261,600 units in April of 2023, above market expectations of 224,600 units.

That said, the combination of positive factors seems to have been greatly overshadowed to a more significant extent by firm hawkish Fed expectations as outgoing data in the U.S. continues to point to sticky inflation and a resilient job market in the U.S. Apart from this, the current debt ceiling standoff and the hawkish rhetoric from top Fed officials, followed by concerns of an economic downturn in the U.S., continue to underpin the greenback suggesting the path of least resistance for the shared currency is to the upside. A Friday University of Michigan consumer sentiment report showed escalating consumer concerns about the economy's trajectory in May alongside the proliferation of negative news about the economy, including the debt crisis standoff. The readings for May fell sharply to a six-month low of 57.7 from 63.5 in April, well below forecasts of 63. Additionally, the expectations gauge declined to 53.4 from 60.5, and the current economic conditions subindex fell to 64.5 from 68.2. That said, Fed fund futures traders are now seeing pricing in a nearly 81% chance that the Fed will hike interest rates by 25bps to 5%-5.25% during the June meeting before pivoting.

As we advance, investors look forward to the release of the April U.S. Retail sales data report, seen higher at 0.8%, up from -0.6% in March, according to preliminary readings. Excluding automobiles Core retail sales data report for April is higher at 0.4%, up from -0.4% in March.

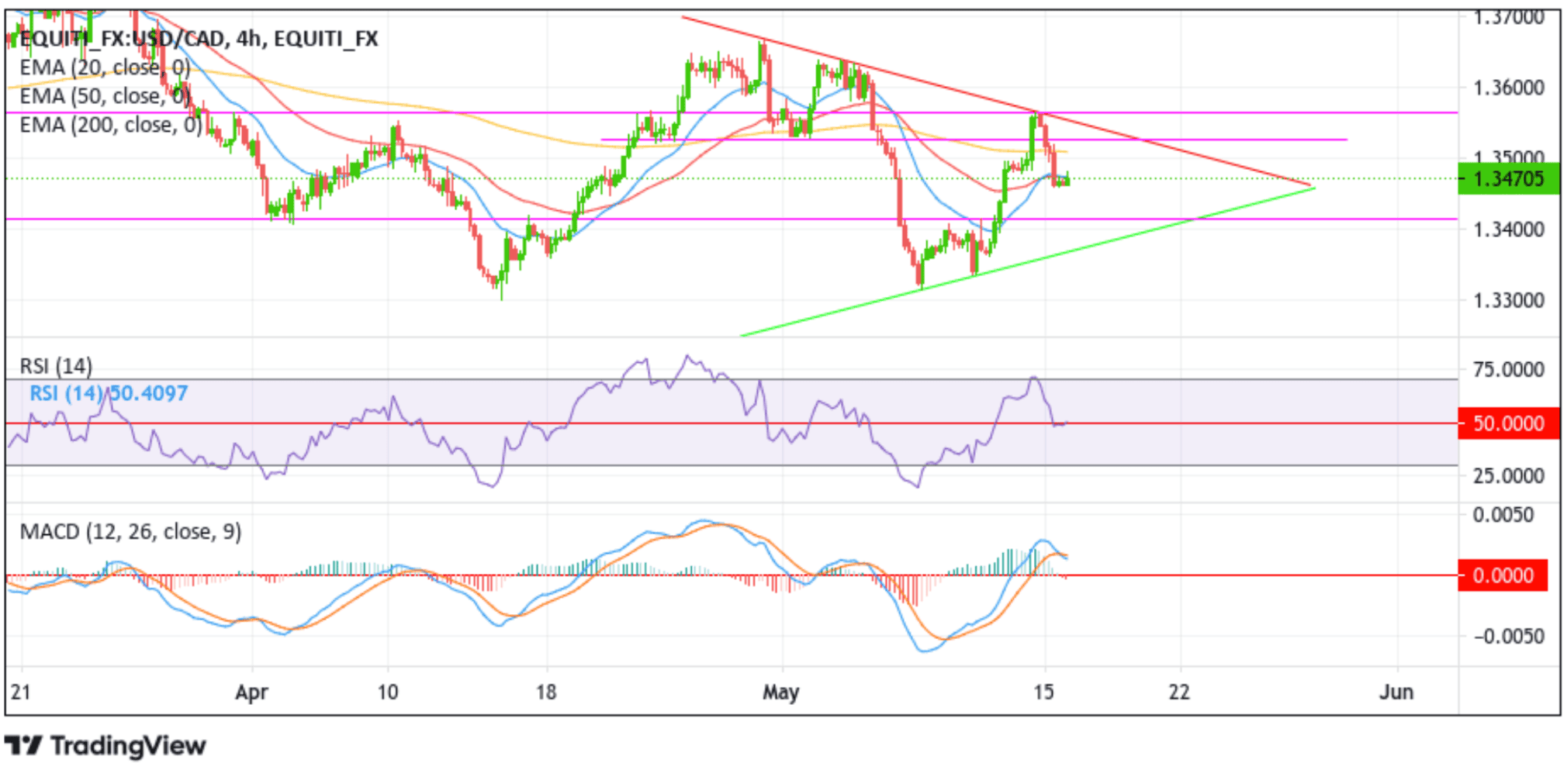

Technical Outlook: Four-Hours USD/CAD Price Chart

From a technical perspective, a further increase in buying pressure would encounter stiff resistance at the 50-day (red) and 20-day (blue) Exponential Moving Average (EMA) at 1.34746 and 1.347481 levels, respectively. If sidelined buyers join in from this seller congestion zone, it will rejuvenate the bullish momentum, provoking an extended rally toward confronting the 200-day (yellow) EMA at the 1.35087 level. Sustained strength above this level would negate any near-term bearish outlook and pave the way for an extended rally above the 1.35250 resistance level en route to the key resistance level plotted by a downward descending trendline extending from the late-April 2023 swing high. A decisive break above this (bullish price breakout) would pave the way for further northward moves targeting the 1.35635 resistance level.

On the flip side, if buyers lock in their profits, dip-sellers and tactical sellers will jump in and trigger a bearish reversal toward the 1.34132 support level. A decisive flip of this support level into a resistance level could cause the downside momentum to pick up, paving the way for a drop toward the key support level plotted by an upward ascending trendline extending from the early-May 2023 swing low. A clean break below this support level would be a fresh trigger for bears to continue pushing down the price, paving the way for further USD/CAD losses.