USD/CAD Eases From One-Week High On Softer U.S. Dollar And Rebounding Crude Oil Prices, FED's Minutes Eyed

Key Takeaways:

- USD/CAD cross eased from a one-week high, weighed by various factors

- Diminishing doubts over early interest rate cuts by the Fed weighs on the buck and helps cap the upside for the USD/CAD

- A goodish pick-up in crude oil prices supports the commodity-linked loonie and helps limit further gains

- Attention shifts towards releasing the FOMC December Meeting Minutes for fresh directional impetus

USD/CAD pair struggled to capitalize on the solid start to the year. They attracted fresh selling on Wednesday during the early part of the Asian session, easing from a one-week high/1.33337, supported by a softer U.S. dollar and a goodish pick-up in crude oil prices. As per press time, the pair is currently down 0.04% for the day but still poised to finish the week on a high note.

A fresh leg down in U.S. Treasury bond yields amid diminishing doubts over early interest rate cuts by the Federal Reserve helped the U.S. dollar trim part of its previous gains and was seen as a key factor that helped cap the upside for the USD/CAD pair. Apart from this, signs of stability in the U.S. equity markets continue to act as a headwind to the buck and prompt follow-through selling around the shared currency.

Moreover, rebounding crude oil prices on Wednesday extended further support to the commodity-linked loonie, which is also seen as another factor that helped limit further gains around the USD/CAD cross. Crude oil prices rose modestly on Wednesday, drawing support from the escalation in the Red Sea conflict over the New Year's weekend and the reported arrival of an Iranian warship on Monday.

Furthermore, the Fed is set to release the minutes of the December monetary policy meeting later today, which is expected to show that a majority of Fed officials during the last meeting favored rates staying unchanged and that the Fed was eyeing multiple rate cuts in 2024, which in turn continues to weigh on the buck.

Additionally, incoming jobs data, popularly known as Non-farm Payrolls (NFP) data, is expected to show the U.S. economy created 163K jobs in December last year compared to 199K jobs created in November, which further weighs on the buck, the path of least resistance for the pair is to the upside.

As we advance, investors look forward to the U.S. docket featuring the release of the JOLTs Job Openings (Nov) and the ISM Manufacturing PMI (Dec) data reports. The main focus, however, remains on releasing the FOMC December Meeting Minutes.

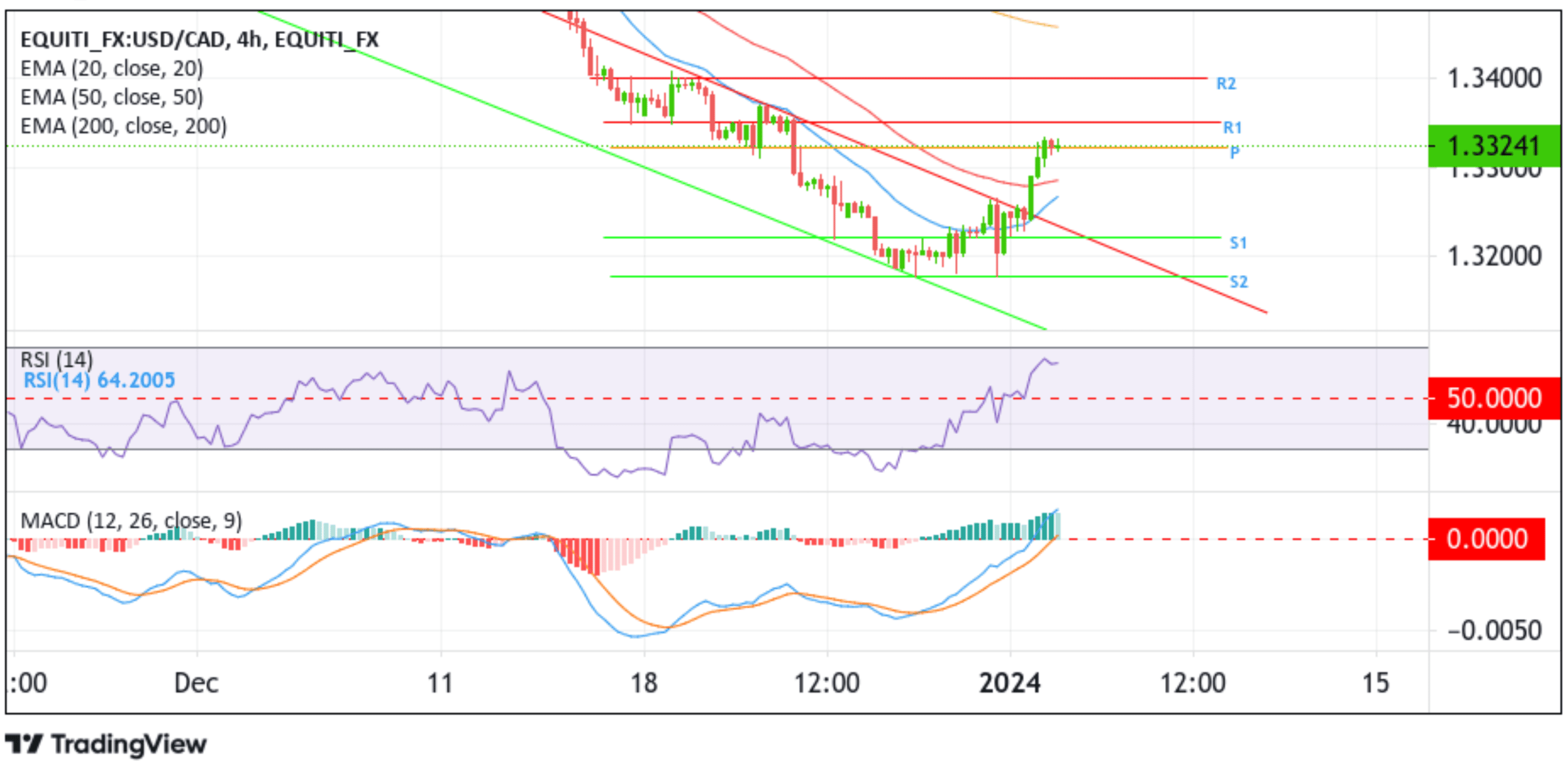

Technical Outlook: Four-Hours USD/CAD Price Chart

From a technical perspective, the price's ability to break above the upper limit of the descending channel pattern plus the subsequent acceptance above the pivot level (p), which corresponds to the 61.8% Fibonacci Retracement level at 1.33216, supports the case for further upside moves. Apart from this, all the technical oscillators on the chart—the Relative Strength Index (RSI) (14) and the Moving Average Convergence Divergence (MACD) — are all in bullish territory, suggesting the continuation of the bullish price action this week and that the current price action runs the risk of fizzling out sooner or later.

If buyers and tactical traders jump back in and trigger a bullish reversal, initial resistance appears at 1.33501. Buying interest could gain momentum if the price convincingly pierces this barrier, creating the conditions for advancing toward the 1.34007 ceilings.