USD/CNH Rises To One Month High Above 7.13000s On Sustained U.S. Dollar Buying

Key Takeaways:

- USD/CNH pair gained positive traction on Tuesday and rose to a one-month high above 7.13000

- The ongoing rise in U.S. Treasury bond yields extends support to the U.S. dollar, which in turn acts as a tailwind to the USD/CNH pair

- A batch of weak Chinese macro data released over the weekend undermines the Chinese Yuan (CNH), which helps keep a lid on further downside moves

USD/CNH cross attracted some dip-buying from the vicinity of the 7.1120 level on Tuesday during the Mid-Asian session and lifted spot prices to a fresh daily high/monthly high to kick off the new year on the right foot. The pair is now trading at $7.13036, posting a 0.26% daily gain, and looks set to maintain its offered tone heading into the European session amid the prevalent tone surrounding the greenback.

The ongoing rise in U.S. Treasury bond yields assisted the U.S. dollar in attracting some dip-buying on Tuesday during the mid-Asian session and turned out to be a key factor that underpinned the USD/CNH pair. Apart from this, the modest rebound in the U.S. equity markets also turned out to be another factor acting as a tailwind for the safe-haven greenback and helping cap the downside for the USD/CNH cross.

Moreover, a batch of weak Chinese macro data released over the weekend continues to undermine the Yuan and drive flows toward the buck, thereby helping exert upward pressure on the USD/CNH pair.

The official manufacturing purchasing managers index declined to 49, the National Bureau of Statistics said in a statement on Sunday. That was weaker than the median.

The forecast of 49.6 by economists in a Bloomberg survey matched the reading seen in June. A gauge of non-manufacturing activity rose to 50.4 from 50.2 in November, boosted by expansion in the construction sector as government-led infrastructure investment accelerated in recent months. Services activity, however, remained in contraction, with an underlying measure staying at 49.3.

Despite the combination of supporting factors, the buck continues to face heavy headwinds from firm market expectations that the U.S. Federal Reserve will soon begin cutting interest rates. The bets were reaffirmed after the Federal Reserve’s preferred measure of inflation, Core PCE prices in the U.S., fell to 0.1% in November against market consensus of a 0.2% rise. CME’s Fed watch tool shows that Fed fund futures traders have priced in a 73.4% chance for a 25bps rate cut in March 2024. This, in turn, suggests the path of least resistance for the USD/CNH cross is to the upside.

As we advance, without any significant market-moving economic news data, the Treasury bond yields and the general market risk sentiment will continue to influence U.S. dollar dynamics and ultimately provide directional impetus to the USD/CNH cross.

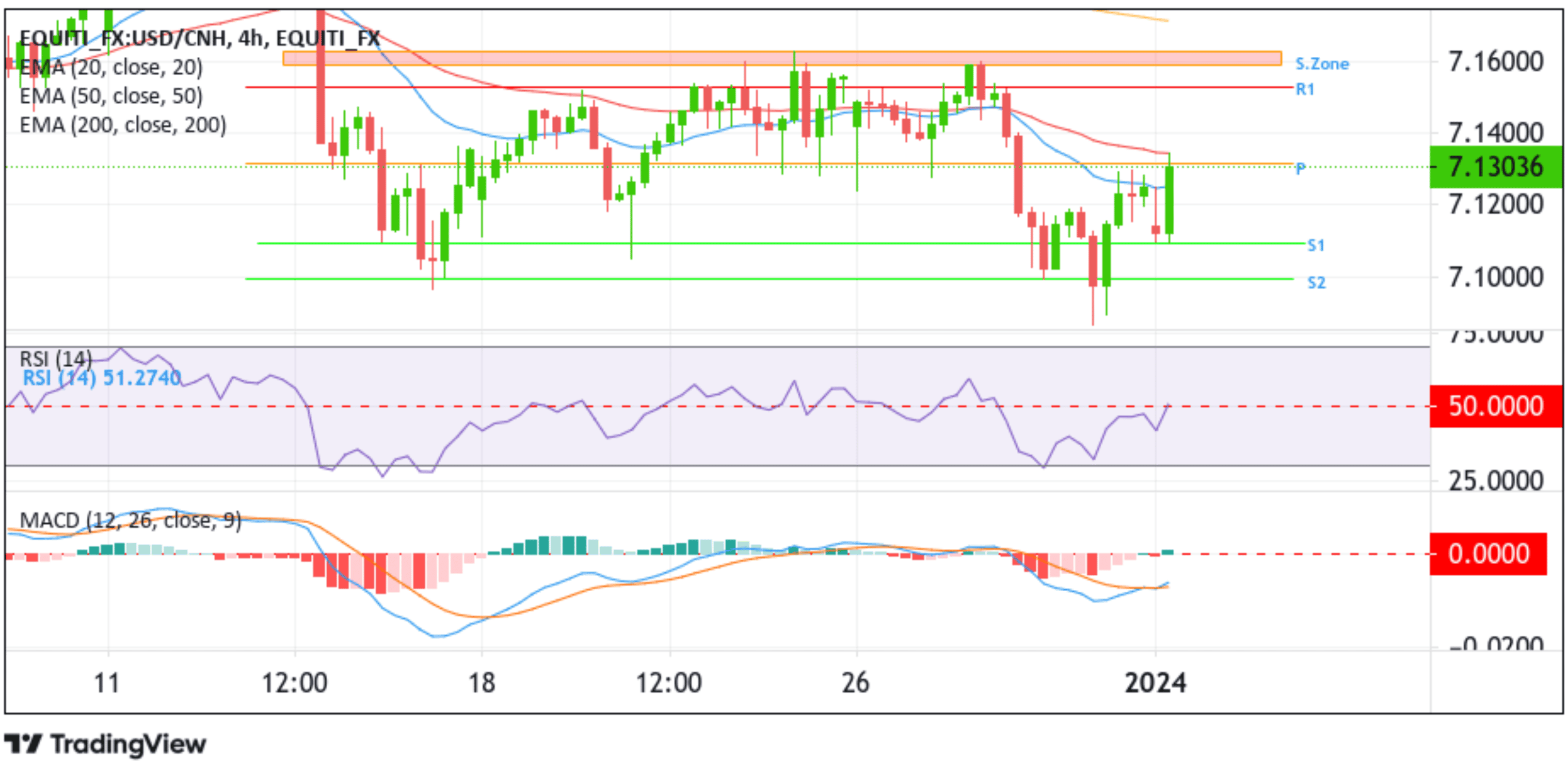

Technical Outlook: Four-Hours USD/CNH Price Chart

From a technical standpoint, the USD/CNH pair found support at the 7.10913 level (S1) and rose modestly, taking over 7.13000s during the Mid-Asian session. As of press time, the price sits directly below the critical pivot level (p) at 7.13187, corresponding to the 61.8% fib level (golden fib). A convincing move above this level in the coming sessions will act as a fresh trigger for new bulls to jump in, paving the way for an accelerated move toward the 7.15299 level (R1), followed by the supply zone ranging from 7.16322 - 7.15884 levels. Sustained strength above these barricades could see the bullish trajectory extend toward confronting the technically strong 200-day (yellow) Exponential Moving Average (EMA) level at 7.17096. If buyers find acceptance above this level, the USD/CNH cross could rise to new heights, paving the way for more gains around the shared currency.

On the flip side, if sellers resurface and spark a bearish turnaround, initial support comes in at 7.10913 level (S1). On further weakness, the focus shifts lower to 7.09922 level (S2).