USD/CNH Clings To Upbeat Chinese Macrodata And Moves Back Above 7.2000s Level, U.S. Fed Interest Rate Decision Awaited

Key Takeaways:

- The offshore Yuan (CNH) rose to around 7.208 per dollar on Monday during the Asian session

- A fresh round of positive Chinese macro data underpins the Yuan and helps cap the downside for the USD/CNH cross

- A modest bounce in U.S. Treasury bond yields helped revive the U.S. dollar supply, which was a tailwind to the USD/CNH pair

- Markets look forward to the U.S. Fed's interest rate decision slated for Wednesday

The offshore Yuan (CNH) rose to around 7.208 per dollar on Monday during the Asian session, moving further away from a six-week low as investors reacted to a slew of positive Chinese macro data released earlier today. The exotic currency pair, however, failed to sustain the bullish momentum and rebound from the daily high and was last seen trading with only modest gains, just above 7.02300s heading into the European session.

A National Bureau of Statistics of China report released earlier today showed China's industrial production expanded by 7.0% year-on-year in January-February 2024 combined, faster than a 6.8% growth in December 2023 and beating market forecasts of 5%. It was the fastest expansion in industrial output in almost two years, boosted by robust activities in manufacturing (7.7% vs 7.1% in December) and utilities (7.9% vs 7.3%), while mining continued to rise (2.3% vs 4.7%). Every month, industrial output grew by 0.56%.

Additionally, China's fixed-asset investment grew by 4.2% year-on-year in January-February 2024, beating market forecasts of 3.2%. Investment in the secondary sector accelerated (11.9% vs 9.0% in December), driven by growth in electricity, heat, gas, and water (25.3%) and mining (14.4%).

To a greater extent, the better-than-expected Chinese industrial production and fixed asset investment data figures overshadowed an uptick in the urban unemployment rate in China.

Further contributing to the sentiment around the exotic currency pair was the modest bounce in U.S. Treasury bond yields, which helped revive the U.S. dollar supply and, in turn, helped exert upward pressure on the USD/CNH pair.

The U.S. dollar index, which measures the greenback against a basket of currencies, continues to be weighed down by a batch of disappointing macro data released late last week. The University of Michigan consumer sentiment for the U.S. increased to 76.5 in March 2024, the lowest in three months, from 76.9 in February and below forecasts of 76.9. Additionally, year-on-year, industrial production in the U.S. edged 0.2% lower in February, following a revised 0.3% fall in January.

Despite the combination of negative factors, the USD/CNH pair upside seems limited as the U.S. dollar continues to draw support from firm market expectations that the Fed will leave rates unchanged during the March and May meetings and start cutting rates during the third quarter of 2024.

This comes after a U.S. Bureau of Labor Statistics (BLS) report released last week showed back-to-back hot U.S. consumer and wholesale inflation readings pointing to sticky inflation in the U.S. and suggested that the Fed will now have to wait further before cutting rates.

Moreover, a U.S. Department of Labor report showed that the number of people claiming unemployment benefits in the U.S. fell by 1,000 to 209,000 in the week ended March 8, 2024, below market expectations of 218,000. The substantial job numbers match last week's NFP numbers in underscoring the historical tightness of the U.S. labor market, adding leeway for the Federal Reserve to prolong its hawkish stance into 2024, if necessary, to lower inflation.

That said, CME's Fed watch tool also shows that Fed fund futures traders have priced at a 99.0% and 85.5% chance, respectively, of the Fed leaving rates unchanged at 5.25 – 5.5% during the March and May meetings.

As we advance, without any significant market-moving economic news data, the Treasury bond yields and general market risk sentiment will continue to influence U.S. dollar dynamics and ultimately provide directional impetus to the USD/CNH cross. The main focus, however, remains on this week's Fes interest decision, slated for Wednesday.

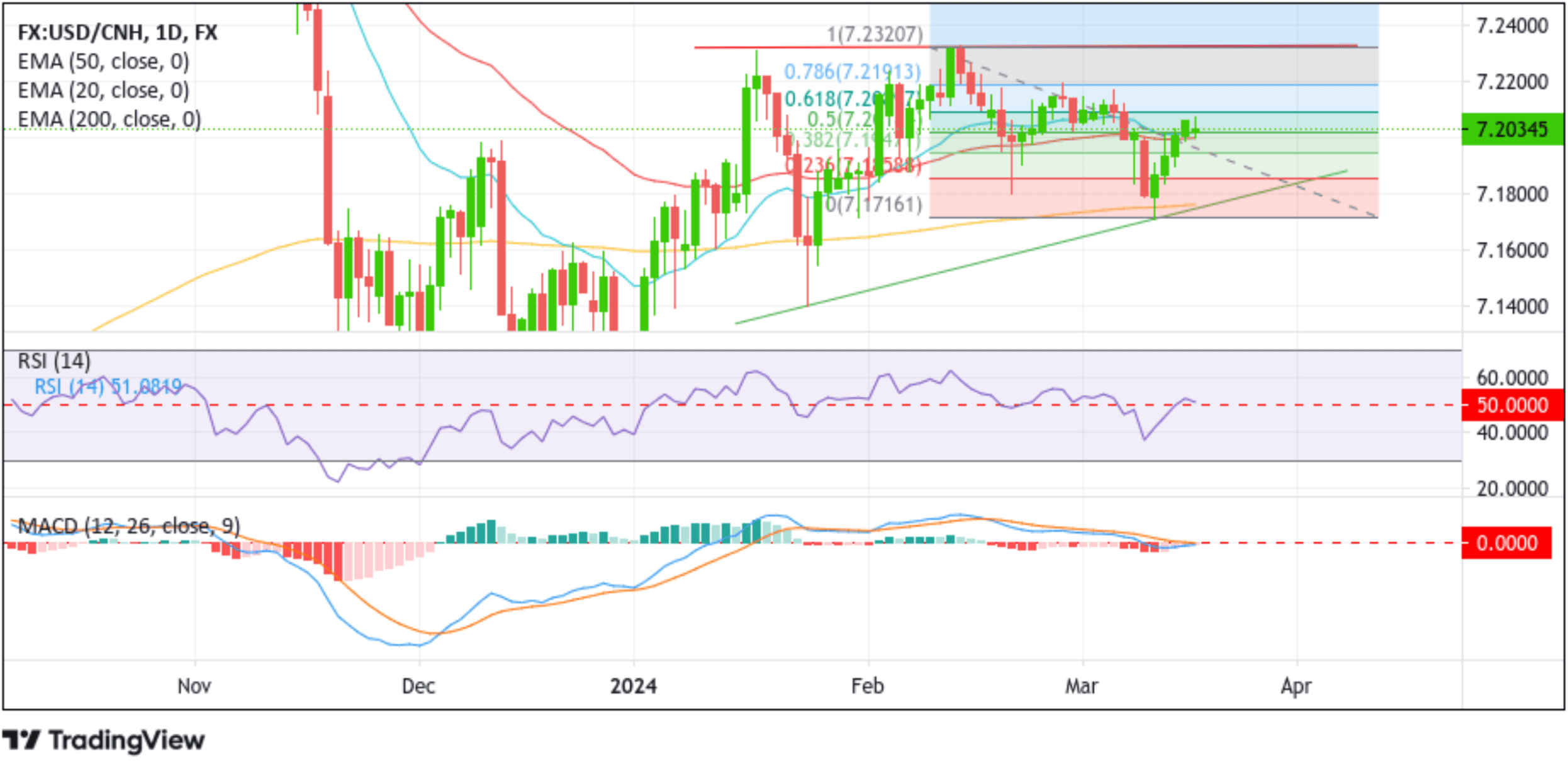

Technical Outlook: One-day USD/CNH Price Chart

After breaking above cluster resistance in the 7.18831/7.19194 area, the exotic currency rose further, with prices now sitting directly below the 61.8% Fibonacci retracement level of the March 12 to 18th March recovery at the 7.20897 level. If the price pierces this fundamental level, buying interest could gain further momentum, paving the way for an ascent toward the 7.21491 level (R1), which would act as a hurdle against further USD/CNH upticks. A decisive move above this level would pave the way for a further extension of the bullish trajectory toward the 7.22514 - 7.22285 supply zone. In highly bullish cases, the USD/CNH cross could extend a neck toward the 7.23356 critical resistance level.

On the flip side, if sellers resurface and spark a bearish turnaround, initial support comes in at the 7.1992 level, which coincides with the 50-day (red) EMA. Acceptance below this level will pave the way for a drop toward the 7.18831/7.19194 area. Sustained weakness below this area will pave the way for a move toward the 7.18140 support level (S2), below which the price could accelerate its downfall toward the key support level plotted by an upward ascending trendline extending from the late-January 2024 swing lower-lows.