USD/CAD Settles Above 1.35700 On Rising Crude Oil Prices And A Muted U.S. Dollar, U.S. Initial Jobless Claims Data Awaited

Key Takeaways:

- USD/CAD pair rises for a second consecutive day, supported by a combination of factors

- Rising crude oil prices extend heavy support to the commodity-linked Loonie

- A muted U.S. dollar, weighed by renewed bets of incoming rate cuts this year, underpins the USD/CAD cross

- Markets await the release of the U.S. initial jobless claims data report for fresh USD/CAD directional impetus

USD/CAD pair built on its goodish bounce from the vicinity of the 1.35153 level touched on Monday and rose above 1.35700 on Tuesday during the Asian session to mark a second consecutive day of positive gains. The current price action helps the shared currency recover.

It lost glory following last week's heavy losses and takes spot prices near the key supply zone, which ranges from 1.36151 to 1.36066.

There has been a goodish bounce in crude oil prices as bets for tighter supply in 2024 continue to support the commodity-linked Loonie. This comes amid further pledges by leading oil-producing countries to cut their oil supply. Russia, a leading major oil producer and a member of the Organization of Petroleum Exporting Countries (OPEC), announced this on Tuesday last week. It will cut its crude oil supply despite low oil levels following a series of attacks on its major oil-producing fields.

Furthermore, little signs of de-escalation of the Israel-Hamas war and the Houthi attacks on ships in the Red Sea continue to threaten global peace and, instead, global crude oil supply, a scenario that continues to extend support to crude oil prices.

That said, the softer tone around the greenback amid renewed bets that the Fed will cut rates this year was another factor underpinning the USD/CAD cross. The bets were raised following Friday's better-than-expected U.S. Core (PCE) data, the Fed's preferred inflation gauge. The annual core PCE inflation rate in the U.S. slowed to 2.8% in February 2024, the lowest in about three years, from 2.9% in January and matching market expectations, a U.S. Bureau of Economic Analysis report showed.

Further contributing to the mood around the greenback and helping underpin the USD/CAD pair was the fresh disappointing U.S. macro data, which showed the S&P Global U.S. Manufacturing PMI was revised lower to 51.9 in March 2024 from a preliminary of 52.5, and compared to 52.2 in February.

As we advance, investors look forward to the U.S. docket featuring the release of the U.S. Initial Jobless Claims Data report. The main focus, however, remains on the Fed Chair, Powell's speech slated for release on Wednesday, and the U.S. monthly jobs report, popularly known as Non-Farm Payrolls (NFP), on Friday.

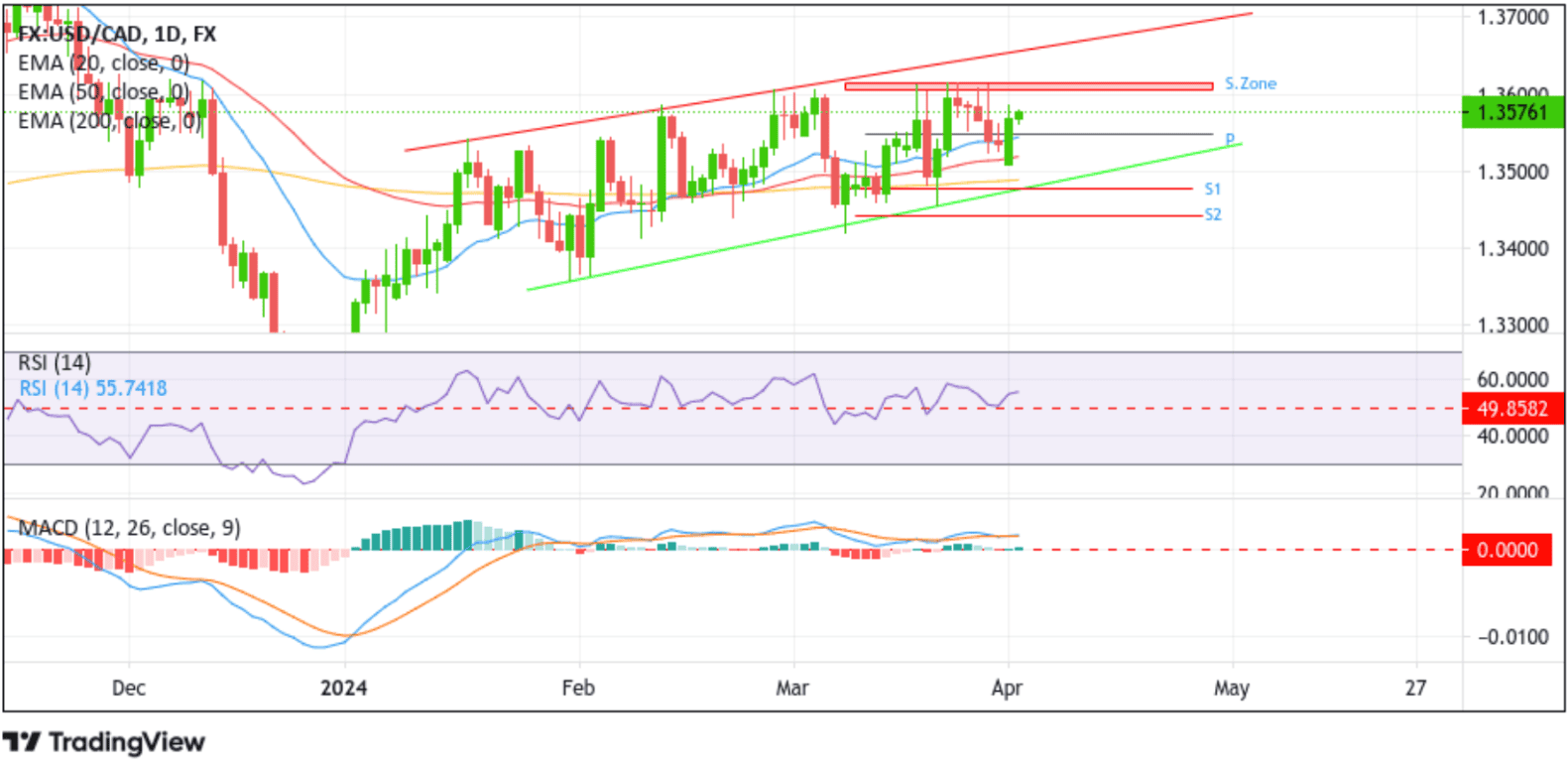

Technical Outlook: One Day USD/CAD Price Chart

Looking at USD/CAD's one-day price chart, the shared currency is portraying a bullish picture and is well placed above the late 1.3500s following an extension of the modest bounce from the vicinity of the 1.35153 level touched on Monday. A subsequent increase in buying pressure in the coming sessions would uplift spot prices toward the key supply zone, ranging from 1.36151 to 1.36066. Sustained strength above this zone would reaffirm the bullish thesis and pave the way for more gains around the shared currency.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial support comes at 1.35523 (P). A convincing move below this level would pave the way for further selling around the USD/CAD pair. The shared currency could then drop further to tag the 20-day (blue) EMA level at 1.35433, followed by the 50-day (red) EMA level at 1.35186 before moving to retest the key support level plotted by an ascending trendline extending from the mid-February 2024 swing lower-lows. A breach below this level, followed by acceptance below the technically strong 200-day (yellow) EMA level at 1.34785, would negate the near-term bullish outlook and pave the way for aggressive technical selling around the USD/CAD pair.