UK Brent Crude Oil Rises For A Second Consecutive Day Supported By Bets For Tighter Supply In 2024 And A Softer U.S. Dollar

Key Takeaways:

- The UK Brent crude oil futures rose modestly on Thursday during the Asian session to trade above $85.800 a barrel

- Bets for tighter supply in 2024 lend heavy support to crude oil prices

- A softer U.S. dollar across the board extends support for crude oil prices

UK Brent crude oil futures rose modestly on Thursday during the Asian session, extending gains for the sixth successive session and the second consecutive day. Bets on tighter supply in 2024 supported crude oil prices as investors continued to assess the latest crude oil stock change data.

As of press time, Brent crude oil futures rose 15 cents (0.18%) to trade at $85.805 per barrel, shy of its session high of $85.93. Brent crude oil price remains on course for its third weekly gain despite a mixed week influenced by mixed U.S. dollar fundamentals.

Tighter Supplies

News of further supply cuts by major oil-producing nations in 2024 continues to support crude oil prices. Brent is up 11% over the last three months as ongoing production curbs by Russia, Saudi Arabia, and other members of the Organization of Petroleum Exporting Countries (OPEC) paint a tighter outlook for crude oil markets. Recently, Russia announced further crude oil supply cuts despite low crude oil levels following a series of attacks on its major oil-producing fields.

Furthermore, little signs of de-escalation of the Israel-Hamas war and the Houthi attacks on Ships in the Red Sea threatened global peace and rather global crude oil supply, a scenario that continues to extend support to crude oil prices.

U.S. Crude Inventories Unexpectedly Rise: EIA

Data from the EIA Petroleum Status Report showed that crude oil inventories in the U.S. rose by 3.165 million barrels in the week ended March 22, 2024, defying market expectations of a 1.275 million decrease.

Gasoline stocks increased by 1.299 million, against forecasts of a 1.65 million fall. Distillate stockpiles, which include diesel and heating oil, went down by 1.185 million barrels, compared with the consensus of a 518 thousand rise.

The data pointed to reduced demand for crude oil, which weighed on prices.

Softer U.S. Dollar

A softer tone around U.S. Treasury bond yields, weighed by renewed bets that the Fed will cut rates this year, acts as a headwind to the greenback and is another factor underpinning crude oil prices.

Despite this, the upside seems limited as the greenback continues to draw support from increased bets that the Fed will have to wait further before starting to cut rates.

This comes after a U.S. Census Bureau report released on Tuesday showed new orders for manufactured durable goods in the United States rose by 1.4% month-over-month in February 2024, more than market expectations of a 1.1% increase and after a downwardly revised 6.9% fall in January. Excluding transportation, new orders increased by 0.5%. Excluding defence, new orders increased 2.2%.

This, along with the hot U.S. consumer and wholesale inflation readings combined with the tight U.S. labor market, suggests that the Fed might be forced to leave rates higher for longer to rein in inflation in the U.S.

In light of this, markets also seem convinced that the Fed will leave rates unchanged during the May meeting. This was evident from CME's Fed watch tool, which now shows Fed fund futures traders have priced in an 89.1% chance the Fed will leave rates unchanged at 5.25–5.5% during the May meeting, up from an 85.5 % chance one week ago.

Despite this, the greenback, which is 1.2% down for the month, continues to face heavy headwinds stemming from growing expectations that the Fed will cut rates this year. This follows Fed Chair Powell's dovish comments before the Joint Economic Committee in Washington, DC, earlier last month, in which he reiterated that rate cuts are on the table this year. The bets were further raised after a mixed U.S. jobs report released on Friday.

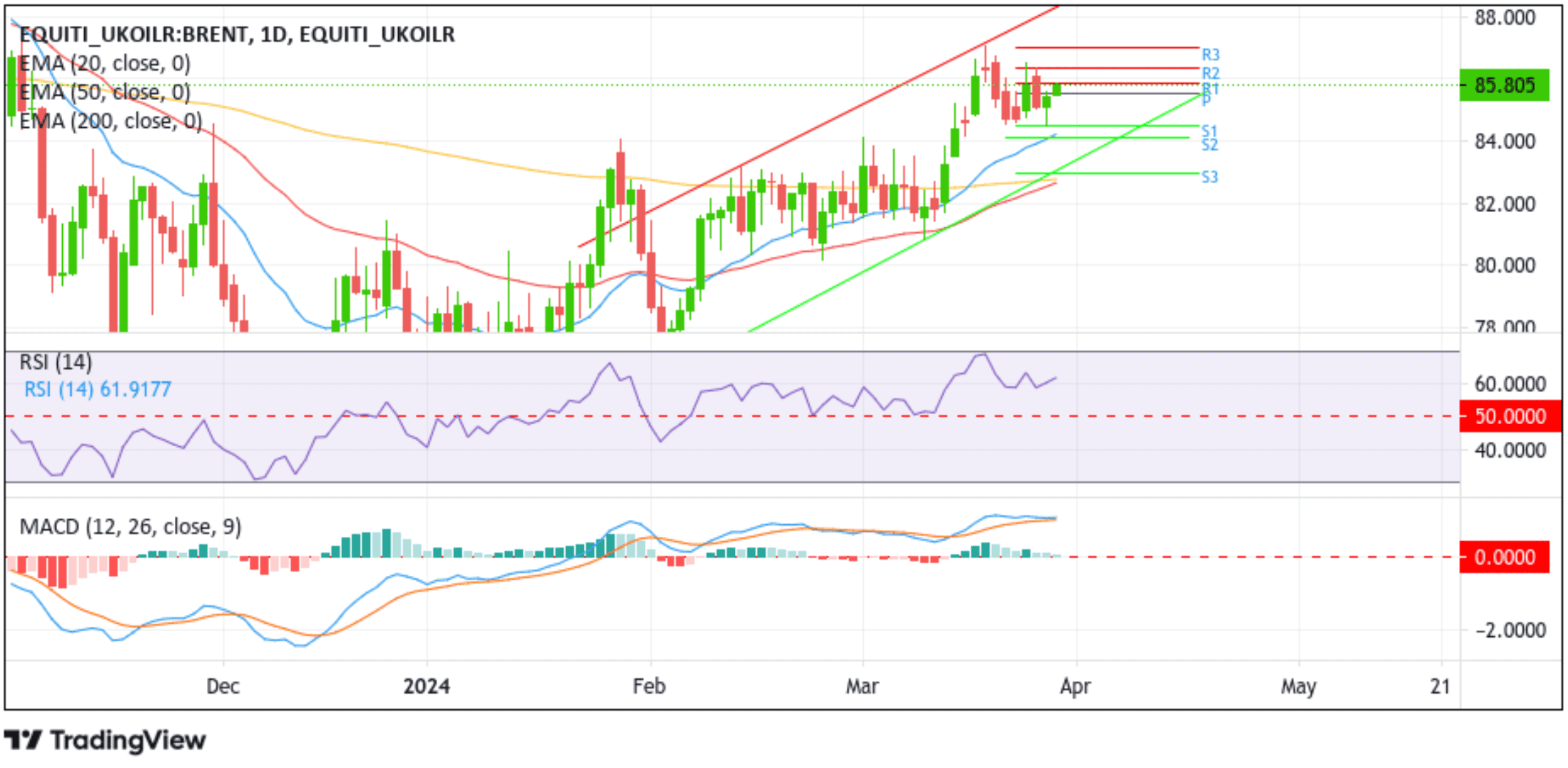

Technical Outlook: One-Day UK Brent Crude Oil Price Chart

From a technical standstill, Brent crude oil price is now placed below a key resistance level (85.880 level) following a spirited comeback in the last five trading sessions. A clean move above the aforementioned barricade would catapult a move toward the 86.370 hurdles (R2). On further strength, Brent oil price could rise further toward the 87.000 psychological mark, above which focus would shift higher toward the 87.000 psychological mark, and in extreme bullish cases, the black liquid could aim for a retest of the key resistance level (upper limit of the multi-week ascending channel pattern).

On the flip side, if dip-sellers and tactical traders resurface and spark a bearish reversal, initial support comes in at the 85.509 pivot level (P). A convincing move below this level will pave the way for an accelerated drop toward the 84.469 support level (S1). On further weakness, Brent oil price could drop toward the 84.103 support level (S2), about which, if this level fails to hold, the black liquid price could fall further toward the key support level ((lower limit of the multi-week ascending channel pattern). A clean break below this level will pave the way for further selling around the dollar denominated commodity.