NZD/USD Slides Back To 0.60100 Levels Ahead Of U.S. PPI Report Release And Jerome Powell's Speech

Key Takeaways:

- NZD/USD meets with fresh supply during the mid-Asian session amid modest USD strength

- Better-than-expected NZ electronic card retail sales report gets overshadowed by a stronger U.S. dollar supported by hawkish Fed expectations

- Retreating U.S. treasury bond yields might help limit further downside around the NZD/USD cross

- Markets await the release of the U.S. wholesale inflation report and Powell's speech

NZD/USD pair struggled to capitalize on its session's earlier goodish bounce from the vicinity of the $0.60108 level. They witnessed fresh supply during the mid-Asian session and dragged spot prices below the $0.60100 level before later paring gains and moving back to settle around mid-0.60100 heading into the European session.

The catalyst for today's Kiwi earlier session's goodish bounce could be attributed to the better-than-expected N.Z. electronic card retail sales report, which most analysts consider to give hints of the strength of the retail sector and ultimately influence the Reserve Bank of New Zealand interest rate A Statistics New Zealand report released earlier today showed electronic card transactions in New Zealand dipped by 0.4% month-on-month on a seasonally adjusted basis. The decline slowed the pace of contraction from the previous month's -0.7%, but the annualized figure decelerated further in April by 3.8%, compared to a 2.3% drop in March.

However, the Kiwi's attempted pullback was short-lived amid a stronger U.S. dollar supported by hawkish Fed expectations. The U.S. Dollar index (DXY), which measures the value of USD against a basket of currencies, appreciated towards $105.290 on Tuesday during the Asian trading session as bets the Fed would cut rates late in 2024 continued to extend support to the safe-haven asset.

The odds of a late rate cut have increased following last Friday's downbeat University of Michigan survey report, which showed U.S. consumer sentiment dropped to a six-month low in May. Furthermore, the survey's reading of one-year inflation expectations rose to 3.5% in May from 3.2% in April, remaining above the 2.3% - 3.0% range seen in the two years before the COVID-19 pandemic, suggesting the Fed could be forced to maintain its hawkish stance through 2024 at a time when Federal Reserve policymakers continue to advocate for higher interest rates in the face of persistent inflationary pressures.

Despite this, retreating U.S. treasury bond yields might help limit further downside around the NZD/USD cross. This comes as investors seem to have decided to stay on the side-lines before releasing the critical U.S. wholesale inflation report (PPI-Producer Price Inflation) later in the day. According to a preliminary report, producer prices in the U.S. are expected to have risen to 0.3% last month from 0.2% in March.

Additionally, U.S. Federal Reserve Chairman Jerome Powell is expected to speak later today during the mid-North American session. Traders will monitor closely how hawkish or dovish his language about future monetary policies is.

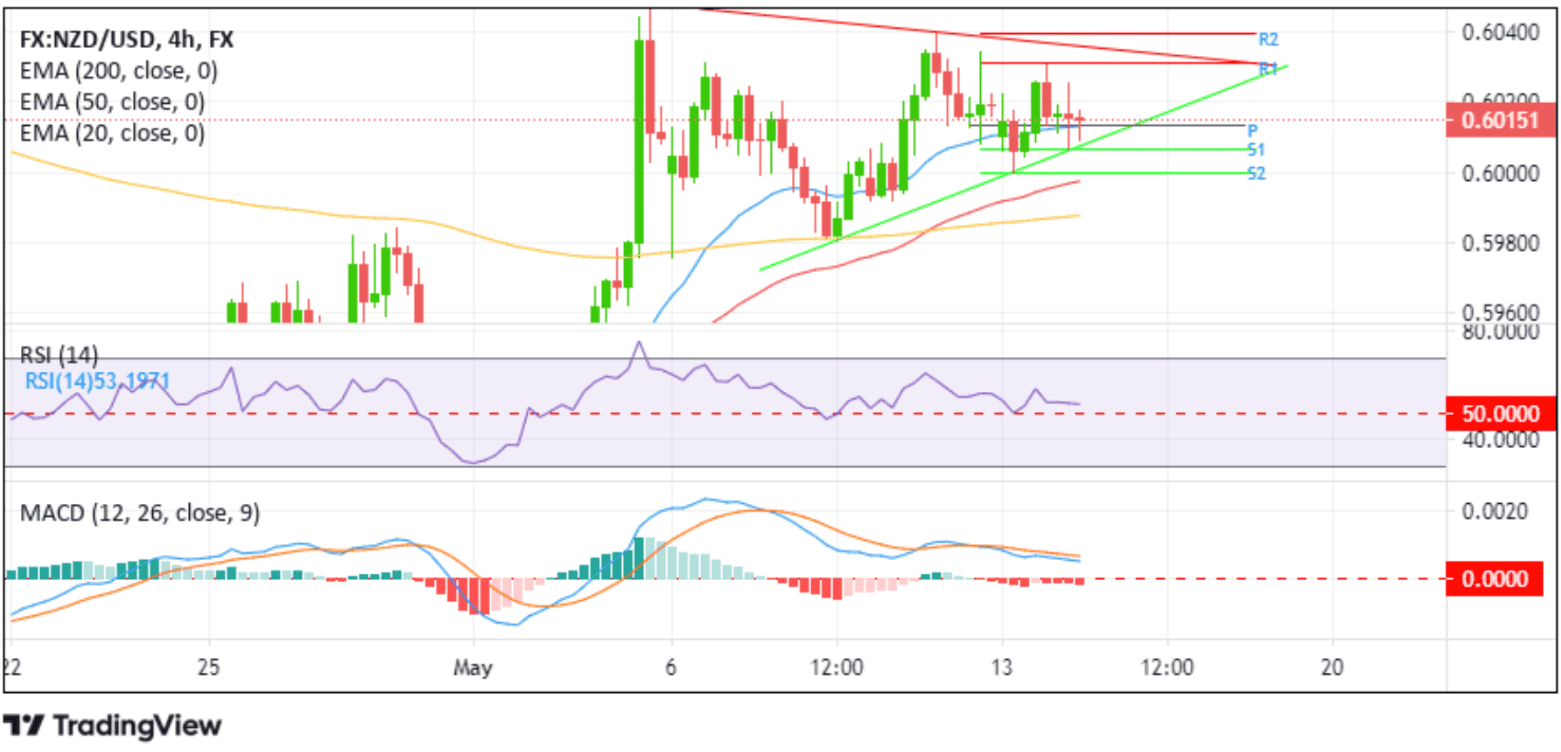

Technical Outlook: Four-Hours NZD/USD Price Chart

From a technical perspective, the NZD/USD cross is currently trading above the 0.60136 level. The pivot level (P) sits directly above the critical support level of the Bullish Pennant chart pattern extending from the early May 2024 swing lower-lows. The support above level should lend support to spot prices in case of further selling in the coming sessions. Apart from this, the technical oscillators on the chart are in positive territory and support the case for further buying this week, lending crucial support to the central currency pair. If buyers resurface and spark a bullish reversal, the first resistance level is at $0.60304. If the price pierces this barrier, buying interest could gain further momentum, paving the way for a rise toward the key resistance level of the Bullish Pennant chart pattern extending from the early May 2024 swing to higher highs. A clean move above this level would affirm the bullish bias and pave the way for extended gains around the major currency pair. The NZD/USD cross could then rise to retest the $0.60396 resistance level (R2), about which, if the price breaks decisively above this level, this would prompt a rise toward the 0.60479 - 0.60441 supply zone.

On the flip side, if selling pressure persists in the coming sessions and sellers manage to breach the lower level of the Bullish Pennant chart pattern, downside pressure could accelerate, paving the way for a drop toward the $0.60068 support level. On further weakness, the focus shifts toward the $0.60000 psychological mark en route to the 0.59996 level (S2).