USD/CAD Eases Further Below 1.35400s Amid Fresh U.S. Dollar Supply, Powell's Remarks At Wyoming Eyed

Key Takeaways:

- USD/CAD pair moves further below 1.35400, weighed by a combination of factors

- Retreating Treasury bond yields undermine the greenback, which in turn helps cap the upside for the USD/CAD cross

- A goodish bounce in crude oil prices plus prospects of another interest rate increase by the BoC offer support to the loonie

- The markets focus remains on Fed Chair Jerome Powell's remarks at the three-day Jackson Hole Symposium in Wyoming

The USD/CAD cross extended the overnight bounce from the vicinity of the 1.35643 level and witnessed selling for the third consecutive session on Wednesday. As of press time, the shared currency trades with modest losses below 1.35400 amid a fresh U.S. dollar supply.

A fresh leg down in U.S. Treasury Bond Yields and a weaker risk tone undermined the safe-haven greenback, which was a key factor that acted as a headwind to the USD/CAD pair. Additionally, a goodish rebound in the U.S. equity markets undermined the greenback and helped cap the USD/CAD pair against further upticks. Apart from these, a National Association of Realtors report on Tuesday showed Existing-home sales in the United States dropped 2.2% from a month earlier to a seasonally adjusted annualized rate of 4.07 million units in July 2023, the lowest level since January and below market expectations of 4.15 million. Year-over-year, sales slumped 16.6%. In turn, this was a contributing factor that acted as a headwind to the greenback and helped limit further gains for the USD/CAD cross.

Further weighing on the greenback is the goodish bounce in crude oil prices as markets weighed weak demand indicators from top importer China and the prospect of further U.S. rate hikes against potential supply tightness.

Additionally, the loonie continues drawing support from a Statistics Canada report last week which showed inflation in Canada surged higher the previous month, supporting the case for another rate hike by the Bank of Canada (BoC). The annual inflation rate in Canada rose to 3.3% in July 2023 from 2.8% in the previous month and above market expectations of 3%. Every month, the CPI rose 0.6% in July, following a 0.1% gain in June. Excluding food and energy costs, Canada's annual inflation stayed at a 2-year low of 3.2% for the second month in July 2023 but beat market forecasts of 2.8%. Every month, Canadian core consumer prices rose 0.5% in July 2023, after a 0.1% drop in June and slightly above market expectations of a 0.4% increase.

Despite the combination of negative factors, the downside seems cushioned amid firm bets that the Federal Reserve (Fed) will hike interest rates one more time by 25 basis points (bp) during the September or November meeting. This comes after August's FOMC Meeting Minutes report released last week on Wednesday showed Federal Reserve officials expressed concern at their most recent discussion about the pace of inflation and said more rate hikes could be necessary unless conditions change. Noteworthy discussions during a two-day July meeting resulted in a quarter percentage point rate hike in August that markets generally expected to be the last of this cycle.

However, recent data pointing to a modest rise in inflation both at the consumer and producer levels, cooling job growth but a resilient job market, and stronger-than-expected U.S. GDP growth have to a greater extent, reversed hopes that the Fed may refrain from tightening monetary policy further this year.

As we advance, investors look forward to the U.S. docket featuring the release of the August Building Permits data report, the July New Home Sales data report, and the U.S. services and Manufacturing PMI data (Aug). Investors will look for cues from releasing the June Canada Core retail sales data report. The main focus, however, remains on Fed Chair Jerome Powell's remarks at the three-day Jackson Hole Symposium in Wyoming later this week.

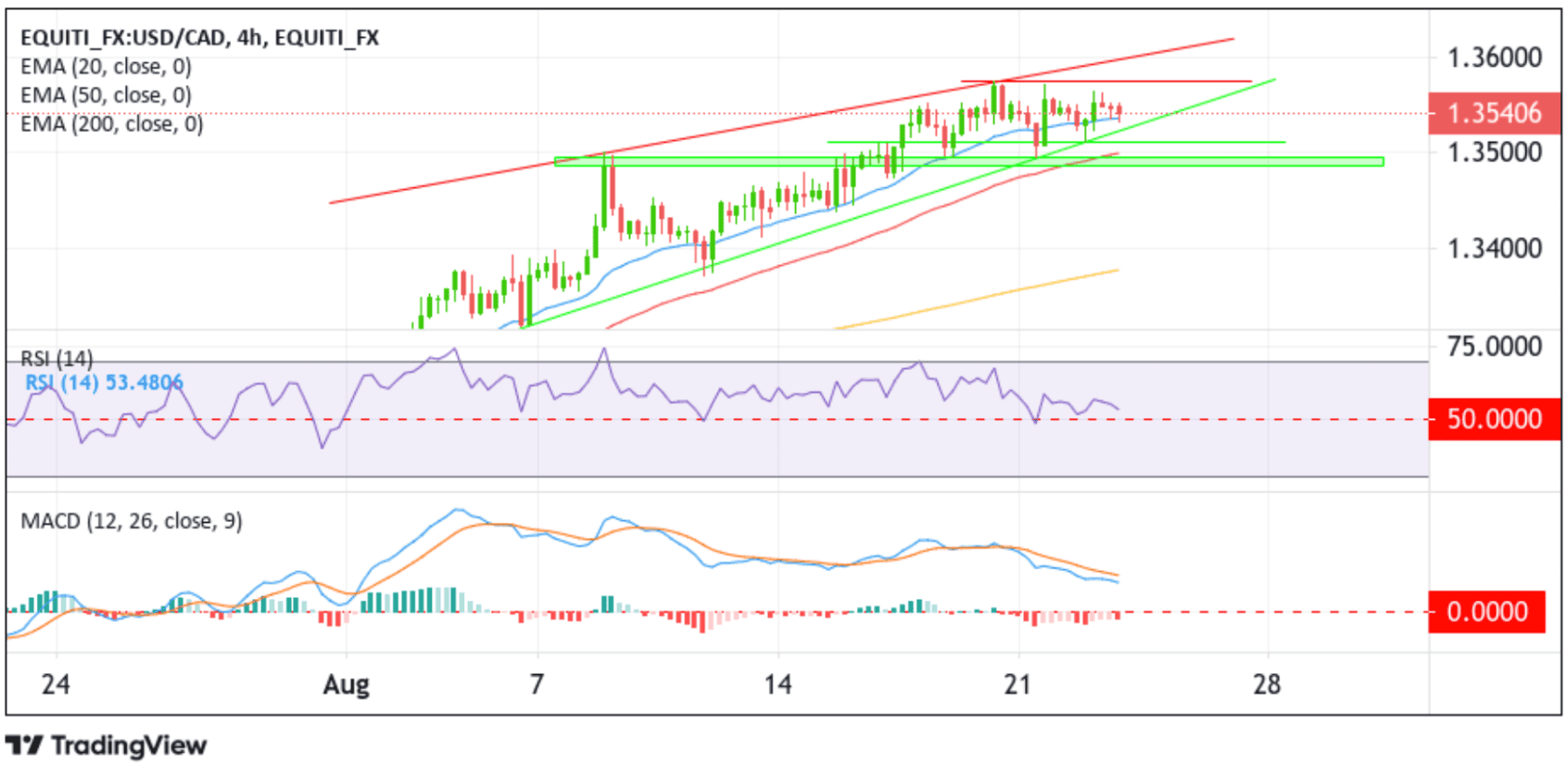

Technical Outlook: Four-Hours USD/CAD Price Chart

From a technical standpoint, a further increase in selling momentum beyond the current price level will find support at the lower-ascending trendline extending from the early-August 2023 swing low. A subsequent break below this support level will pave the way for a drop toward the 1.35111 support level. A decisive flip of this support level into a resistance level will pave the way for a move toward the demand zone ranging from 1.34975 - 1.34850 levels, which sits above the 50-day (red) EMA level at 1.34994. Sustained strength below these barriers will pave the way for a decline toward the next relevant support level at 1.34111. In dire cases, the bearish trajectory could be extended to tag the technically strong 200-day EMA level at 1.33774.

On the flip side, the 1.35723 resistance level now acts as an immediate hurdle, above which a bout of short-covering can lift the pair back toward retesting the upper-ascending trendline from the early-August 2023 swing high. Buying interest could gain momentum if the price pierces this barrier, paving the way for further gains around the USD/CAD cross.