USD/CAD Extends Recovery Momentum From Monthly Low And Trades Firmly Above 1.36000 Mark, U.S New Home Sales Data Eyed

Key Takeaways:

- The USD/CAD pair witnessed some buying and rose above the 1.36500 mark on Monday

- The ongoing recovery in U.S. Treasury bond yields plus declining crude oil prices supported the safe-haven greenback and helped cap the downside for the USD/CAD in the meantime

- Despite the combination of supporting factors, firm market expectations that the Federal Reserve is done with its rate-hiking cycle and hawkish BoC market expectations remain supportive of the Loonie and might help further gains around the USD/CAD pair

- Markets await the release of the U.S. New Home sales data report for fresh directional impetus

USD/CAD cross extended the corrective bounce from the vicinity of the 1.35290 level/monthly low touched on Friday and rose modestly on Monday to trade above the 1.36500 mark during the mid-Asian session. The pair looks set to maintain its bid tone heading into the European session amid the prevalent sentiment surrounding U.S. Treasury bond yields. The ongoing recovery in U.S. Treasury bond yields lent some support to the safe-haven greenback, which traded above the 103.600 mark on Monday during the second part of the Asian and was seen as a key factor that acted as a tailwind to the USD/CAD pair.

Further lending support to the buck was the S&P Global report, which showed the U.S. Composite PMI held steady at 50.7 in November 2023, unchanged from the previous month's three-month high, indicating a marginal further expansion in private sector activity, a preliminary estimate showed. Although manufacturing firms reported a slower pace of development, service providers witnessed a fractional uptick in the output growth rate, the fastest since July. Additionally, the ongoing decline in crude oil prices as markets remained uncertain over more production cuts by the OPEC+ after a delay in a meeting last week undermined the Loonie and helped exert upward pressure on the USD/CAD pair.

Despite the combination of supporting factors, the greenback continues to be undermined by firm market expectations that the Federal Reserve is done with its rate-hiking cycle. This comes after minutes of the November meeting revealed that Federal Reserve officials at their most recent meeting expressed little appetite for cutting interest rates anytime soon, particularly as inflation remains well above their goal.

Apart from this, two U.S. Bureau of Labor Statistics reports released last week pointed to cooling inflation pressures at the consumer and producer level, which, together with slowing job and wage growth, fully reinforce market expectations that the Fed is done with its monetary policy tightening campaign. CME's Fed watch tool shows that Fed fund futures traders have priced in a 100% chance that the Fed will leave its Fed Funds rates unchanged at 5.25% - 5.5% during the December meeting.

In contrast, the Bank of Canada will likely hike its benchmark interest rates during the December meeting. This comes after headline and core inflation rates in Canada fell slightly last month but remained well above the Central Bank's 2% target. Additionally, Bank of Canada Governor Tim Macklem reiterated during a speech at the Saint John Region Chamber of Commerce the previous week that the central bank was prepared to raise rates again if needed and defended the need for restrictive monetary policy while acknowledging the impact of previous rate hikes.

In an article published by Reuters.com, the governor said, "Higher interest rates are squeezing many Canadians, but these rates are relieving price pressures." "To return to low inflation and stable growth in the years ahead, we need these higher interest rates and slow growth in the short term, he further added." This, in turn, lends support to the perceived riskier Canadian dollar (CAD) and suggests the path of least resistance for the USD/CAD cross is to the downside.

As we advance, investors look forward to the U.S. docket featuring the release of the New Home Sales (Oct) data report for fresh USD/CAD directional impetus.

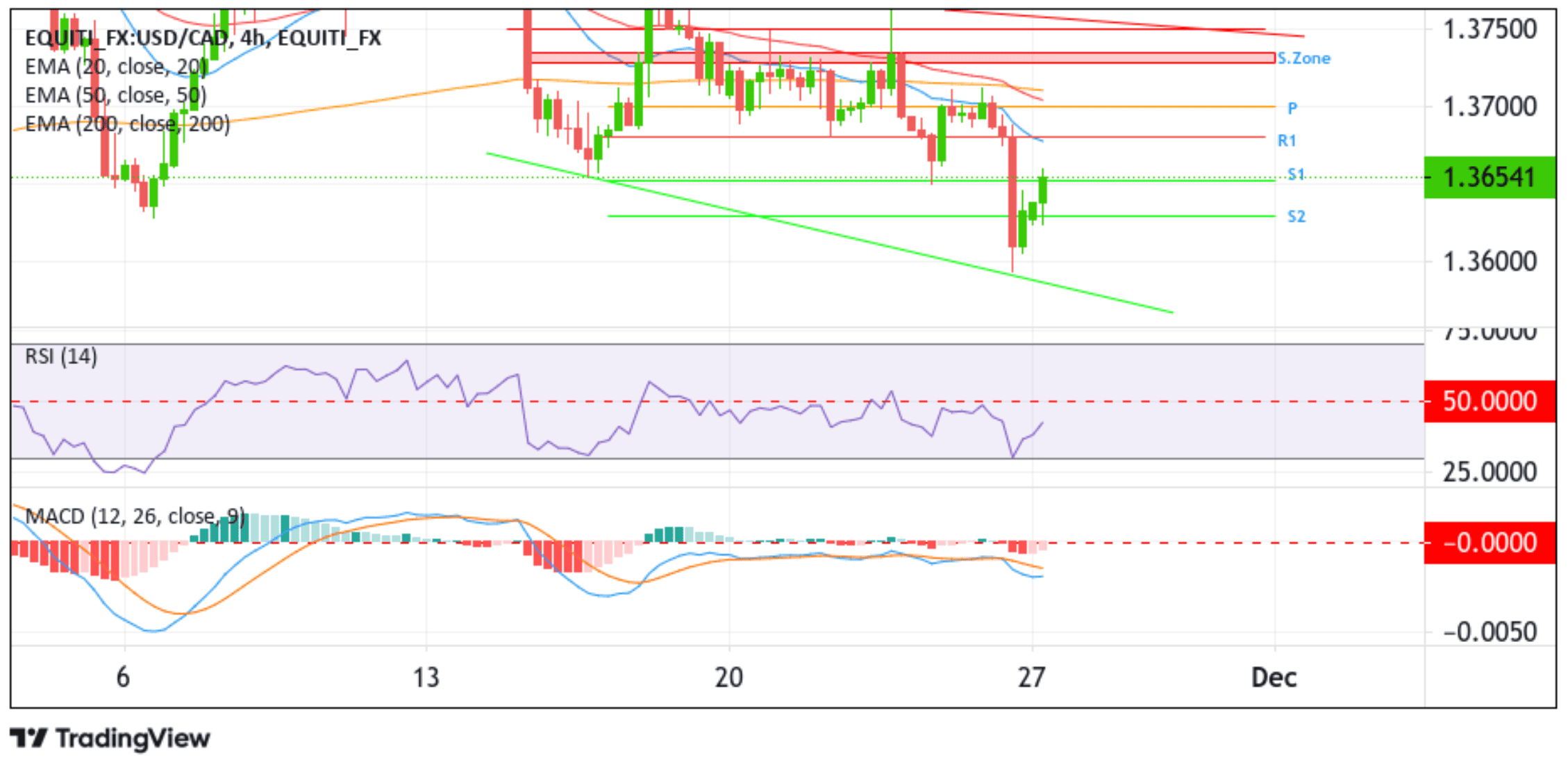

Technical Outlook: Four-Hour USD/CAD Price Chart

From a technical perspective, USD/CAD extended the modest bounce from the vicinity of the 1.35290 level and is currently placed just above the 1.36500 mark, posting a 0.21% daily gain. Some follow-through buying would face resistance at the 1.36792 level (R1). A decisive flip of this resistance level into a support level would pave the way for an ascent toward the key pivot level (P) at 1.36985, corresponding to the 61.8% Fibonacci retracement level (Golden Fib). A clean move above this key level would pave the way for a move toward the seller congestion zone due to the 50 (red) and 200 (yellow)-days Exponential Moving Average (EMA) at the 1.37016 and 1.37096 levels, respectively. Suppose side-lined buyers join in from this zone. In that case, it will rejuvenate the bullish momentum, provoking an extended rally toward the supply zone ranging from the 1.37345 - 1.37272 levels, followed by the 1.37487 resistance level (R2) and the key resistance level plotted by a downward-sloping trendline extending from the mid-November 2023 swing higher-highs.

On the other hand, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial support comes in at 1.36491. If sellers manage to breach this floor, the shared currency could drop toward the 1.36267 support level (S2). Failure to defend this level could see the shared currency accelerate its downfall toward the key support level plotted by a downward-sloping trendline extending from the mid-November 2023 swing lower-lows. A subsequent break below (bearish price breakout) this level would act as a fresh trigger for new sellers to jump in and help push the price downward further.