USD/CAD Shoots To A Fresh One-Week High On Dovish BoC Decision And Weak Crude Oil Prices, NFP Data Looms

Key Takeaways:

- USD/CAD shot to a fresh one-week high on Thursday during the Asian session, a looks set to reclaim the 1.36000 mark

- Rebounding U.S. Treasury bond yields revive U.S. dollar demand and help limit further losses around the USD/CAD pair

- BoC's decision to hold rates steady and weaker sentiment surrounding crude oil prices undermine the loonie

- The market focus entirely shifted toward the release of the NFP data report for crucial USD/CAD directional impetus

The USD/CAD cross extended the corrective bounce from the vicinity of the 1.34806 level or two-month low touched on Monday, marking a fourth successive day of regaining lost ground on Thursday. The bullish recovery momentum has lifted spot prices to a fresh one-week high just below the 1.36000 round mark during the second half of the Asian session. It looks set to extend its offered tone heading into the European session amid the prevalent tone surrounding the buck.

A fresh leg up in U.S. Treasury bond yields amid uncertainty about the outlook for interest rates helped revive U.S. dollar demand, a key factor underpinning the USD/CAD pair. However, the Fed is expected to leave rates unchanged next week after its two-day policy meeting. This comes after a series of softer U.S. inflation and labor reports and, more so, minutes of the last policy meeting convinced investors that the Fed would not hike rates again this year. Apart from this, dovish comments by top Fed officials, including the Fed Chair, Jerome Powell, in the past few weeks further solidified market expectations that the Fed will leave its rates unchanged during the December meeting.

Moreover, fresh data released on Wednesday showed private businesses in the U.S. hired 103K workers in November 2023, below a downwardly revised 106K in October and expectations of 130K, indicating a cooling labor market in the U.S., which further cemented market expectations that the Fed will maintain its status quo during the December meeting.

Furthermore, the decision by the Bank of Canada (BoC) to hold its target for the overnight rate at 5% for a third consecutive meeting in December 2023 continues to weigh on the loonie. It helps drive flows toward the safe-haven buck. Wednesday's decision was in line with market expectations, as after raising rates 10 times since early 2022, the bank has been signalling recently that it was almost nearing the end of its tightening campaign. The bank's decision now officially takes borrowing costs to a 22-year high.

The loonie continues to be undermined by the generally weaker sentiment surrounding crude oil prices. This comes amid worries about global fuel demand after EIA data showed a larger-than-expected rise in gasoline inventory. Furthermore, concerns about China's economic health and fuel demand also weighed on crude oil prices. This comes after Moody's rating agency cut its outlook on China's sovereign credit rating to negative on Tuesday, citing the increasing risks to growth and a property sector in crisis.

As we advance, investors look forward to the U.S. docket featuring the release of the Initial Jobless Claims Data Report for the previous week. Investors will further look for cues from the release of the Canadian Building Permits (MoM) (Oct) data report. The main focus, however, remains on the release of the U.S. monthly jobs data report, popularly known as Non-farm payrolls (NFP), on Friday.

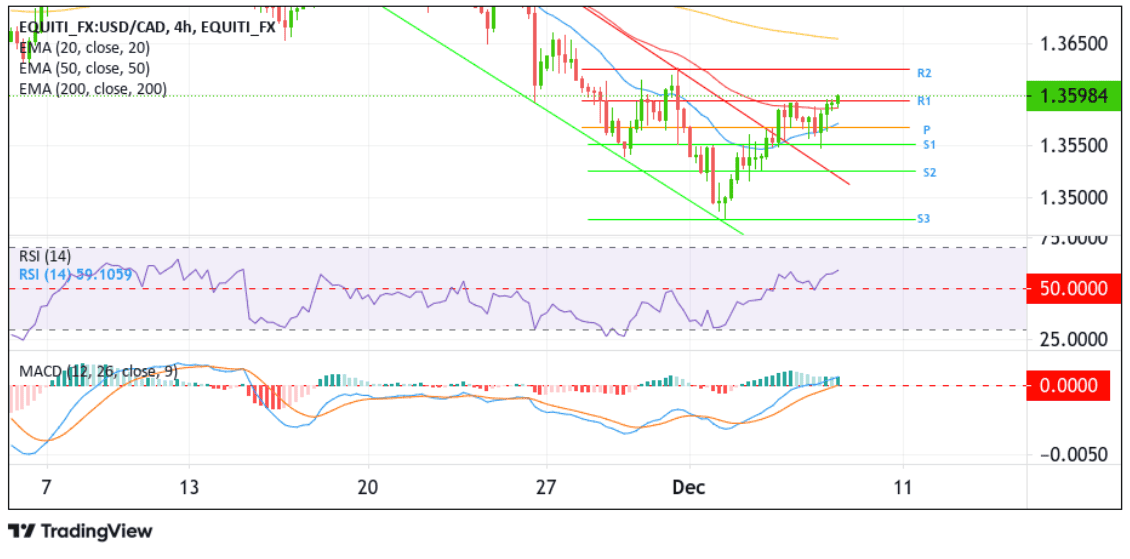

Technical Outlook: Four-Hour USD/CAD Price Chart

From a technical standpoint, USD/CAD's ability to find acceptance above the key resistance level plotted by a downward-sloping trendline extending from the late-November 2023 swing lower-lows and the subsequent move above the pivot level (P), which corresponds to the 61.8% Fibonacci retracement level (golden fib) at 1.315679, favored bulls and supported the case for further upside moves. A further increase in buying momentum from the current price level would uplift spot prices toward the 1.36258 ceiling (R2). A clean move above this level will pave the way for a further extension of the recovery momentum toward the technically strong 200-day (yellow) Exponential Moving Average (EMA) at the 1.36570 level. A convincing move above this level would negate any near-term bearish outlook and act as a fresh trigger for new buyers to jump in and help lift the USD/CAD price higher.

On the flip side, if sellers resurface and spark a bearish turnaround, initial support comes in at the resistance level (R1), which is now turned to the support level. On further weakness, USD/CAD could drop to tag the 50-day (red) EMA at the 1.35876 level before descending further down to tag the 20-day (blue) EMA at the 1.35754 level before attacking the key pivot level (P). If sellers manage to breach this key floor, downside momentum could pick up pace, paving the way for a move toward the 1.35523 support level (S1), which corresponds to the 50% fib retracement of the 6th December to 7th December rally, about which, if this level fails to defend itself, USD/CAD could extend a leg down to the 1.35278 floor before testing the key resistance level now turned support level of the upper limit of the descending channel pattern.