Gold Refreshes From Monthly-Low And Retakes 2020.00 Levels On Softer U.S Dollar, ADP Non-Farm Employment Change Data Eyed

Key Takeaways:

- Gold extended recovery momentum above the 2020.00 level on Wednesday during the Asian session

- Softer U.S. jobs data reports solidifies market expectations that the Fed will leave rates unchanged next week

- The better-than-expected U.S. PMI data report released on Tuesday fails to offer any support or the buck amid the general optimism across the commodity markets

- Moody's rating agency's action on Tuesday to cut its outlook on China's sovereign credit rating to negative might help cap the upside for gold prices

- Markets shift focus toward the release of the ADP Nonfarm Employment Change (Nov) data for fresh gold directional impetus

Gold extended the recovery momentum from the one-month low/2009.45 level touched on Tuesday and edged slightly higher on Wednesday to trade above the 2020.00 level, supported by the underlying bearish sentiment surrounding the U.S. dollar. The U.S. Dollar index, which measures the greenback against a basket of currencies, extended the corrective slide from the vicinity of the 104.100 level touched on Tuesday and dropped back below the 103.900 mark on Wednesday, bolstered by dovish Fed expectations, which in turn helped limit further gains around the precious yellow metal.

Solid market bets that the Fed is done with its rate-hiking cycle after a new batch of data showed cooling signs of labor demand continued to weigh on Treasury bond yields, which forced the U.S. dollar index to trim part of its previous gains following a two-day modest rally and in turn was seen as a key factor that helped cap the downside for the XAU/USD cross.

A U.S. Bureau of Labor Statistics (BLS) report on Tuesday showed the number of job openings decreased by 617,000 from the previous month to 8.733 million in October 2023, marking the lowest level since March 2021 and falling below the market consensus of 9.3 million, signalling cooling signs of the labor market in the U.S.

The downbeat JOLTs job report comes after Powell said on Friday that the U.S. central bank plans on "keeping policy restrictive" until policymakers are convinced that inflation is under control. "It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance or to speculate on when the policy might ease," Powell said in prepared remarks for an audience at Spelman College in Atlanta. "We are prepared to tighten policy further if it becomes appropriate to do so."

Powell's remarks come on the heels of dovish comments by Fed Governor Christopher Waller, who said on Tuesday that he is increasingly confident that monetary policy is currently well-positioned to slow the economy and get inflation back to 2%.

These, combined with the November Monetary Policy Meeting minutes and the softer U.S. consumer and producer inflation reports, fully solidify market expectations that the Fed will leave its rates unchanged during the December meeting.

The downbeat mood surrounding the buck saw a better-than-expected U.S. PMI data report released on Tuesday overshadowed to a greater extent by the general optimism across the commodity markets. An Institute of Supply Management (ISM) report released on Tuesday showed that the U.S. ISM Services PMI increased to 52.7 in November 2023 from 51.8 in October, beating forecasts of 52. The reading pointed to stronger growth in the services sector amid faster increases in business activity and production (55.1 vs. 54.1) and employment (50.7 vs. 50.2).

That said, despite the combination of supporting factors, gold prices continue to face headwinds from Moody's rating agency's action on Tuesday to cut its outlook on China's sovereign credit rating to negative, citing the increasing risks to growth and a property sector in crisis. This could help cap the upside for the XAU/USD cross and warrant caution to traders against submitting aggressive bullish bets around the precious yellow metal.

As we advance, investors look forward to releasing the ADP Nonfarm Employment Change (Nov) data report, which is expected to show an increase in payrolls in the U.S. in November. A Softer reading would solidify market expectations that the Fed will leave rates unchanged when it holds its two-day policy meeting next week

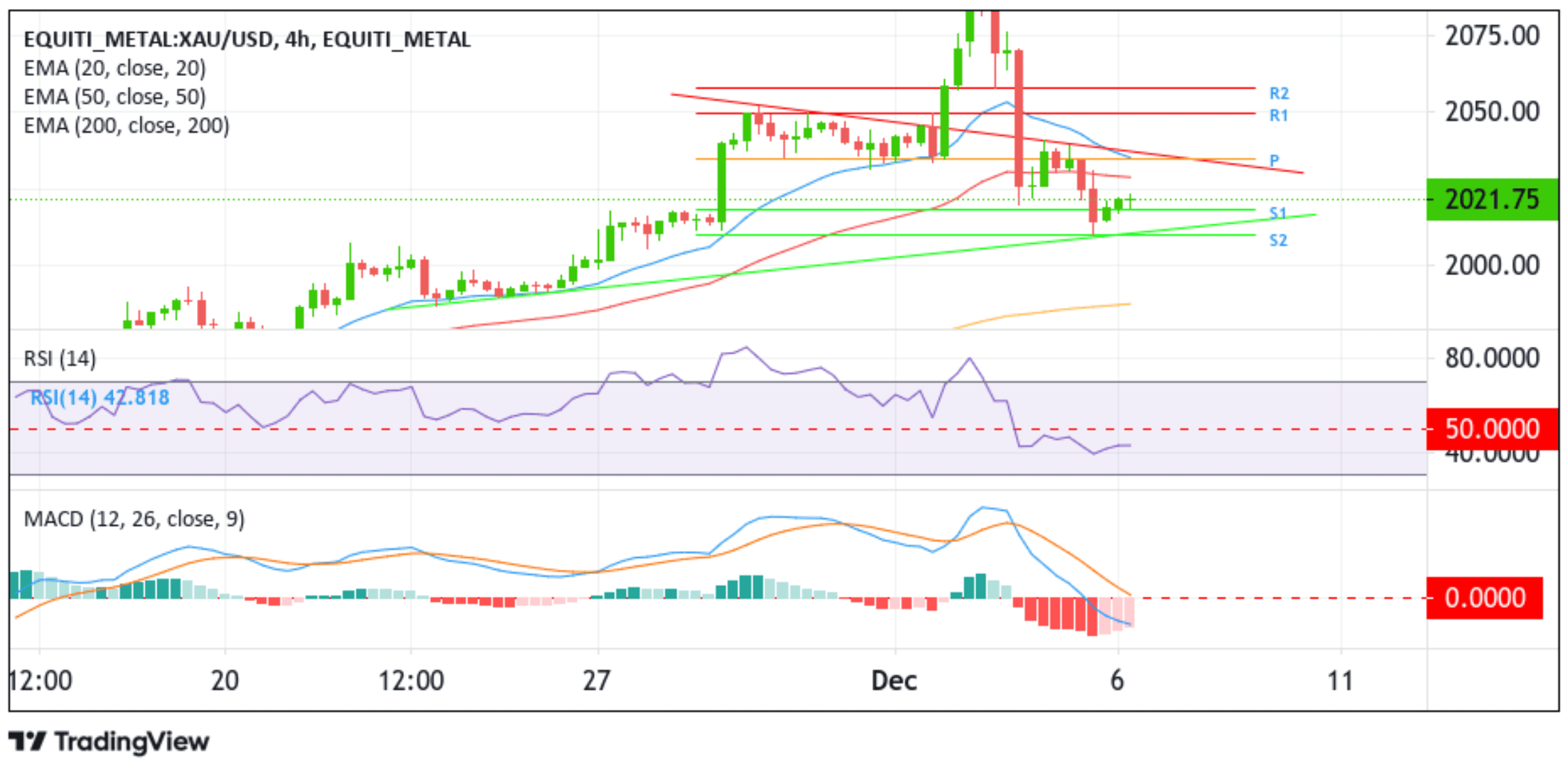

Technical Outlook: Four-Hours Gold Price Chart

From a technical standpoint, some follow-through buying would uplift spot prices to tag the 50-day (red) Exponential Moving Average (EMA) at the 2028.75 level. Acceptance above this EMA level will pave the way for a further ascent toward the pivot level (p), which coincides with the 20-day (blue) EMA level at the 2033.98 level. A convincing move above this level will pave the way for a rally toward the key resistance level plotted by a downward-sloping trendline extending from the late-November 2023 swing to higher highs. A clean break above this resistance level would reaffirm the bullish bias and pave the way for an extension of the bullish recovery momentum toward the 2049.67 (R1) and 2058.09 (R2) ceilings.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial support comes in at the 2018.26 level (S1). If sellers breach this floor, the focus will shift toward the key support level plotted by an upward-ascending trendline extending from the late-November 2023 swing to lower lows. A subsequent break (bearish price breakout) below this support level would pave the way for a move toward the 2009.84 support level (S2). A decisive move below this level will pave the way for an accelerated decline toward the 1996.79 floor.

💥Trade XAU/USD NOW!💥