Gold Remains Defiant Above 2300.00 Mark Despite Modest U.S. Dollar Strength

Key Takeaways:

- Gold (XAU/USD) rose slightly on Wednesday to cement itself above the 2300.00 mark

- The modest U.S. dollar strength fails to limit gains around the precious yellow metal

- Uncertainty about the Fed's rate cut path continues to act as a tailwind for gold prices

Gold (XAU/USD) rose slightly on Wednesday during the Asian session to trade at 2316.99 an ounce, following a rebound from the vicinity of the 2307.29 level touched earlier in the session and moving further from a four-week low touched on Friday as investors continued to reassess their forecasts for interest rate cuts in 2024 in response to disappointing U.S. jobs data and remarks from central bank officials.

On Tuesday, Minneapolis Fed Reserve President Neel Kashkari, speaking at a Milken Institute Conference, said he expects the central bank to hold borrowing costs steady for an "extended period" and possibly all year until further clarity on disinflation is obtained. He did not rule out the possibility of another rate hike.

Kashkari's comments came a day after Richmond Federal Reserve President Tom Barkin indicated that the central bank had time to wait until policymakers were more confident about inflation easing before cutting rates. This was in line with guidance provided by the Fed after its latest meeting earlier this month.

The Fed officials' comments come days after a U.S. Bureau of Labor Statistics report showed that the U.S. economy added fewer jobs than anticipated last month, with just 175,000 jobs created, leading investors to bring forward their forecasts for the Federal Reserve's first rate cut from November to September. Additionally, annual wage growth slowed to 3.9%, and the unemployment rate unexpectedly climbed to 3.9%.

That said, the path for the Fed's rate trajectory will be clear with time. As yet, a number of Fed monetary policy indicators, including U.S. consumer price inflation (CPI), producer price inflation (PPI), retail sales, and Core PCE price index data reports, are set to be released later in the month.

The non-yielding bullion continues to draw support from geopolitical tensions amid the ongoing conflicts in the Middle East following the recent attack by Israel against Gaza. Israel forces struck Rafah on southern Gaza's southern edge from the air and ground on Monday in what threatened to be an escalation of the seven-month-long conflict at a time when Hamas had agreed to a ceasefire proposal. Still, Israel decided to press with strikes since the conditions of the proposal didn't meet their terms.

A lack of settlement between the parties is set to boost the precious yellow metal's safe-haven appeal further, which remains supportive of further uptick movements around the safe-haven asset.

That said, the modest U.S. dollar strength fails to limit gains around the precious yellow metal at the back of hawkish Fed remarks and geopolitical tensions. Additionally, the unclear path concerning the Fed's rate cut continues to act as a tailwind to gold prices.

Without any significant market-moving economic news data, the Treasury bond yields and the general market risk sentiment will continue to influence U.S. dollar dynamics and ultimately provide directional impetus to gold (XAU/USD) prices.

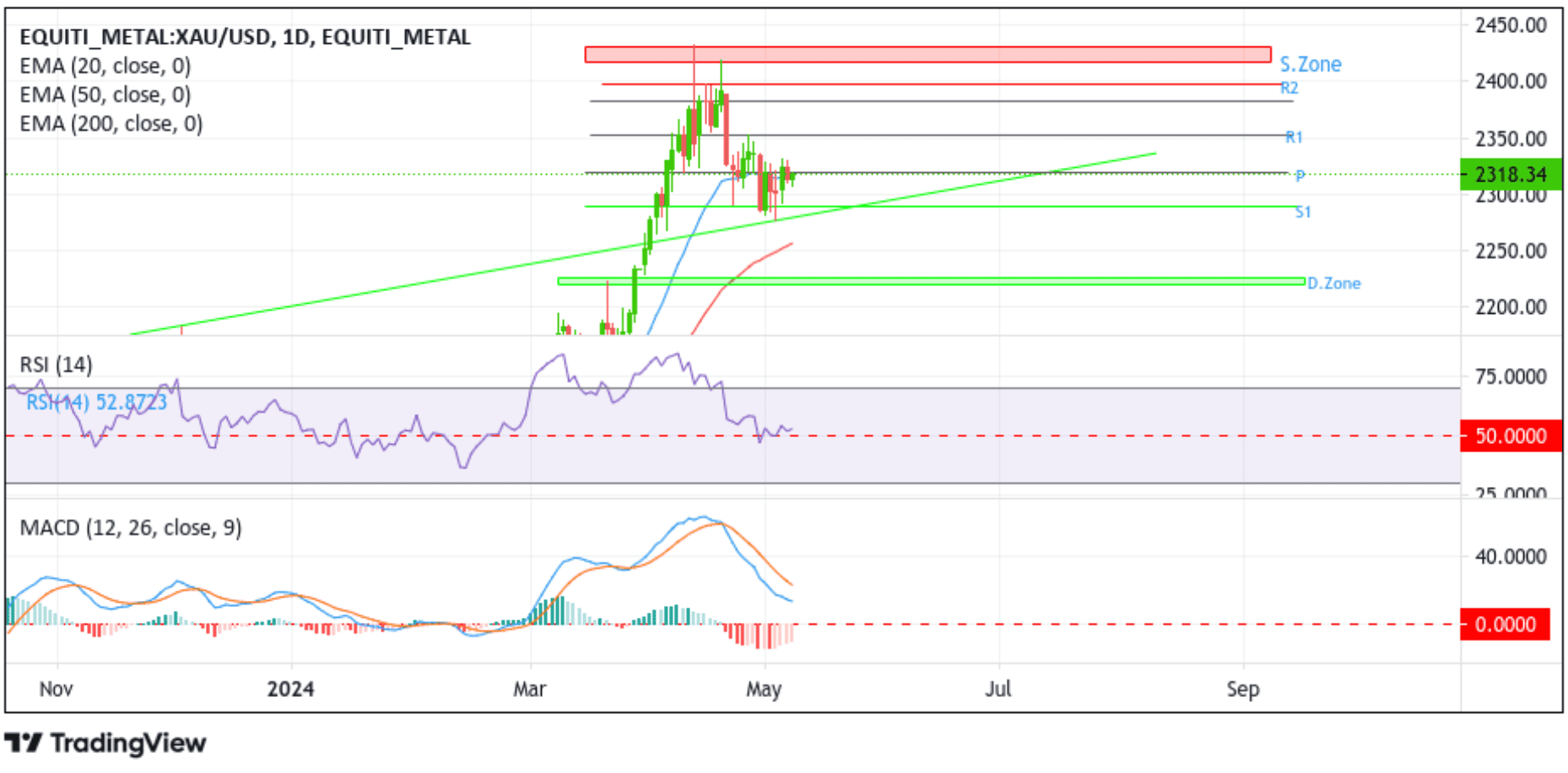

Technical Outlook: One-Day Gold Price Chart

From a technical standpoint, gold's daily chart shows bulls found the momentum to push further upwards and extend the sharp bounce from the upper limit of the multi-week ascending channel pattern following support from the 20-day blue) EMA level. On further buying, gold prices would rise toward the 2349.45 pivot level (p). A clean move above this level would reaffirm the bullish bias and pave the way for a further extension of the bullish corrective move. Further upticks, however, will face stiff resistance at the 50% and 61.8% Fibonacci retracement levels of the 22nd April-3rd May recovery move at 2353.68 and 2371.72 levels, respectively. A convincing move above these levels would act as a fresh trigger for new buyers to jump in, paving the way for an ascent toward the supply zone of the 2430.67 - 2417.81 levels.

On the flip side, the 2289.84 support level (S1) now protects the immediate downside for gold prices. However, a decisive move below this level will pave the way for a drop toward the key resistance level, now turned support level of the multi-week ascending channel pattern. A subsequent break below this level could see gold accelerate its fall toward tagging the 50-day (red) EMA level at the 2256.35 level, about which, if the price finds acceptance below this level, gold could fall further before finding support at the 2226.75 - 2220.78 demand zone.