EUR/JPY Remains Above 159.000s Amid Signs of Slight Weakness, Lagarde's Remarks At Wyoming Awaited

Key Takeaways:

- EUR/JPY showed signs of slight weakness during the Asian session but remains firm above the 159.000 mark

- Reports of intervention by BoJ act as a headwind to the Japanese Yen (JPY)

- Monetary policy divergence between ECB and BoJ is set to continue to weigh on the JPY

- Markets focus shifts toward ECB President Christine Lagarde’s remarks at the Jackson Hole Symposium in Wyoming later this week

EUR/JPY pair seesawed between tepid minor gains and minor losses during the mid-Asian session. The cross struggled to capitalize on extending the earlier bounce from the vicinity of the 159.232 level and ran out of steam after attracting fresh selling in the last hour or so on the second day of the week. At the time of speaking, the pair is still up over 3 pips for the day despite the modest pullback and remains within a heavy bullish bias.

The Japanese Yen (JPY) has been on a downward spiral for the past year against the Euro (euro), despite multiple corrective moves, as a combination of factors continues to weigh on the safe-haven Yen. Recently, reports emerged that the Bank of Japan (BoJ) will purchase unlimited government bonds at a fixed rate with a residual maturity of 5 to 10 years. This, in turn, is seen as a key factor undermining the Yen and helping exert upward pressure on the EUR/JPY cross.

Analysts at JPMorgan noted, "We think that the MoF (Ministry of Finance Japan) will not intervene in the FX market at around the 145 level. Our threshold level of JPY buying intervention is around 150," they said in a note.

The deteriorating global economic outlook, exacerbated by worsening economic conditions in China, continues to weigh on the Yen. This comes after a series of weak Chinese macro data releases early this month showed that the post-Covid rebound had stalled, adding to worries of a global economic downturn. On Monday, the People's Bank of China (PBoC) slashed its 1-year loan prime rate (LPR) by 10bps to a record low of 3.45%. In contrast, surprising markets by holding steady the 5-year rate to bolster the property market and the overall economy failed to liven the mood.

This, combined with the ultra-dovish monetary policy stance adopted by the Bank of Japan, continues to weigh on the Yen and suggests the path of least resistance for the EUR/JPY cross is to the upside. In contrast, the European Central Bank (ECB) has always been pro-hawkish in its bid to tame inflation in the eurozone area. In fact, since the commencement of the ECB's tightening cycle in July 2022, ECB officials have implemented an unprecedented 425 basis point increase in rates, marking the fastest tightening pace in its history.

As we advance, market participants look forward to second-tier euro and Japanese economic data, which, along with broader market risk sentiment, will influence the Euro and Yen dynamics. The main focus, however, remains on ECB President Christine Lagarde’s remarks at the Jackson Hole Symposium in Wyoming later this week.

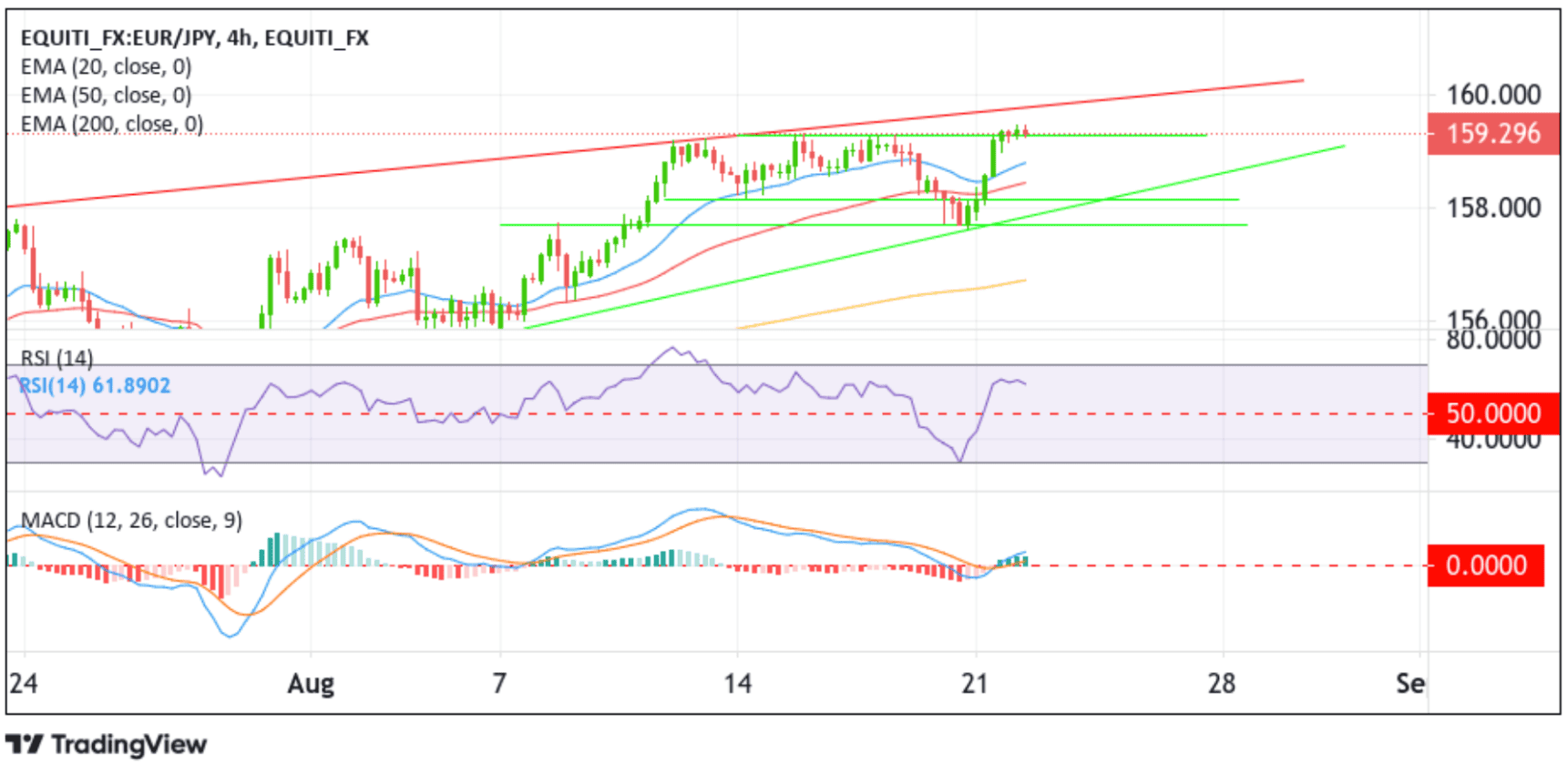

Technical Outlook: Four-Hours EUR/JPY Price Chart

From a technical standpoint, a further increase in selling pressure beyond the current price level will face initial resistance at the 159.289 level. Further south, the EUR/JPY price could drop toward tagging the 20-day (blue) and 50-day (red) EMA levels at 158.812 and 158.432, respectively. Acceptance below these levels will pave the way for a further drop toward the 158.194 support level. If cleared decisively, the aforementioned barrier will pave the way for a further decline toward the lower-ascending trendline extending from the early-August 2023 swing low. A subsequent bearish price breakout will pave the way for an accelerated fall below the 157.651 support level toward the technically strong 200-day (yellow) EMA level at 156.715. A convincing move below this EMA level will negate any near-term bullish and pave the way for aggressive technical selling around the EUR/JPY pair.

All the technical Oscillators in the chart hold in dip bullish territory as both the RSI (14) and MACD crossover are above their signal lines, indicating a bullish sign of price action this week and suggesting the current downtick risks chances of fizzling out sooner or later. Accepting the price above the technically strong 200 EMA (yellow) at the 6.88622 level validates the bullish outlook. Additionally, the 50 (red) and 200 (yellow) EMA Crossover (golden cross) at the 6.85997 level adds credence to the bullish thesis.

On the flip side, if dip-buyers and tactical traders jump back in and trigger a bullish reversal, initial resistance appears at the upper-ascending trendline extending from the late-July 2023 swing high. A subsequent bullish price breakout will reaffirm the thesis and pave the way for further gains around the EUR/JPY cross.