EUR/JPY Struggles To Extend Beyond 140 Level Despite Hawkish Top ECB Official's Statements

- EUR/JPY Pair attracts fresh selling on Thursday to drift lower during the early Asian session

- The deliberate attack on the infrastructure of the Nord Stream 1 pipeline renews the energy supply fears in the eurozone area

- Hawkish ECB Official's statements uplift the euro

- BOJ's intervention move fades away

EUR/JPY pair came under renewed selling pressure on Thursday after attracting fresh bearish bets from the vicinity of 140.404 level in the early hours of the Asian session and dragged spot prices lower from the previous day's high. At the time of speaking, the pair is down over 20 pips for the day and looks set to maintain its bid tone going forward to the European session.

The shared currency's latest struggle could be attributed to renewed energy supply fears in the eurozone area after a deliberate attack on the infrastructure of the Nord Stream 1 pipeline. As a result, gas continued to spew out under the Baltic Sea for the third day after first being detected, remaining far from clear who might be responsible for any sabotage of the Nord Stream pipelines that Russia and European partners spent billions of dollars building. The deliberate attack contributes directly to pushing up energy bills across the eurozone, further denting the market sentiment. It is worth noting that gas is a major source of electricity generation; a surge in gas prices leads to an increase in electricity prices. "A development that could have a more immediate impact on gas supplies to Europe was a warning from Gazprom that Russia could impose sanctions on Ukraine's Naftogaz due to ongoing arbitration," analysts at ING Research said. Naftogaz's CEO said on Wednesday that the Ukrainian energy firm would continue arbitration proceedings against Gazprom over Russian natural gas, which transits the country. Gazprom said earlier in the week that while rejecting all Naftogaz's claims in arbitration, it may introduce sanctions against the company in case it presses ahead with the case.

European gas prices rose following news of the leaks, with the October Dutch price up by 11% at 204.50 euros/megawatt hour on Wednesday. Although prices remain below this year's peak, they remain more than 200% higher than in early September 2021. It should be noted that the European Commission President Ursula von der Leyen announced on Wednesday that they would propose new import bans on Russian products that will deprive Russia of another €7 billion in revenue, as reported by Reuters.

Further limiting the euro was the news that the European Bank for Reconstruction and Development trimmed its 2023 growth forecast for the region, citing rising energy prices piling more pressure on consumers as the reason for their decisive action. Inflation in the EBRD's region, which covers some 40 economies stretching from Kazakhstan to Hungary and Tunisia, reached an average of 16.5% in July, a level last seen in 1998, based on the bank's latest report published in September.

"While food has been a vital inflation driver in the EBRD region, Javorcik did not expect this to spark social unrest, pointing to wheat prices returning to levels last seen before Russia invaded Ukraine on Feb. 24, based on the report. The bank estimated economies across to region will grow 2.3% in 2022 - 120 basis points above its May forecast - thanks to a stronger first half of the year when households spent savings accumulated during COVID-19 lockdowns despite a fall in real wages. But reduced Russian gas supply prompted the bank to trim 2023 growth projections to 3% from a prior forecast of 4.7%. Ukraine's GDP was forecast to contract 30% in 2022, while the Russian economy is set to shrink 5% instead of the 10% forecast previously." The bank said; Despite the negative factors, the EURO bulls were strengthened during the ECB President's speech at the Atlantic Council, in which she confirmed that the ECB would take action needed to deliver their primary goal target of Price Stability. Her comments were further backed up by another ECB policymaker Martins Kazaks who said the ECB's next hike must be big. Several other ECB Governing Council members, namely Olli Rehn, Peter Kazimir, and Robert Holzmann, openly favored a 0.75% rate hike in the next meeting. That said, a host of other ECB Governing Council members will be speaking today to hope they will remain hawkish like their counterparts hence limiting any further downside for the pair.

On Thursday's Japanese docket, the Bank of Japan (BOJ) intervened in the foreign exchange market last week by buying the Yen for the first time since 1998 to shore up the battered currency after the Bank of Japan stuck with ultra-low interest rates. Confirmation of intervention came hours after the BOJ's decision to hold rates at near zero to support the country's fragile economic recovery, a position many analysts believe to be increasingly untenable given the global shift to higher borrowing costs. BOJ Governor Haruhiko Kuroda told reporters the central bank could hold off on hiking rates or changing its dovish policy guidance for years. "There's absolutely no change to our stance of maintaining easy monetary policy for the time being. We won't be raising interest rates for some time," Kuroda said after the policy decision.

Despite the Japanese government's intervention in the FX market, a big divergence in the monetary policy stance adopted by the Bank of Japan continues to weigh on the Japanese yen. Market participants believe that the impact of intervention remains short-lived. Therefore, only restrictive measures could be a tailwind for the Japanese yen. Adding to this, the risk-on impulse, as depicted by a positive tone around the equity markets, further undermines the safe-haven JPY. This, in turn, should limit any further downside move for the EUR/JPY pair below the 139.00 mark. As we advance, speeches from a host of ECB Policy makers will be of great importance in determining the directional impetus for the shared currency. Given the hawkish expectations among the ECB officials, further downside movies seem elusive.

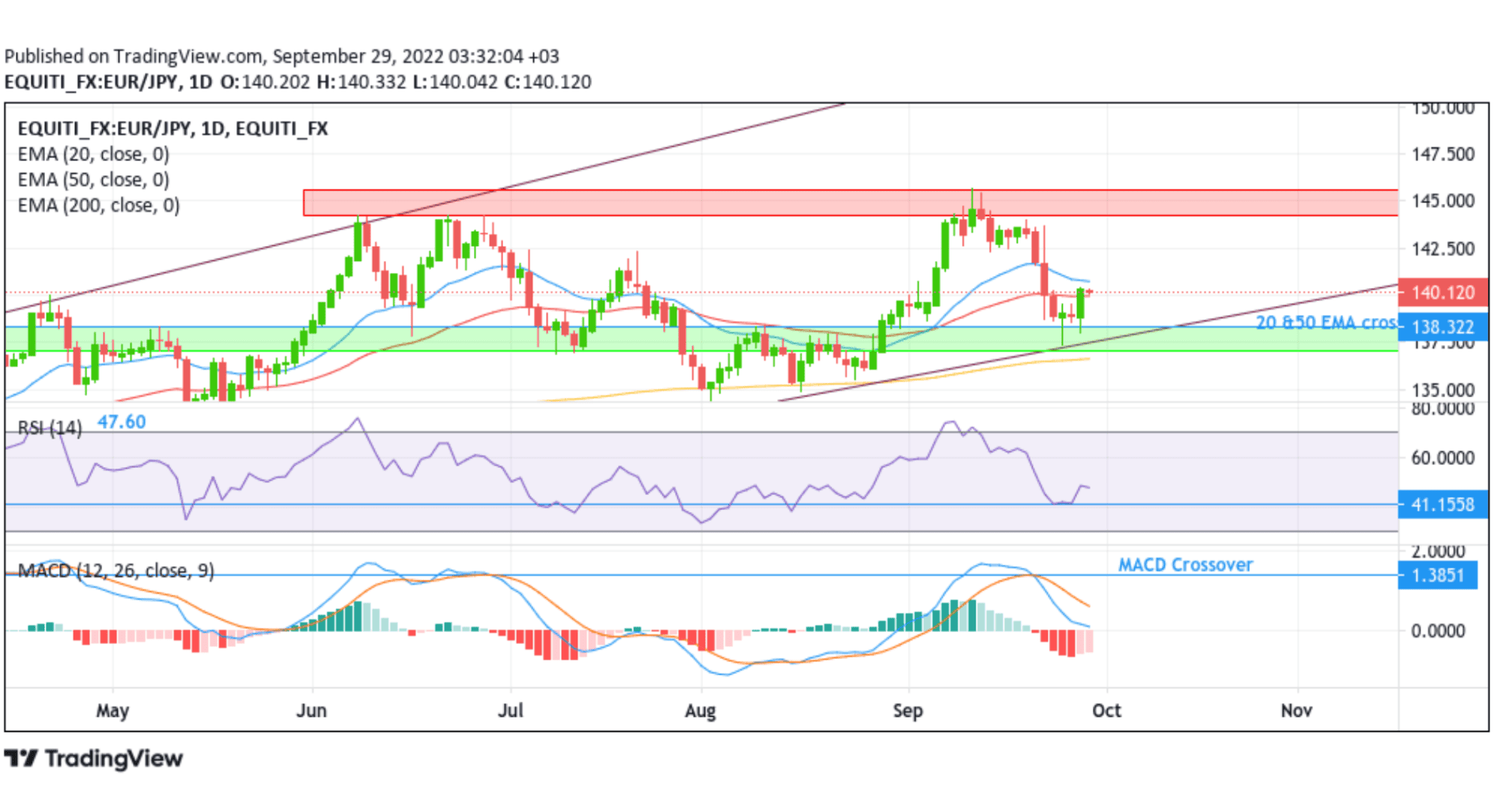

Technical Outlook: One-Day EUR/JPY Price Chart

From a technical standstill using a one-day price chart, the price has retraced from the vicinity of 140.404 level after a substantial increase in the last three days. Some follow-through buying would drag spot prices to the key Demand zone ranging from 137.062 - 138.349 levels. The latter coincides with the multi-ascending channel pattern plotted from the march 2022 swing low. If sellers manage to breach this floor, downside pressure could accelerate, paving the way for a drop towards the 133.343 support level. On further weakness, the focus shifts down towards the 127.714 level.

The moving average convergence divergence (MACD) crossover at 1.3851 paints a bearish filter, while The 20 and 50 Exponential Moving Average(EMA) crossover at the 138.322 level portrays an upside bias.

On the flip side, if dip-buyers and tactical traders jump back in and trigger a bullish reversal, initial resistance appears at the 140.791 level (50 EMA). If price pierces this barrier, buying interest could gain momentum, creating the right conditions for an advance towards the 144.231 - 145.610 ceiling (Supply zone).