EUR/JPY Bears Regain Control To Defend Against Further Downtick Below 140.000 level Amid Japan Intervention

- EUR/JPY Pair attracted some buying on Wednesday to extend the overnight rebound from the vicinity of 140.283

- Downbeat German industrial production data undermine the euro and exert upward pressure on the pair

- Japan confirms record interventions to support the yen

EUR/JPY cross-capitalized on the modest overnight rebound from the vicinity of 140.283 and gained positive traction on Wednesday. The pair has snapped a two-day losing streak and looks set to maintain the offered tone heading into the European session amid retreating Japanese treasury bond yields.

The current price action could be attributed to the Hawkish talks from the likes of ECB governing council member Robert Holzmann, followed by the Bank of England's Catherine Mann saw the move higher in European treasury bond yields that we saw last week on Friday, accelerating further yesterday and today, further undermining market expectations of potential rate cuts by year-end. In turn, this was seen as a factor that underpinned the euro.

Furthermore, the hawkish comments from the ECB's Holzmann and Catherine Mann on Monday reinforced the global view of higher rates for longer. The hawkish comments from the top ECB officials come days after the ECB raised its key rates by 50 bps at the end of the February monetary policy meeting. The ECB, however, stated that they would assess the future direction of their policy and that future interest rate decisions would be based on data, taking a meeting-by-meeting approach. This is the only disappointment for Euro bulls and, in turn, may have caused the downward pressure on EUR/JPY to cross witnessed over the last two days.

Additionally, the euro was weighed down by disappointing German industrial production data, which showed Industrial production in Germany went down sharply by 3.1% month-over-month in December of 2022, following an upwardly revised 0.4% rise in November and worse than market forecasts of a 0.7% decline. This marked the steepest drop in industrial output since March 2022.

Shifting to the Japanese docket, Japan confirmed on Tuesday that it made record interventions in the foreign exchange market in October, selling the dollar worth 6.35 trillion yen ($48 billion) to support the yen currency, Ministry of Finance (MOF) data showed.

Commenting on the move, "The interventions were aimed at countering excessive currency moves driven by speculative trading, and they had certain effects," Finance Minister Shunichi Suzuki told reporters. "We'll continue to monitor market moves carefully."

Separate Ministry of Finance data on Tuesday showed Japan's foreign reserves rose for the third straight month to $1.25 trillion at the end of January, boosted by interest payments on foreign bonds, waning interest rates, softening of the dollar, and gains in gold.

In other news, Japan posted a current account surplus of JPY 33.4 billion in December 2022, narrowing sharply from a surplus of JPY 1,803.6 billion recorded in November and missing expectations of JPY 98.4 billion according to a Japan Ministry of Finance data released early on Wednesday. Imports grew annually by 22.4% to JPY 9,941.5 billion in December, outpacing an 11.8% rise to JPY 8,715.9 billion in exports. The combination of mixed data was a key factor that underpinned the YEN and exerted upward pressure on the EUR/JPY pair.

As we advance, the backdrop still favours the European Bulls. The current price action seems short-lived and risks fizzling out amid possibly continuing the ultra-loose monetary policy by the Bank of Japan (BOJ) amid reports that the BOJ, Deputy Governor Masayoshi Amamiya - an advocate of ultra-loose-policy will taken over as the governor.

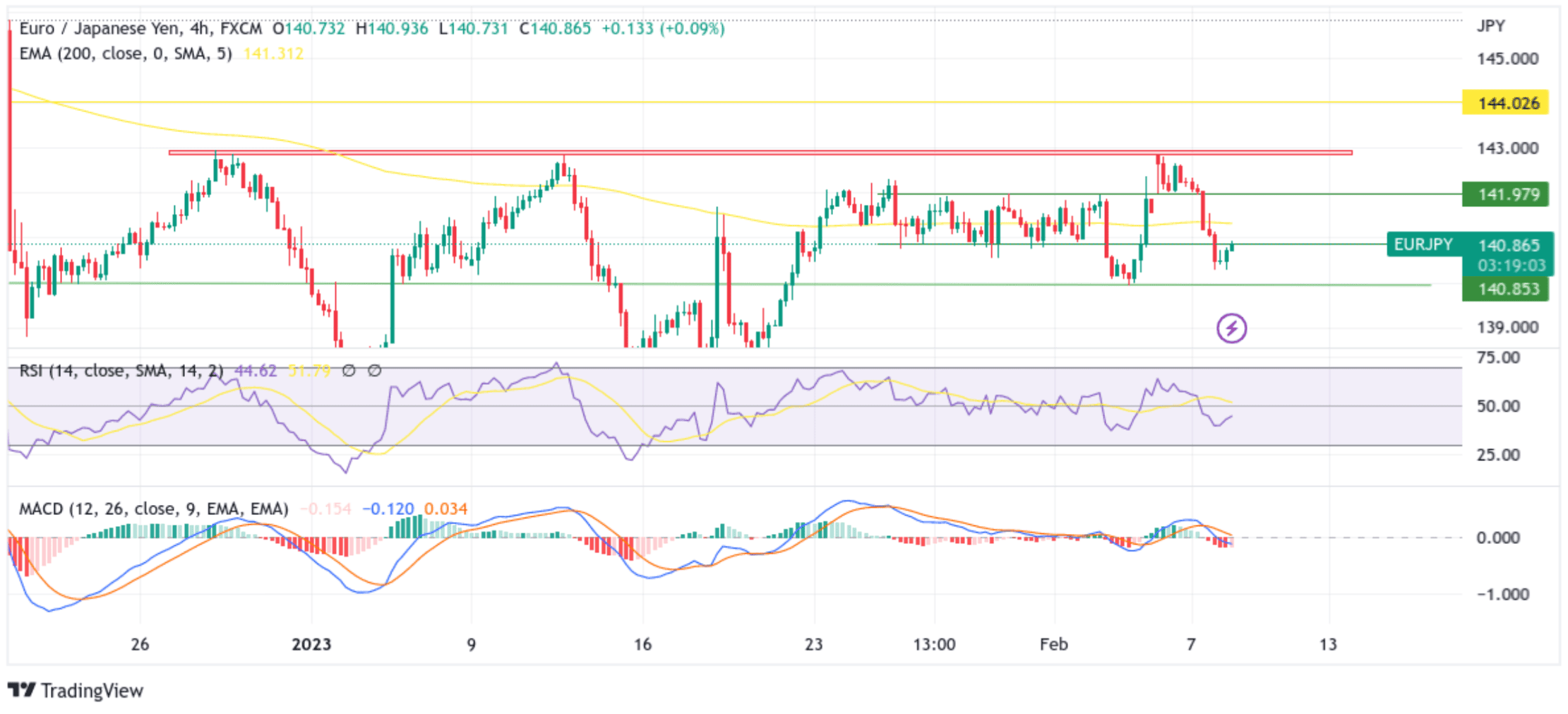

Technical Outlook: EUR/JPY Four-Hour Price Chart

From a technical perspective, any subsequent rise will likely find some resistance at the strong 200 Exponential Moving Average (EMA) level at 141.341. A convincing break above this level will be a new trigger for bullish traders and set the stage for a further near-term corrective incline. The bullish uptick could then accelerate toward the next relevant hurdle plotted by a horizontal trendline at the 141.979 level. If bulls pierce this level, the upward momentum could then accelerate toward the key supply zone ranging from 142.821 - 142.949 levels, which would act as a barricade against further uptick. However, a convincing break above the aforementioned zone would negate any near-term bearish outlook and pave the way for aggressive technical buying.

All the technical oscillators are in negative territory, indicating the overall bias is bearish, and the recent uptick could be short-lived. Additionally, the price is still below the technically important 200 Exponential Moving Average (EMA), which adds credence to the bearish bias. The RSI (14) is at 44.62, is below the signal line, and portrays a bearish filter. On the other hand, the Moving Average Convergence Divergence (MACD) Crossover is below the signal line, pointing to a bearish sign for price action.

On the flip side, if dip-sellers and technical traders jump back in and trigger a bearish reversal, the price will find support at the 140.000 psychological mark en route to the key demand zone ranging from 139.931 - 139.994 levels. If sellers manage to breach these floors, downside momentum could pick up the pace, paving the way for a drop toward the 139.000 psychological mark. Sustained weakness below this level would pave the way for a decline toward August 2015 high and December 2022 low at the 138.900 level.