EUR/JPY Reverses Corrective Slide From Weekly High And Retakes Mid 159.000s, German CPI Data Eyed

Key Takeaways:

- The EUR/JPY cross reverses a corrective slide from the vicinity of the 159.834 level and retakes 159.600s

- A drop in yields on the 5-year JGB auctioned earlier today weighs on the Japanese Yen and helps cap the downside for the pair

- Upbeat Eurozone trade balance data extends support for the euro

- The market's focus shifts toward the release of the German key inflation report for fresh EUR/JPY directional impetus

The EUR/JPY pair reversed a corrective slide from the vicinity of the 159.834 level after attracting fresh buying on Tuesday during the second part of the Asian session. They climbed above the 159.700 mark before paring gains and moving slightly lower to settle above the 159.500 mark.

The catalyst for Tuesday's mid-Asian session push higher could be attributed to the drop in yields on the 5-Year JGB auctioned earlier today, which in turn was seen as a key factor that undermined the Japanese Yen (JPY) and helped cap the downside for the shared currency. Official figures from the Japanese Ministry of Finance show the yields on the 5-Year JGB auctioned earlier today dropped to 0.197% in January from 0.325% in December.

Further contributing to the sentiment around the EUR/JPY cross was the slightly hotter-than-expected inflation data report released earlier today, which failed to support the Yen. The Bank of Japan (BoJ) report released earlier today showed producer prices in Japan unexpectedly showed no growth year-on-year in December 2023, beating market forecasts of a 0.3% drop after a 0.3% growth in the previous month. Every month, producer prices rose by 0.3% in December, the same pace as an upwardly revised figure in November.

Additionally, later today, incoming data is expected to show that consumer inflation rose in Germany last month to 0.1% from -0.4% in November, which supports the case for a hawkish European Central Bank (ECB) shortly, which lends support to the Euro (EUR).

Moreover, the euro continues to draw support from a Eurostat report released on Monday, which showed the Eurozone's trade surplus widened to EUR 20.3 billion in November 2023, surpassing market expectations of EUR 11.2 billion and up from a slightly revised EUR 11.4 billion in the previous month.

In other news, a Federal Statistical Office data report released on Monday showed the German economy contracted 0.3% in 2023, following a revised 1.8% expansion in 2022, as stubbornly high inflation throughout the year, along with rising interest rates, dampened activity and demand from both home and abroad.

As we advance, investors look forward to the euro docket featuring the release of the German key inflation data report. Investors will look for cues from releasing the German ZEW Current Conditions (Jan) data report.

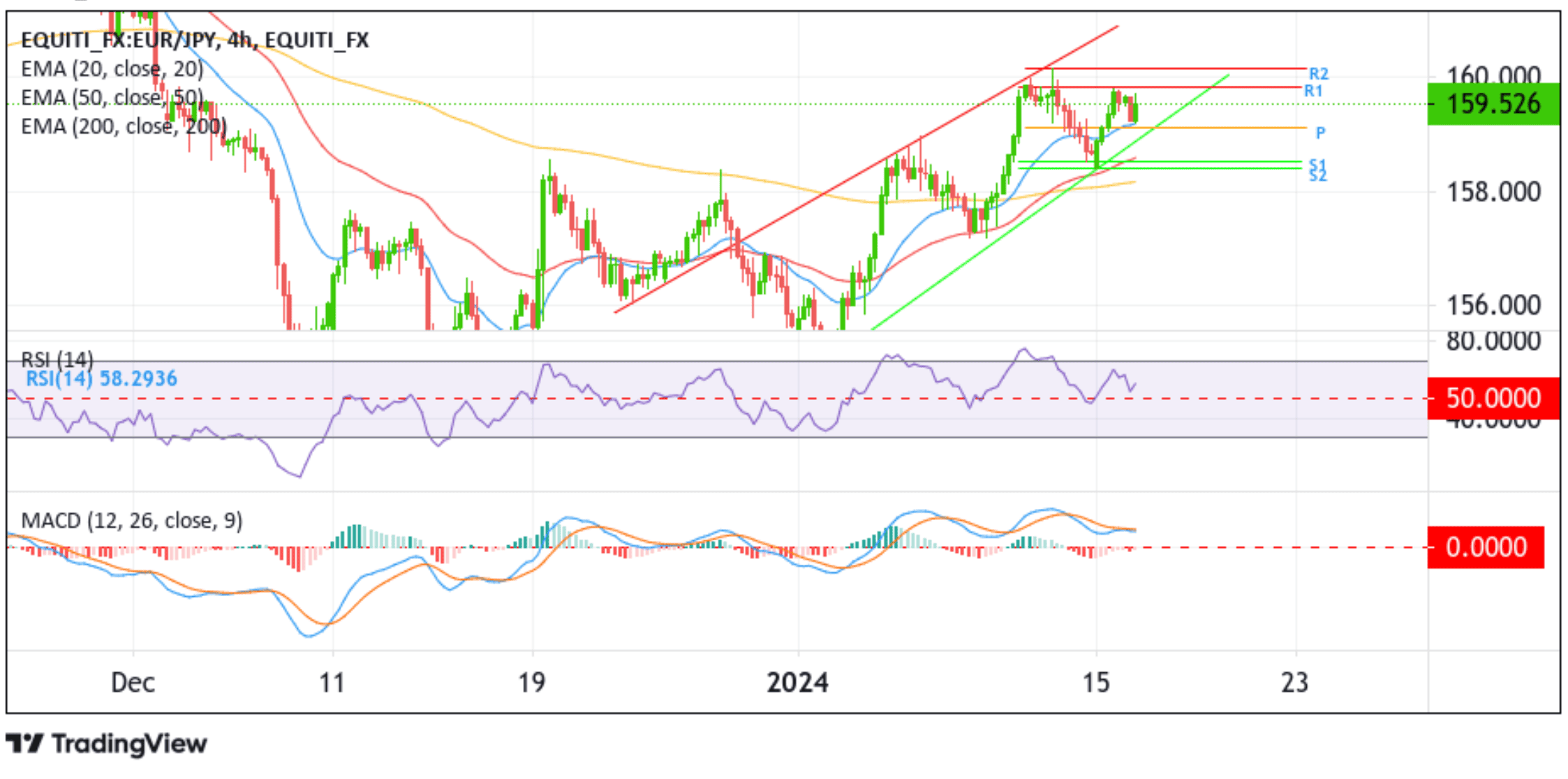

Technical Outlook: Four-Hours EUR/JPY Price Chart

From a technical standpoint, EUR/JPY has been trading within an ascending channel for the better part of late last month and early this month, portrayed by a series of impulsive and corrective moves. Some follow-through buying from the current price level would face initial resistance at 159.825 (R1). A four-hour candlestick close above this level would act as a signal that the corrective pullback has run its course, paving the way for an impulsive move toward the 160.157 ceilings and ultimately toward the upper limit of the ascending channel pattern extending from the early January 2024 swing higher-highs.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial support appears at 159.109 (P), corresponding to the 50% fib level. A convincing move below this level would pave the way for extending the corrective slide toward the upper limit of the ascending channel pattern, extending from the early January 2024 swing to lower lows. A subsequent break below this key support level (bearish price breakout) will pave the way for an accelerated decline toward the 158.517 level (S1). On further weakness, EUR/JPY could drop toward the 158.412 (S2) level, about which, if this level fails to hold, the price could drop further toward the technically strong 200-day (yellow) EMA level at the 158.815 level. A convincing move below this level would negate the bullish outlook and pave the way for further losses around the shared currency.