GBP/USD Moves Back Above Mid-127000s On Subdued U.S. Dollar Demand, U.S. Markets Closed For Martin Luther King Holiday

Key Takeaways:

- The GBP/USD cross attracted fresh buying on Monday during the Asian session and moved back above mid-1.27000s

- Subdued U.S. dollar demand amid a generally weaker tone surrounding Treasury bond yields weighs on the buck

- A combination of positive U.K. macro data lends support to the cable and helps cap the downside for the GBP/USD pair

- U.S. markets remain shut today for the Martin Luther King Holiday

The GBP/USD pair attracts fresh buying on the first day of the week and rebounds from the vicinity of the 1.27236 level, marking a third consecutive session of positive gains. The momentum has lifted post prices above mid-1.27000s and recovered part of its previous week's losses. Subdued U.S. dollar demand amid a generally weaker tone surrounding the Treasury bond yields underpinned the perceived riskier cable. It was a key factor that kept a lid on the GBP/USD cross against further downtick moves.

Markets seem convinced that the Fed will begin cutting rates as soon as March, which supports retreating Treasury bond yields. This comes after a U.S. Bureau of Labor Statistics report on Friday showed producer prices in the U.S. unexpectedly declined 0.1% month-over-month in December 2023, the same as in November, compared to forecasts of a 0.1% rise.

Meanwhile, the core PPI, which excludes food and energy, was flat, the same as in the previous two months and below forecasts of a 0.2% increase. Year-on-year, the headline PPI rate increased to 1% from 0.8%, compared to estimates of 1.3%, while the core rate fell to 1.8% from 2%, compared to expectations of 1.9%.

The better-than-expected U.S. PPI inflation report, to a greater extent, contrasts heavily with the consumer price inflation report released a day earlier, which showed inflation pressures at the consumer level went up to 3.4% in December 2023 from a five-month low of 3.1% in November and reverses hopes that the Fed will be forced to hike rates during the March meeting. That said, CME's Fed Watch tool shows that Fed Fund futures traders have now priced in a 70.0% chance of a 25 basis point rate cut in March compared to 60.9% last week.

Shifting to the U.K. docket, an Office for National Statistics report released on Friday showed manufacturing production in the U.K. grew 0.4% month-over-month in November 2023, the first growth after four consecutive months of decline and almost in line with market estimates of a 0.3% rise.

Moreover, the British economy expanded 0.3% month-over-month in November 2023, rebounding from a 0.3% fall in October and beating market forecasts of a 0.2% rise. It is the most substantial GDP growth in five months, led by a 0.4% rise in service output, namely information and communication (1.5%), particularly the publishing of computer games and telecommunications.

Additionally, the U.K.'s trade deficit narrowed sharply to £1.408 billion in November 2023 from a revised £3.198 billion in the previous month, as imports fell by 2.3% and exports increased by 0.1%. That said, the combination of positive U.K. macro data supports the cable and helps exert upward pressure on the GBP/USD pair.

As we advance, the U.S. markets remain closed today as the U.S. celebrates the Martin Luther King Holiday; hence, there will be minimal trading volume. Nevertheless, the general market risk sentiment and Treasury bond yields will continue to influence the U.S. dollar sentiment and provide short-term trading opportunities around the GBP/USD pair.

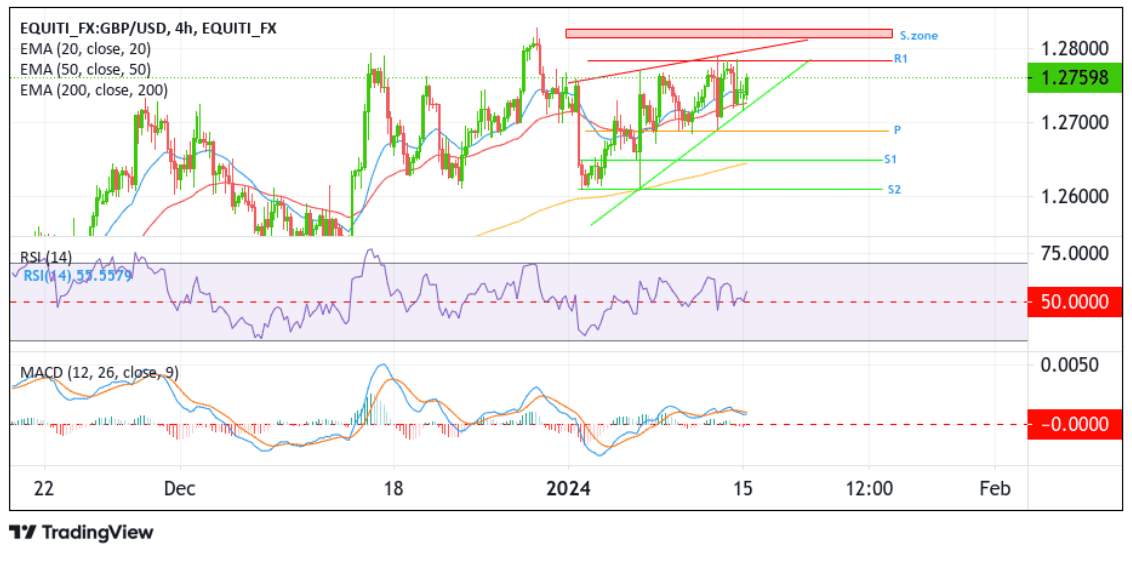

Technical Outlook: Four-Hours GBP/USD Price Chart

From a technical standpoint, GBP/USD extended the modest bounce from the key support level plotted by an upward ascending trendline extending from the early-January 2024 swing lower-lows and is trading with modest gains above mid 1.27500s. A further increase in buying momentum from the current price level will uplift spot prices toward the 1.27838 level (R1). A clean move above this barrier will pave the way for an extension of the bullish momentum toward the key resistance level plotted by an upward ascending trendline extending from the early January 2024 swing to higher highs. A convincing move (bullish price breakout) above this level would reaffirm the bullish thesis and pave the way for a move toward the supply zone ranging from 1.28259 - 1.28143. Sustained strength above this zone would pave the way for more gains around the shared currency.

On the flip side, if sellers resurface and spark a bearish turnaround, initial support comes in at the key support level plotted by an upward ascending trendline. A subsequent break below this level will pave the way for a drop toward the pivot level (P) at 1.26884. A four-hour candlestick close below this level will act as a leeway for a decline toward the 1.26497 level (S1), which sits directly above the technically strong 200-day (EMA) level at 1.26459. A decisive move below the aforementioned support level, followed by acceptance below the 200-day (EMA) level, would negate the bullish bias and pave the way for aggressive technical selling around the GBP/USD cross.