US30 Futures Index Little Unchanged As Investors Await For More Inflation Data

Key Takeaways:

- The US30 futures index was near flat on Friday during the Asian session in the aftermath of the U.S. CPI release

- A U.S. BLS report showed inflation in the U.S. continues to remain stubborn, which in turn suggests the Fed could be forced to lift rates soon

- Salesforce, Inc. (NYSE: CRM) and Verizon Communications, Inc. (NYSE: V.Z.) led the list of top gainers and top losers, respectively, before the bell

- The market's focus shifts toward the release of the U.S. producer price inflation figures for fresh US30 Index directional impetus

The Dow Jones futures index (US30) was near flat on Friday during the Asian session as investors continued to assess the latest U.S. consumer inflation data report and its implication on future monetary policies while waiting for more inflation data reports later today for further confirmation of the Fed's following path of policy move.

As of press time, futures tied to the Dow Jones rose slightly to trade at the $37707.20 level and extend an overnight bounce from the vicinity of the $37423.39 level in the after-trading hours on Thursday. Additionally, the moves follow a muted day on Wall Street, as the 30-stock Dow inched up by around 15 points to close at 37,711.02, while the S&P 500 finished marginally lower at 4,780.24, and the technology-heavy Nasdaq Composite closed at its flat line in the aftermath of the latest U.S. inflation data report.

A U.S. Bureau of Labor Statistics report on Thursday showed the annual inflation rate in the U.S. went up to 3.4% in December 2023 from a five-month low of 3.1% in November, higher than market forecasts of 3.2%, as energy prices went down at a slower pace. Compared to November, consumer prices increased 0.3%, the most in three months and above forecasts of 0.2%. Excluding food and energy, the annual core consumer price inflation rate in the United States eased to a 2-1/2-year low of 3.9% in December 2023, down from 4% in the prior month and just above market forecasts of 3.8%. Monthly, core consumer prices rose only by 0.3% in December, as they did in November, matching market estimates.

The immediate market implication of the slightly-hotter-than-market consensus data report saw the primary index slip by more than 0.9%/34.8 points before paring losses and inching up to close with modest gains above the $37700.00 mark. In contrast, the U.S. dollar index (DXY), which measures the greenback against a basket of currencies, rose by more than 0.55%/0.558 points, supported by rising Treasury bond yields, before later paring gains and slipping lower to close with modest losses below the $102.400 mark.

That said, the U.S. Consumer Inflation data report comes on the heels of an equally hotter-than-expected U.S. macro data release on Friday, which showed the U.S. labour market continues to remain tight despite the Fed leaving rates unchanged in the last three meetings. Furthermore, it comes back to hawkish comments by top Fed officials recently, who raised concerns that the markets are pricing rate cuts ahead of themselves and that further rate hikes could be on the way. That said, the combination of factors has, to a greater extent, raised market doubts over early interest rate cuts by the Federal Reserve.

CME's Fed Watch tool shows now that the probability of a 25 basis point rate cut in March has fallen to 60.9% from 73.4% last week, with the likelihood of a 25 basis point rate hike during the March meeting having risen modestly to 36.2% from 26.6% last week.

In other economic news, the number of Americans filing for unemployment benefits fell by 1,000 from the previous week's upwardly revised value to 202,000 on the period ending January 6th, well below market expectations of 210,000, a U.S. Department of Labor report released Thursday. In the meantime, continuing claims fell by 34,000 to 1,834,000 on the earlier week, also below market expectations of 1,871,000. The data matched other recently-released job gauges in underscoring the historical tightness of the U.S. labor market, adding leeway for the Federal Reserve to prolong its hawkish stance into 2024, if necessary, to lower inflation.

Gainers and Losers

Here are the top US30 index movers today before the bell, a week in which the primary index is set to close with modest gains.

Top Gainers⚡

The top performers on the US30 Index were:

- Salesforce, Inc. (NYSE: CRM) rose 2.75%/7.26 points to trade at $271.39 per share.

- Nike, Inc. (NYSE: NKE) added 2.07%/2.15 points to trade at $105.92 per share.

- The Travelers Companies, Inc. (NYSE: TRV) gained 0.93%/1.79 points to trade at $194.88 per share.

Top Losers💥

The worst performers on the US30 Index were:

- Verizon Communications, Inc. (NYSE: V.Z.) lost 2.99%/1.17 points to trade at $37.91 per share.

- Walgreens Boots Alliance, Inc. (NASDAQ: WBA) declined 2.63%/0.65 points to trade at $24.03 per share.

- Boeing, Co. (NYSE: B.A.) shed 2.27%/5.18 points to trade at $222.66 per share.

As we advance, investors look forward to releasing the U.S. wholesale inflation data report, popularly known as the Producer Price Index (PPI) data report, which is expected to show a rise in inflation pressure at the producer level last month. The data would influence the USD price dynamics and help provide the next leg of a directional move for the primary index.

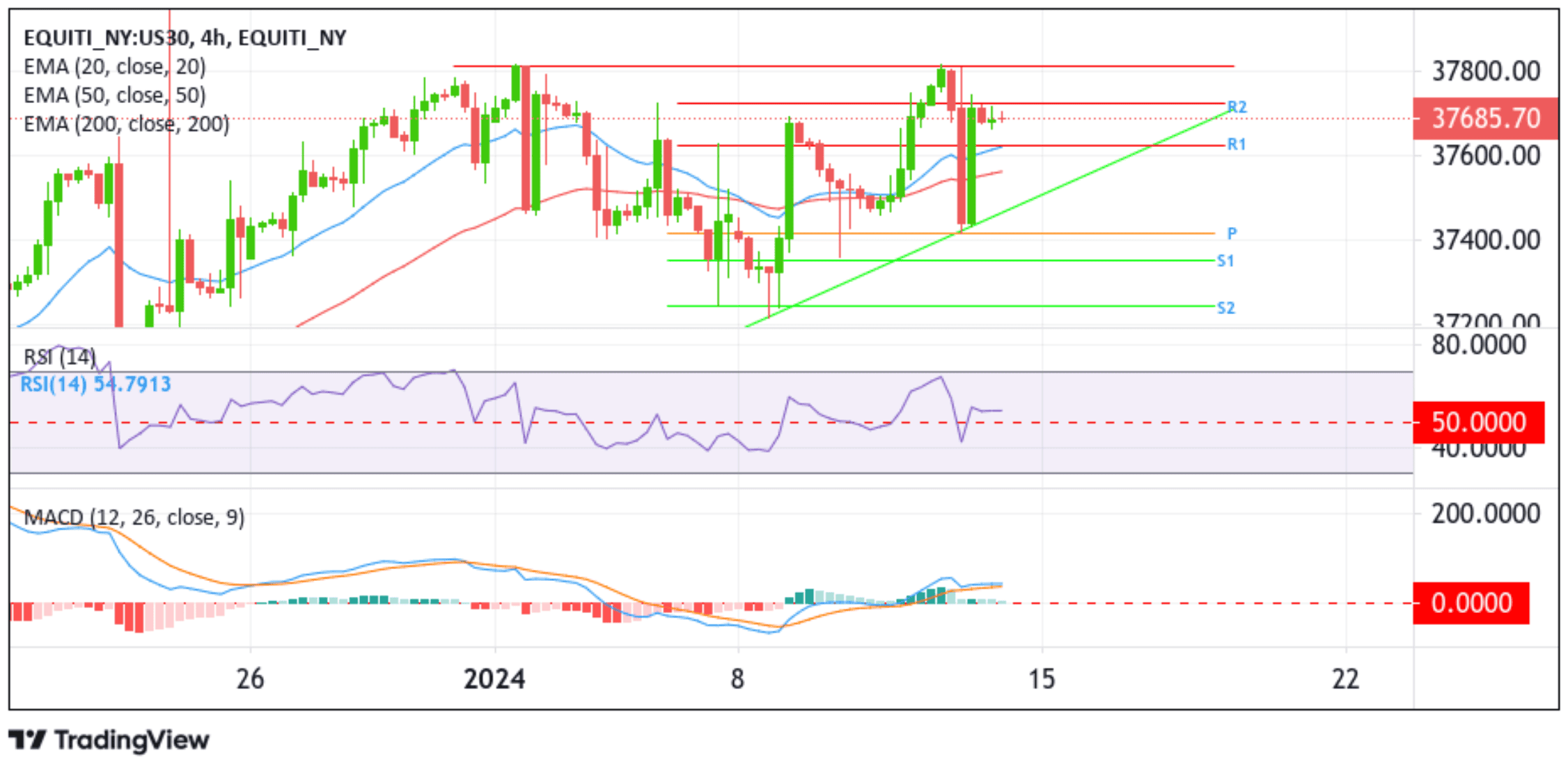

Technical Outlook: Four-Hours US30 Futures Price Chart

From a technical perspective, the primary's index ability to capitalize on the move above the pivot level (p), which corresponds to the 61.8% Fibonacci retracement level at $37445.88, and the subsequent acceptance above the $37624.47 resistance level (R1) and the $37700.00 mark favors bullish traders. Sustained strength above the $37722.21 resistance level (R2), followed by the $37811.56 horizontal resistance, will reaffirm the optimistic bias and pave the way for additional gains. The US30 price could rally toward the four-year record high of $37814.00.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial support comes in at $37624.47. If sellers manage to breach this floor, downside pressure could accelerate, paving the way for a drop toward the key ascending trendline, extending from the early - January 2024 swing lower-lows. A clean break below this support level will pave the way for a move toward the $37445.88 level. A convincing move below this level would act as a fresh trigger for new sellers to jump in, paving the way for an extension of the bearish trajectory toward $37353.61 (S1), followed by the $37244.41 level and, in highly bearish cases, the primary index could extend a leg down toward the $37055.44 - $37020.08 demand zone.