EUR/JPY Extends The Sharp Rebound From Monthly Low On The Aftermath Of BOJ's Decision

- EUR/JPY pair attracted some buying during the early Asian session and extended the sharp rebound from the vicinity of the 138.832 level

- Luis de Guindos, Vice-President of the ECB, comments on the Eurozone Banks' readiness to weather rising Interest rates offered some support to the Euro

- A combination of Negative Euro macro data reports undermined the Euro on Tuesday

- Bank of Japan Widens its Yield Target Range which in turn saw the Japanese yen surge more than 2% toward 133 per dollar on Tuesday

The EUR/JPY cross witnessed some renewed buying pressure during the early Tokyo session after a major rebound in the vicinity of the 138.832 level and staged some follow-through buying. As per press time, the EUR/JPY cross is up over 35 pips for the day and looks set to maintain its offered tone heading into the European Session.

The shared currency attempted recovery could be attributed to the comments made by Luis de Guindos, Vice-President of the ECB, when asked how resilient banks are when facing the changing environment (yield curves). said, "Our assessment of bank resilience under different macroeconomic scenarios shows that the banking sector is sound enough to handle the effects of rising rates on their balance sheets. However, banks must prepare for potential longer-term effects related to monetary policy normalization. And they should pay special attention to interest rate risk in their asset and liability management".

Guindo's Comments come days after Eurostat data showed the Core inflation rate in the Euro Area, which excludes prices for energy, food, alcohol, and tobacco, remained at 5% in November of 2022, the same as in October and holding at a record level. Additionally, The Consumer Price Index In the Euro Area decreased by 0.10 percent in November of 2022 over the previous month. Every year, The consumer price inflation in the Euro Area was revised to 10.1 percent year-on-year in November 2022, slightly up from a preliminary estimate of 10.0 percent. That said, the combination factors were seen as key factors that offered some support to the Euro.

Germany Producer Inflation Slows to 9-Month Low

The annual producer inflation in Germany fell to 28.2% in November 20zz from 34.5% in October, less than market forecasts of 30.6%, pointing to the lowest level since February. Excluding energy, producer prices climbed 12.7% from a year earlier. Every month, producer prices were down 3.9%, the second straight month of drop, compared with the consensus of a 2.5% fall and after a 4.2% decline in October.

Eurozone Current Account Swings to Deficit

The Euro Area posted a current account deficit of EUR 4.4 billion in October 20zz, compared with a surplus of EUR 6.51 in the same month of the previous year.

The goods account shifted to a EUR 2.6 billion deficit from last year's EUR 12.9 billion surpluses, with imports surging to near-record high levels on rising energy prices. The bloc reported a EUR 86.7 billion gap from January to October, compared with a EUR 253.0 billion surplus during 2021.

Bank of Japan Widens Yield Target Range

The Bank of Japan unexpectedly increased the upper limit of its tolerance band on 10-year government bonds to 0.5% from 0.25%. Following the Central Bank's decision, the Japanese yen surged more than 2% toward 133 per dollar on Tuesday, hitting its strongest levels in 4 months. As widely expected, the central bank also kept its ultra-low benchmark interest rates unchanged. The surprise yield curve control adjustment pushed the benchmark 10-year JGB yield to as high as 0.47% on Tuesday, the highest since 2015. The move came just days after the Japanese government was reportedly planning to revise a decade-old accord with the BOJ to add flexibility to the 2% inflation target.

That said, the combination of factors was seen as key factors that underpinned the Yen and, in turn, contributed to the lacklustre performance witnessed yesterday surrounding the EUR/JPY pair.

As we advance in the absence of any significant market-moving economic news data from both dockets, the Euro bond yields, along with the broader market risk sentiment, will influence the Euro and allow traders to grab some trading opportunities around the EUR/JPY pair.

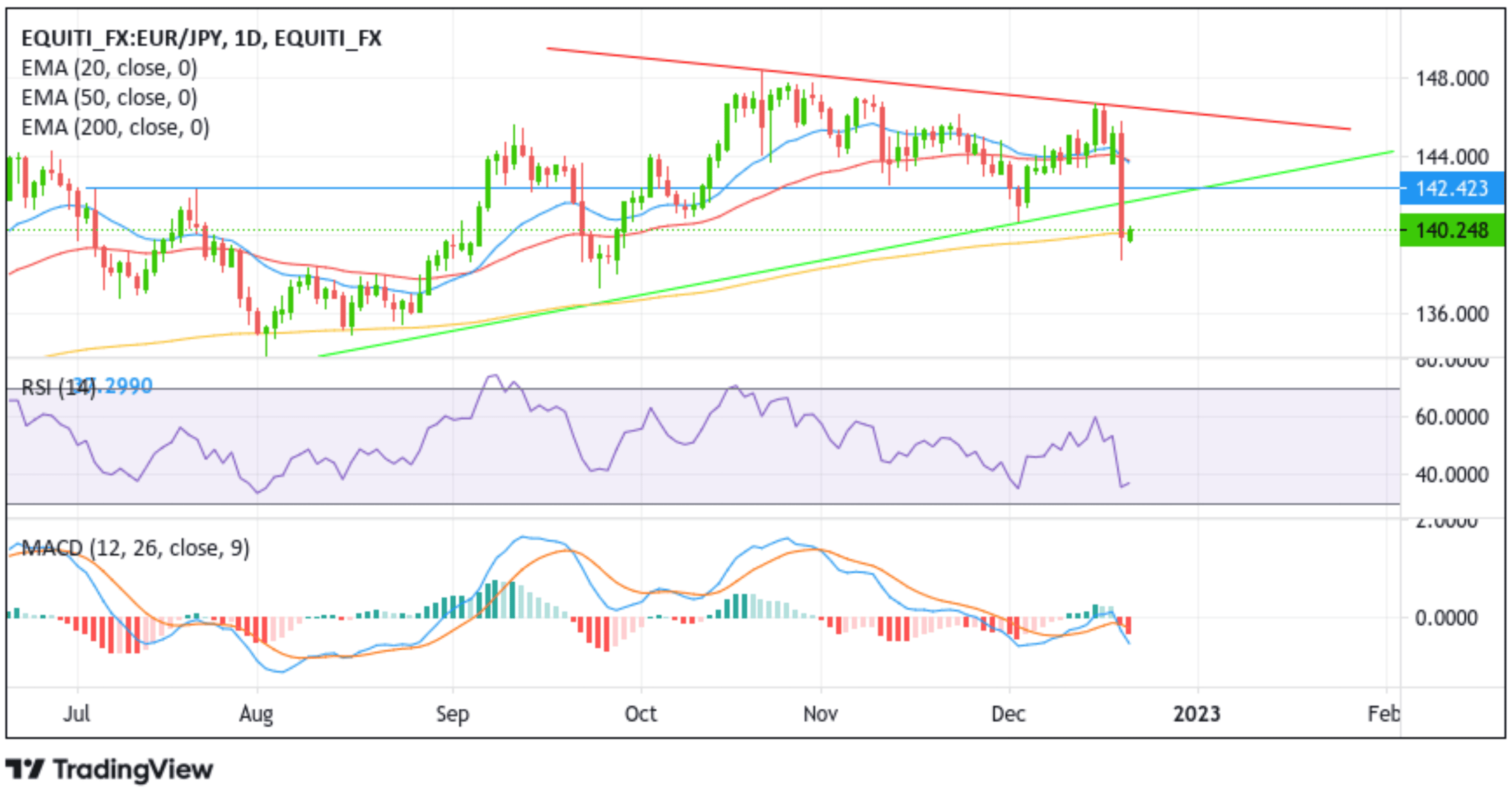

Technical Outlook: One-Day EUR/JPY Price Chart

From a technical perspective, using a one-day price chart, the price has extended the modest rebound from the vicinity of the 138.832 level after the price had earlier on broke out from an ascending trendline of a Bearish Pennant Chart Pattern (Key support level) plotted from the august 2022 swing low. Some follow-through buying would uplift spot prices to the immediate hurdle (ascending trendline of a Bearish Pennant Chart Pattern) now turned resistance level. Sustained strength above this barrier would allow a move toward the 142.423 resistance level. If the price pierces, this barrier's bullish momentum could accelerate toward retesting the key resistance level plotted by a descending trendline of the Bearish Pennant Chart Pattern extending from the October 2022 swing high. A convincing break above this floor would pave the way for aggressive technical buying around the EUR/JPY pair.

All the technical oscillators are in negative territory, with the RSI (14) at 37.2990 below the signal line portraying a bearish filter. Still, a move above the key resistance level and a push above the signal line would trigger traders to place new bullish bets, while the Moving Average Convergence Divergence (MACD) crossover is below the signal line adding further credence to the downside bias. Additionally, the 20 and 50 Exponential moving averages (EMA) crossover at the 143.919 level reaffirms the bearish bias.

On the Flipside, if dip-sellers and tactical traders jump in and trigger a bearish reversal, the price will find support at the 138.116 support level. If sellers manage to breach this floor, the EUR/JPY pair could turn vulnerable and accelerate the downfall toward the key demand zone ranging from 136.912 - 137.540 levels. Sustained strength below this barricade would pave the way for more losses surrounding the EUR/JPY pair.