USD/CNH Trades Firmly Above 7.30000s As Markets Shrug Off PBoC'S Decision, Jackson Hole Symposium And Powell's Speech Awaited

Key Takeaways:

- USD/CNH extended its modest pullback from the vicinity of the 7.28335 level and edged higher for the second consecutive day

- Rising bets for one more 25 basis point (bps) rate hike by the Federal Reserve (Fed) in September or November support rising Treasury Bond yields and fresh U.S. dollar buying

- Chinese Yuan (CNH) shrugs off PBoC's decision to Cut 1-Year LPR rates to a record Low of 3.45%

- The market focuses on the Jackson Hole Symposium And Powell's speech

The USD/CNH cross extended its modest pullback from the vicinity of the 7.28335 level touched on Friday and witnessed buying for the second consecutive day on Monday. As per press time, the shared currency is trading in heavy gains above the 7.32000s level and looks set to keep its bid tone heading into the European session.

Elevated U.S. Treasury Bond yields, bolstered by hawkish Fed expectations, are a key factor supporting the USD/CNH pair. Markets seem convinced that the Federal Reserve (Fed) will hike interest rates one more time by 25 basis points (bp) either during the September or November meeting. CME's Fed Watch Tool shows fed fund futures traders now pricing in almost a 14% and 36% chance that the Fed will raise interest rates by 25bps to 5.5% during the September and November FOMC Meetings, respectively.

This comes after August's FOMC Meeting Minutes report released on Wednesday showed Federal Reserve officials expressed concern at their most recent meeting about the pace of inflation and said more rate hikes could be necessary unless conditions change. Noteworthy discussions during a two-day July meeting resulted in a quarter percentage point rate hike in August that markets generally expected to be the last of this cycle.

However, recent data pointing to a modest rise in inflation both at the consumer and producer levels, cooling job growth but a resilient job market, and stronger-than-expected U.S. GDP growth have to a greater extent, reversed hopes that the Fed may refrain from tightening monetary policy further this year.

Shifting to the Chinese docket, the People's Bank of China (PBoC) on Monday slashed its 1-year loan prime rate (LPR) by 10bps to a record low of 3.45% while surprising markets by holding steady the 5-year rate, a reference for mortgages, at 4.2%. Monday's decision followed the central bank's unexpected reduction in both short-term loan rates and the medium-term policy rate last week. It seeks to balance helping the faltering Chinese economy and stemming further weakness in the yuan.

Additionally, today's decision was widely expected, as the Chinese Central Bank has repeatedly vowed in the previous weeks to release more liquidity for the economy amid slowing business activity, a downturn in industrial production, a growing deflationary outlook, weak Chinese retail sales, and weak trade performance.

To a greater extent, the Chinese Yuan (CNH) shrugged off the PBoC's decision, with the single currency weakening significantly in the aftermath of the announcement. Further contributing to the mood around the USD/CNH cross are growing fears of a recession in the U.S. due to the Fed's rate hikes, which in turn continue to weigh on investors' sentiment. This was evident from a generally weaker tone around the U.S. equity markets, which continue to extend some support to the safe-haven greenback, exerting upward pressure on the USD/CNH cross.

As we advance, without any significant economic news data from both dockets, the broader market risk sentiment and U.S. Treasury bond yields will continue to influence the U.S. dollar and provide short-term trading opportunities around the USD/CNH pair. The focus, however, remains on the three-day Jackson Hole Symposium and Fed Chair Powell's speech on Thursday.

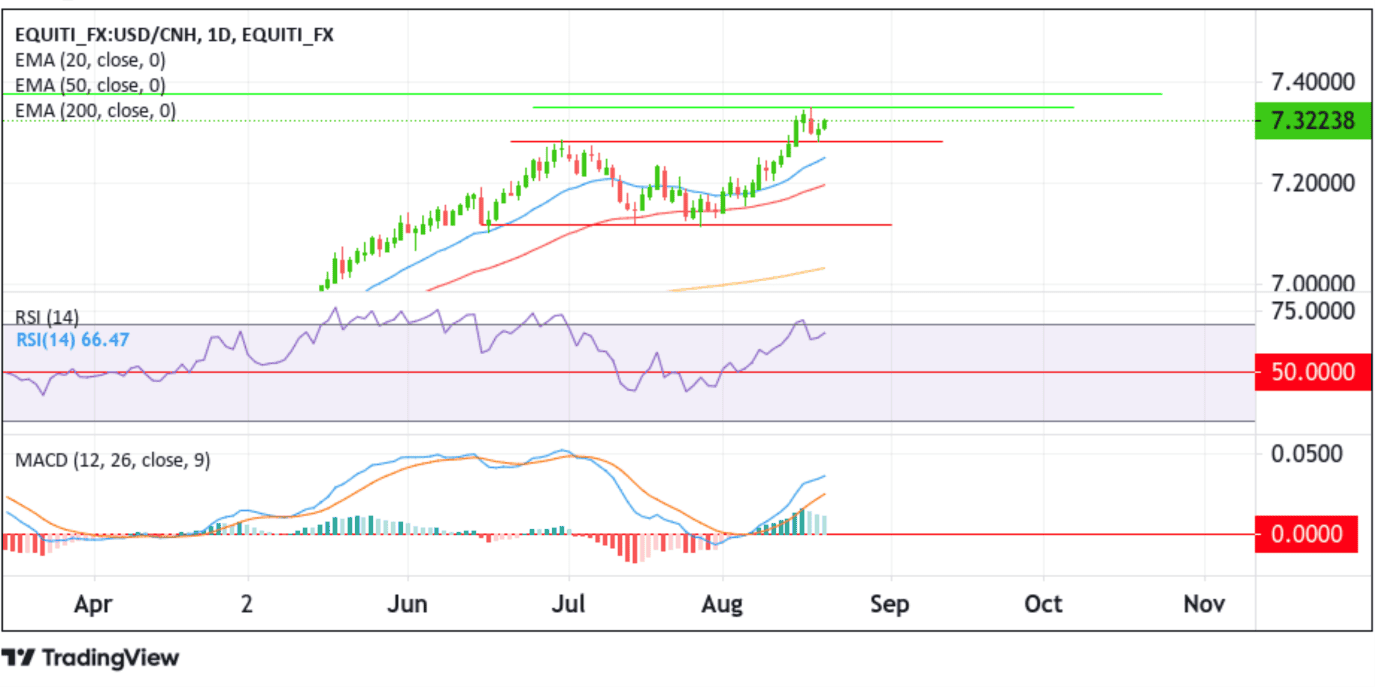

Technical Outlook: One-Day USD/CNH Price Chart

From a technical standpoint, strong follow-through buying from the current price level would lift spot prices toward the 7.34843 resistance level. A decisive flip of this resistance level into a support level would pave the way for a near-term move toward the October 2022 swing high at the 7.37458 level, about which, if the price manages to move above this key resistance level, it will pave the way for further gains toward the 7.40000 mark.

All the technical Oscillators in the chart hold dip bullish territory as both the RSI (14) and MACD crossover are above their signal lines, indicating a bullish sign of price action this week. Accepting the price above the technically strong 200 EMA (yellow) at the 6.88622 level validates the bullish outlook. Additionally, the 50 (red) and 200 (yellow) EMA Crossover (golden cross) at the 6.85997 level adds credence to the bullish thesis.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial support comes at the 7.28335 level. On further weakness, the USD/CNH cross could drop to tag the 50-day (red) EMA level at 7.19582. Acceptance below this level would pave the way for an accelerated decline toward the 7.11834 support level. A decisive flip of this support level into a resistance level would pave the way for further losses around the USD/CNH cross.