USD/JPY Bears Squash Bulls Attempted Recovery Above 146.300 Mark As Markets Eye Fed's Preferred Inflation Gauge

Key Takeaways:

- USD/JPY pair edged lower during the Asian session after extending a modest pullback from the vicinity of 146.290

- Further downtick seems elusive amid hawkish Fed expectations

- Mixed Japanese macro data extends some support to the Yen

- Markets await the release of the U.S. Core PCE Price Index data for fresh directional impetus

The USD/JPY witnessed aggressive selling on Thursday during the Asian session and dropped to a fresh daily low below the 145.800 mark. The pair managed to extend the overnight bounce from the vicinity of 146.290 level and looks set to keep its offered tone heading into the European session amid fresh U.S. dollar supply.

A fresh leg down in U.S. Treasury Bond Yields helped the U.S. dollar index, which measures the greenback against a basket of currencies, attract fresh selling below 103.200 mark on Thursday, which in turn was seen as a key factor that acted as a headwind to the USD/JPY pair. Additionally, a goodish bounce in the U.S. equity markets further undermines the greenback and helps cap the upside for the USD/JPY pair.

Further weighing down on the buck is the fresh round of disappointing U.S. macro data released on Wednesday, which showed the U.S. economy grew at an annualized rate of 2.1% in the second quarter of 2023, compared to the preliminary figure of 2.4% and the first quarter's expansion of 2.0%. Additionally, Private businesses in the U.S. hired 177 thousand workers in August 2023, the least in five months, missing market expectations of a 195 thousand rise and following an upwardly revised 371 thousand increase in July. To a greater extent, the downbeat U.S. GDP and ADP non-farm employment change data overshadowed a surge in the number of homes under contract sold last month but still awaiting closing transactions.

Despite the combination of negative factors, the downside seems limited amid Firming market expectations that the Federal Reserve (Fed) will hike interest rates one more time by 25 basis points (bp) during the September or November meeting. This comes after Fed Chair Jerome Powell warned last Friday during an annual retreat in Jackson Hole, Wyoming, that there could still be further rate hikes. While Powell said the central bank could be flexible, he said it still has a long way to go to fight inflation.

Further cementing the odds of a hawkish Fed was August's FOMC Meeting Minutes report released this month, which showed Federal Reserve officials expressed concern at their most recent meeting about the pace of inflation and said more rate hikes could be necessary in the future unless conditions change.

In contrast, the Bank of Japan (BoJ) is expected to maintain its ultra-loose monetary policy setting, and this might hold back investors from placing aggressive bearish bets around the minor. It is worth recalling that BoJ Governor Kazuo Ueda last month ruled out the possibility of any imminent change in ultra-loose monetary policy settings and signalled no immediate plans to alter its yield curve control measures.

Meanwhile, a Japanese Ministry of Economy Trade and Industry report earlier today showed industrial production in Japan declined by 2.0% month-over-month in July 2023, compared with market forecasts of a 1.4% fall after a final 2.4% growth in the previous month. The mood was, however, enlightened by better-than-expected Retail sales, which rose 6.8% year-on-year in July 2023, accelerating from a downwardly revised 5.6% gain in June and exceeding the consensus forecast for a 5.4% growth.

As we advance, investors look forward to the U.S. docket featuring the release of the Fed's preferred inflation gauge-US core PCE Price Index data and the Initial Jobless Claims data.

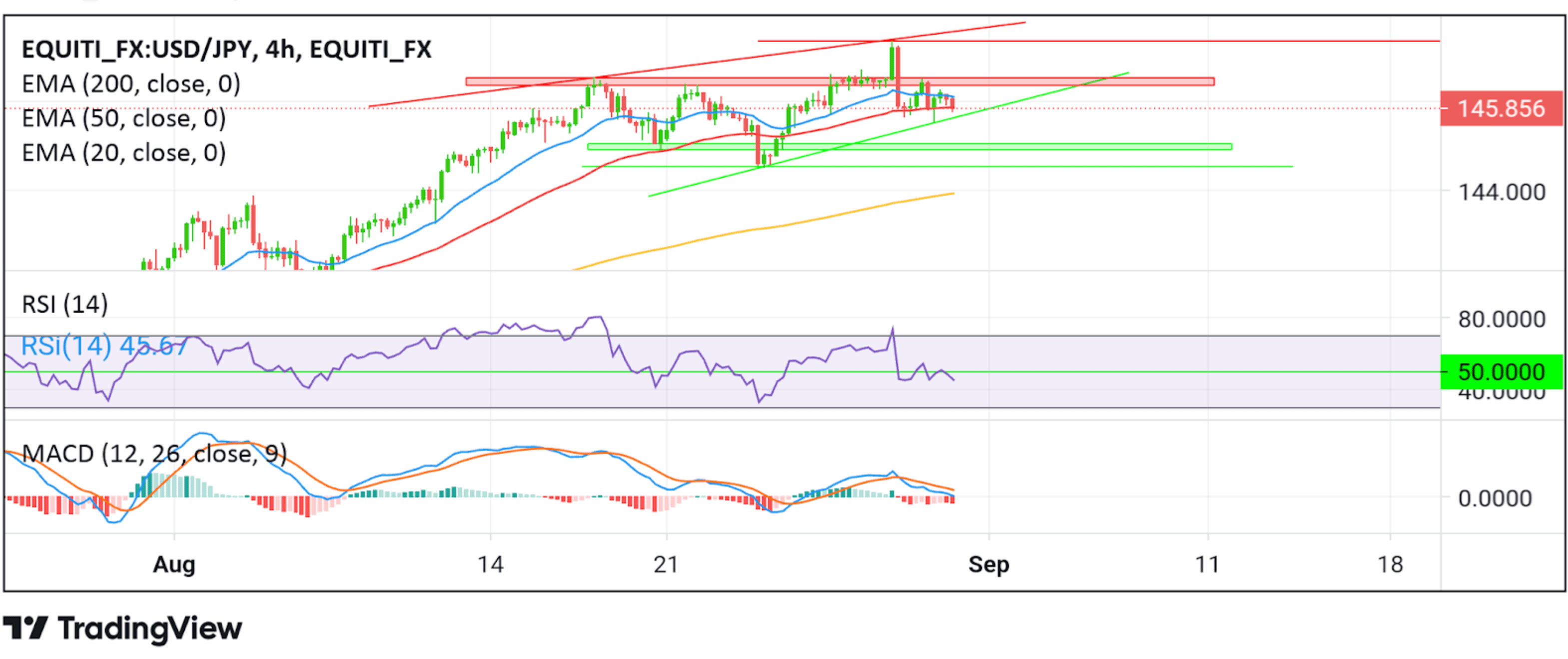

Technical Outlook: Four-Hour USD/JPY Price Chart

From a technical standstill, some strong follow-through selling would drag spot prices toward the 50-day (red) Exponential Moving Average (EMA) at the 145.889 level en route to the lower limit of the ascending channel pattern extending from the late-August 2023 swing low. If sellers manage to breach these barricades, downside pressure could accelerate, paving the way for a drop toward the 145.055 - 144.923 demand zone. Sustained weakness below this zone would pave the way for a further decline toward the 144 539 support level. If cleared decisively, this barrier will pave the way for other losses around the USD/JPY cross.

On the flip side, if dip-buyers and tactical traders jump back in and trigger a bullish reversal, initial resistance appears at the supply zone, ranging from 146.537 to 146.371. A convincing move above this zone will pave the way for a rally toward the 147.367 resistance level. If the price pierces this ceiling, the price could accelerate further toward the upper limit of the ascending channel pattern extending from the mid-August 2023 swing high. A move above this support level will reaffirm the bullish thesis and pave the way for further gains around the USD/JPY cross.