US WTI Crude Oil Rises For Second Consecutive Day As Dollar Weakens, China Looks to Bolster Economy

Key Takeaways:

- U.S. WTI crude oil edged slightly higher on Friday, the Asian session supported by a combination of factors

- Subdued U.S. Dollar action underpins crude oil prices helping black liquid rises from a one-week low

- China's Central Bank seeks to Bolster the broader economy amid clues of peaceful Post-Covid recovery

- Despite heavy bearish pressure, crude oil continues to draw support from further oil cuts by Saudi Arabia and Russia

The U.S. WTI crude oil price edged slightly higher on Friday during the Asian session, extending the modest pullback from the vicinity of 78.92 touched on Thursday to mark a third day of positive move in the last seven as the dollar continues to pullback from a five-week high and as China's central bank looks to support the property market and broader economy.

As per press time, U.S. West Texas Intermediate rose 47 cents to $80.45 per barrel, mainly supported by the subdued U.S. dollar action - the U.S. dollar index (DXY), which measures the greenback against a basket of currencies, has been on a strong bullish momentum the last two weeks, supported by rising bets that the Federal Reserve (Fed) will hike interest rates by 25 basis points (bps) either in September or November before pivoting, which in turn remain supportive of rising Treasury Bond yields and is seen as a key factor underpinning the greenback and helping exert downward pressure on crude oil prices.

The bets were cemented after August's FOMC Meeting Minutes report released on Wednesday showed Federal Reserve officials expressed concern at their most recent meeting about the pace of inflation and said more rate hikes could be necessary unless conditions change. Noteworthy discussions during a two-day July meeting resulted in a quarter percentage point rate hike in August that markets generally expected to be the last of this cycle.

However, recent data pointing to a modest rise in inflation both at the consumer and producer levels, cooling job growth but a resilient job market, and stronger-than-expected U.S. GDP growth data have to a greater extent, reversed hopes that the Fed may refrain from tightening monetary policy further this year. CME's Fed Watch Tool shows fed fund futures traders now pricing in almost a 14% and 36% chance that the Fed will raise interest rates by 25bps to 5.5% during the September and November FOMC Meetings, respectively.

Further weighing on crude oil prices is the weak demand from China, as fresh macro data from China continues to point to a subdued recovery in the wake of its fight against Covid-19. A National Statistics Bureau of China report on Tuesday showed China's industrial production increased 3.7% year-on-year in July 2023, slowing from a 4.4% rise in June and below forecasts of 4.4%, due to softer rises in manufacturing activity (3.9% vs 4.8%) and mining output (1.3% vs 1.5%). Additionally, China's retail sales increased by 2.5% year-on-year in July 2023, slowing from a 3.1% growth in the prior month and missing market estimates of 4.5%. Despite the combination of harmful macro data, China's central bank said it would keep liquidity reasonably ample this week and maintain a "precise and forceful" policy to support economic recovery against headwinds.

That said, further undermining crude oil prices is the fresh batch of U.S. economic data released on Thursday showing the number of Americans filing for unemployment benefits fell in the last week, suggesting the still-tight labor market could prolong the Fed's tightening campaign to cool the economy.

Elsewhere, U.S. crude oil inventories fell by 5.96 million barrels in the week to August 11, 2023, above market expectations for a 2.32 million barrel draw, a U.S. Energy Information Administration report showed on Wednesday. On this note, crude oil prices have found some support in their attempt to regain their lost glory. With pledges by Saudi Arabia and Russia's decision to extend supply cuts through September, crude oil prices could extend their modest pullback; however, a stronger U.S. dollar supported by hawkish Fed expectations could act as a stumbling block.

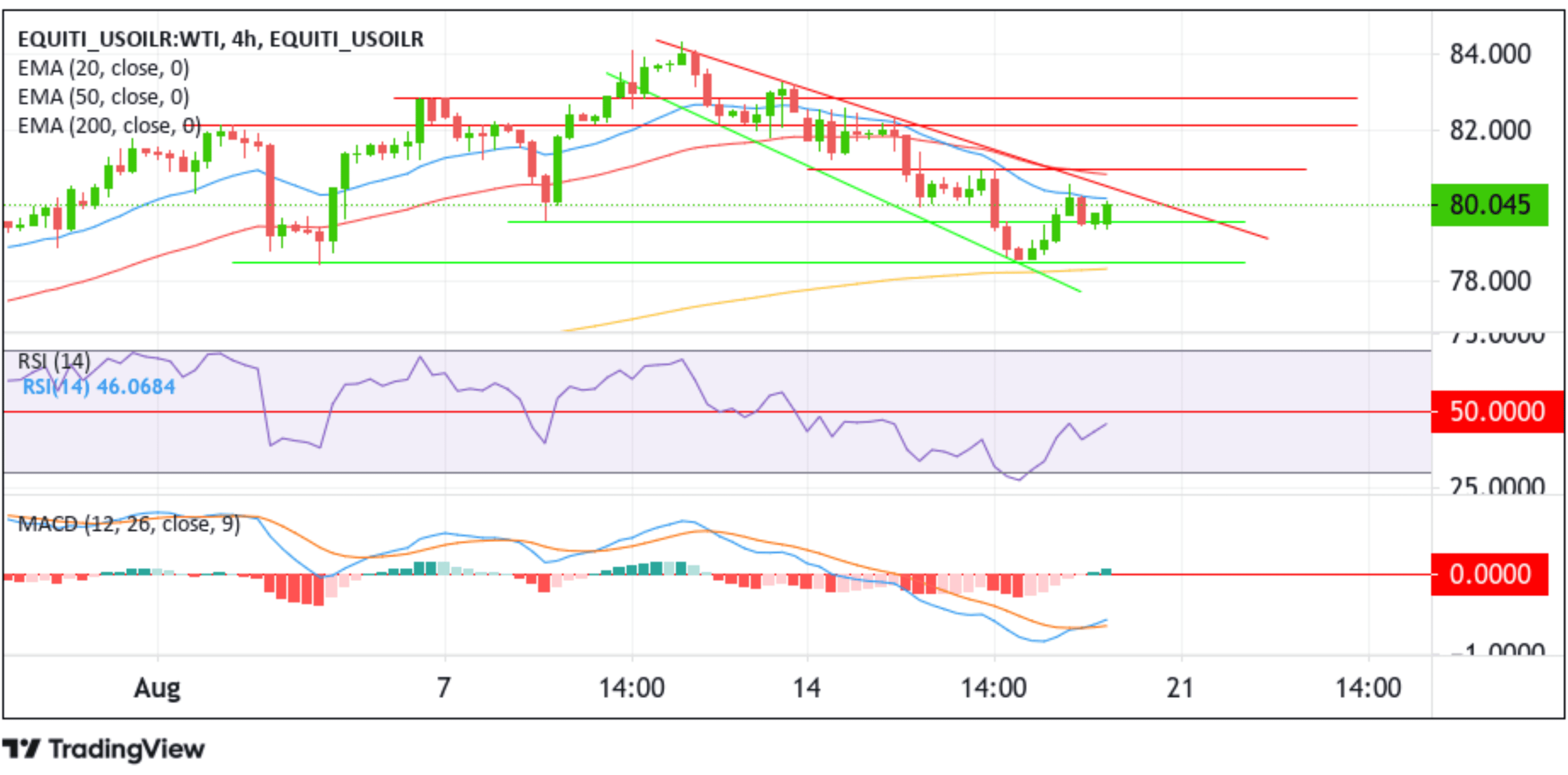

Technical Outlook: Four-Hours US WTI Crude Oil Price Chart

From a technical standpoint, a further increase in buying pressure from the current price level will uplift spot prices toward the downward-sloping trendline extending from the mid-August 2023 swing high. A subsequent break above this resistance level could boost spot prices toward tagging the 50-day(red) EMA level at 80.29, which sits directly below the 80.948 resistance level. A convincing move above these barriers will pave the way for a rally toward the 82.106 resistance level en-route to the 82.834 ceilings. On further strength, the bullish trajectory could be extended toward the 2023 record high at 84.308.

On the flip side, if dip-sellers and tactical traders jump back and in and trigger a bearish reversal, initial support appears at 79.600. On further weakness, the attention shifted toward the 78.509 support level, about which a short covering move will pave the way for a drop toward the technically 200-day solid (yellow) EMA level at 78.352. A four-hour candlestick close below this level would pave the way for aggressive technical selling, about which the price could drop further toward the 77.00 mark.