WEEKLY Global Fundamental Analysis (20-24 May)

GBP/USD

The sterling pound looks poised to extend gains for a sixth consecutive week against the dollar amid a generally weaker U.S. dollar across the board. The greenback last week lost nearly 0.8% and continues to remain on the negative side in turn lending further support to the GBP/USD pair as signs of cooling US inflation and easing consumer spending cemented market bets that the Federal Reserve will begin cutting rates as soon as the September meeting and not during the November meeting. On the UK docket, data last week showed the unemployment rate in the UK edged up for a third month and wage growth stayed at 6%, in line with the BOE’s forecast, reinforcing bets the central bank could soon start cutting the interest rate. The probability of a BoE rate cut by June increased slightly to 50%, and traders continue to bet the central bank would deliver two quarter-point cuts by the end of the year. Looking forward, the GBP/USD pair will be guided this week by BoE Governor Bailey's Speech on Tuesday, the UK’s Inflation data report, and FOMC Meeting Minutes release on Wednesday, UK’s Manufacturing and Services PMI, U.S. Initial Jobless Claims and New Home Sales (Apr) data report on Thursday and Finally, the UK Core Retails (MoM) (Apr) data report on Friday.

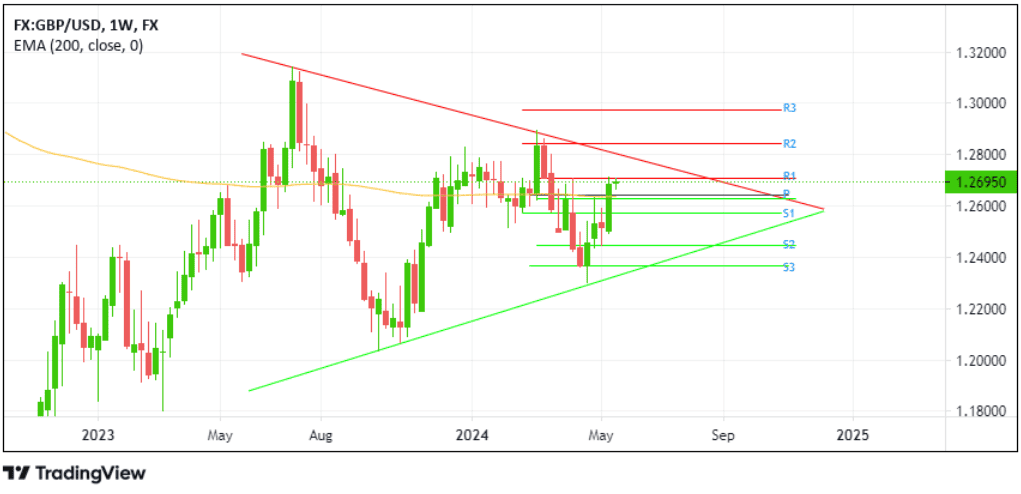

Based on GBP/USD’s weekly chart, here are the key levels to watch out for this week:

Resistance (R3): 1.2975 | Pivot Point (P.P.): 1.2641 | Support (S3): 1.2570 |

Resistance (R2): 1.2843 | Support (S2): 1.2439 | |

Resistance (R1): 1.2773 | Support (S1): 1.2570 |

NZD/USD

The New Zealand dollar seems likely to post a tenth-weekly gain against the U.S. dollar this week in the wake of subdued U.S. dollar action. The Kiwi however weakens against the greenback and moves below the $0.61300 mark on Monday during the Asian session as investors shift their focus toward Wednesday’s Reserve Bank of New Zealand Interest rate decision. The New Zealand central bank is widely expected to leave its official cash rate at 5.5% for the seventh consecutive meeting, and policymakers are likely to reiterate the need to keep policy restrictive for a sustained period to return inflation to its 1-3% target band. Last week, data showed that the country’s 2-year inflation expectations fell to their lowest level in almost three years during the second quarter, fuelling speculation that the RBNZ might consider lowering rates later this year. On the U.S. docket, the U.S. dollar index which measures the the greenback against a basket of currencies continues to remain on the backfoot heading into a week full of key U.S. macro data as signs of cooling US inflation and easing consumer spending cemented market bets that the Federal Reserve will begin cutting rates as soon as the September meeting and not during the November meeting which weighs on the safe-haven buck and continues to act as a tailwind to the NZD/USD pair. Looking ahead, the second part of the week is what will drive price action and influence market sentiment with the RBNZ interest rate decision being the first to headline markets on Wednesday during the early Asian session. Afterward, the May FOMC Meeting Minutes will help drive action during the North-American session. On Thursday, the U.S. Initial Jobless Claims and New Home Sales (Apr) data report will help provide directional impetus for the NZD/USD cross.

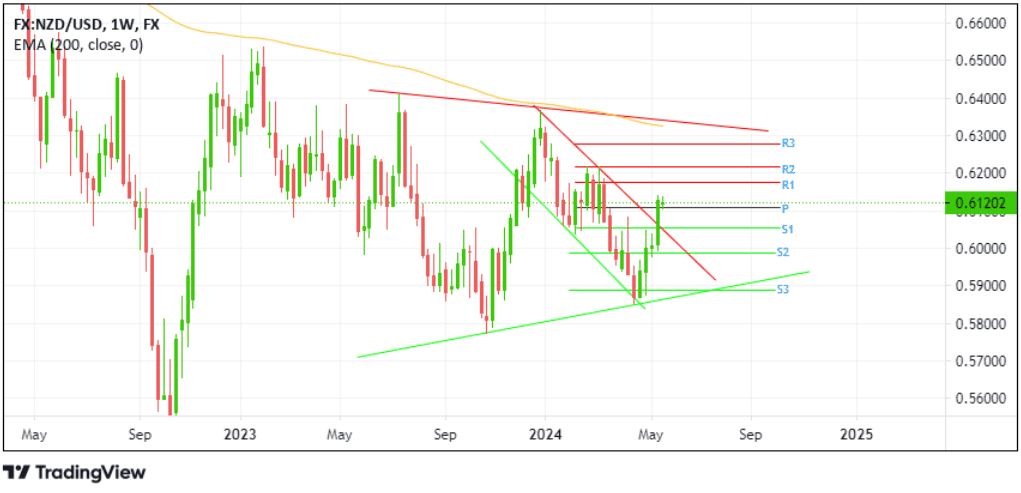

Based on NZD/USD’s weekly chart, here are the key levels to watch out for this week

Resistance (R3): 0.62774 | Pivot Point (P.P.): 0.61095 | Support (S3): 0.58773 |

Resistance (R2): 0.62183 | Support (S2): 0.59881 | |

Resistance (R1): 0.61741 | Support (S1): 0.60527 |

EUR/USD

The euro looks very likely to record a seven-straight weekly gain against the greenback this week and clinch a new two-month high in the wake of increased selling around the safe-haven buck. This comes amid increased odds that the U.S. central bank will commence to cut rates in September rather than in November after data last week showed cooling inflation and easing consumer spending in the U.S. Shifting to the eurozone docket, data last week showed the annual inflation rate in the Euro Area was confirmed at 2.4% in April of 2024, the same as in March while the core rate which excludes energy, food, alcohol & tobacco, fell for a 9th straight month to 2.7%, the lowest level since February 2022 reinforcing bets the European Central Bank could soon start cutting rates. The European Central Bank is expected to begin cutting interest rates in June, with a total of 70 basis points in cuts from the ECB already anticipated by markets this year. Major movements around the major currency pair now hang on incoming key euro and U.S. macro data set for release this week. The second part of the week is what will cause major moves around the major currency pair. The May FOMC Meeting Minutes will be released on Wednesday during the North-American session while the the U.S. Initial Jobless Claims and New Home Sales (Apr) data report will be released on Thursday and Finally, the German GDP(QoQ) (Q1) data report will be released on Friday.

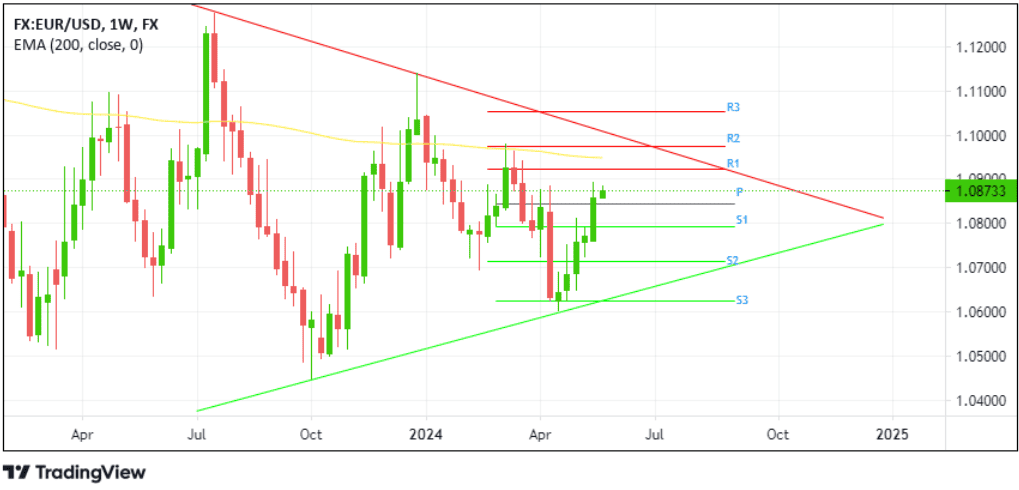

Based on EUR/USD’s weekly chart, here are the key levels to watch out for this week:

Resistance (R3): 1.1052 | Pivot Point (P.P.): 1.0844 | Support (S3): 1.0624 |

Resistance (R2): 1.0974 | Support (S2): 1.0714 | |

Resistance (R1): 1.0922 | Support (S1): 1.0792 |

WTI

The US WTI Crude Oil futures look poised for a second weekly gain this week in the wake of a softer U.S. dollar across the board. Apart from this, news over the weekend of the death of the Iranian Prime Minister stoked political uncertainty in the major oil-producing nation and looks to further lift crude oil prices. Iranian state media on late Sunday evening reported "no sign of life" at the crash site of the helicopter that carried President Ebrahim Raisi, stoking political uncertainty in a major oil-producing nation. Last week, the U.S government announced it had purchased 3.3 million barrels of oil at $79.38 per barrel to replenish its Strategic Petroleum Reserve. Elsewhere, the latest OPEC report indicated that member countries exceeded their production cap by 568,000 barrels per day in April, but maintained solid demand projections of 2.25 million barrels per day in 2024 and 1.85 million barrels per day in 2025. Looking ahead, a slew of key U.S. macro data releases this week will help provide directional impetus for the precious black liquid. This includes the U.S crude oil inventories data and the May FOMC Meeting Minutes report releases on Wednesday. Additionally, the U.S. Initial Jobless Claims and New Home Sales (Apr) data report on Thursday might help determine the next leg of a directional move for crude oil prices.

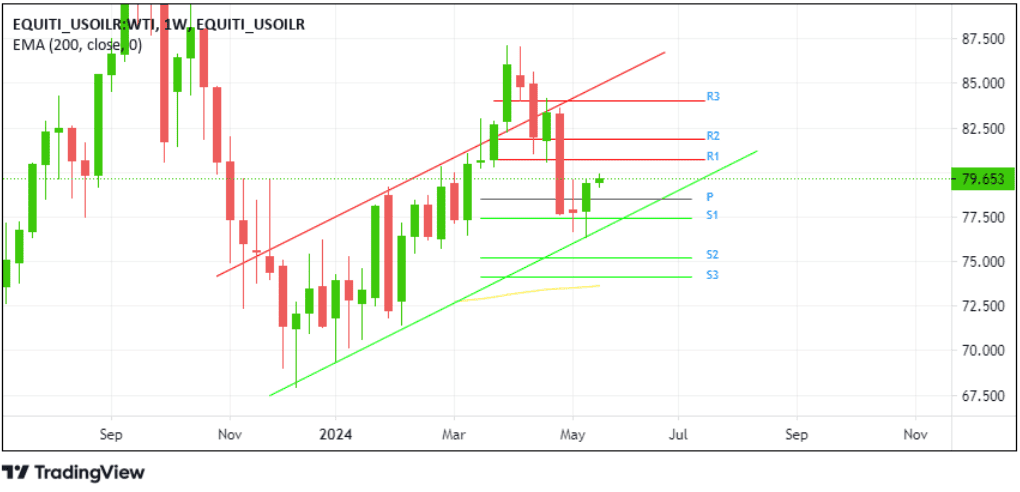

Based on the US WTI Crude Oil futures weekly chart, here are the key levels to watch out for this week:

Resistance (R3): 84.00 | Pivot Point (P.P.): 78.53 | Support (S3): 74.10 |

Resistance (R2): 81.83 | Support (S2): 75.23 | |

Resistance (R1): 80.70 | Support (S1): 77.40 |

U.S Index

All three major U.S. stock futures indexes look likely to close the week with gains in the wake of a weaker U.S. dollar investors continued to assess the Federal Reserve rate outlook in the wake of softer inflation in the U.S. In fact, the Dow Jones Industrial Average (US30) futures rose around 1.30% last week to close with heavy gains above the key $40,000 level for the first time ever on Friday. The Nasdaq 100 futures index on the other hand also rose about 2.22% to close with heavy gains on Friday above the $18500.00 level while the S&P 500 futures index gained around 1.72% last week to close above the $5300.00 level on Friday. Further moves now hing on the upcoming Microsoft Build event on Tuesday and Nvidia’s fiscal first-quarter results, due Wednesday afternoon. Additionally, the May FOMC Meeting Minutes report release on Wednesday combined with the U.S. Initial Jobless Claims and New Home Sales (Apr) data report on Thursday will influence the U.S. dollar price dynamics and help determine the next leg of a directional move for U.S. futures indexes.