WEEKLY Global Fundamental Analysis (27-31 May)

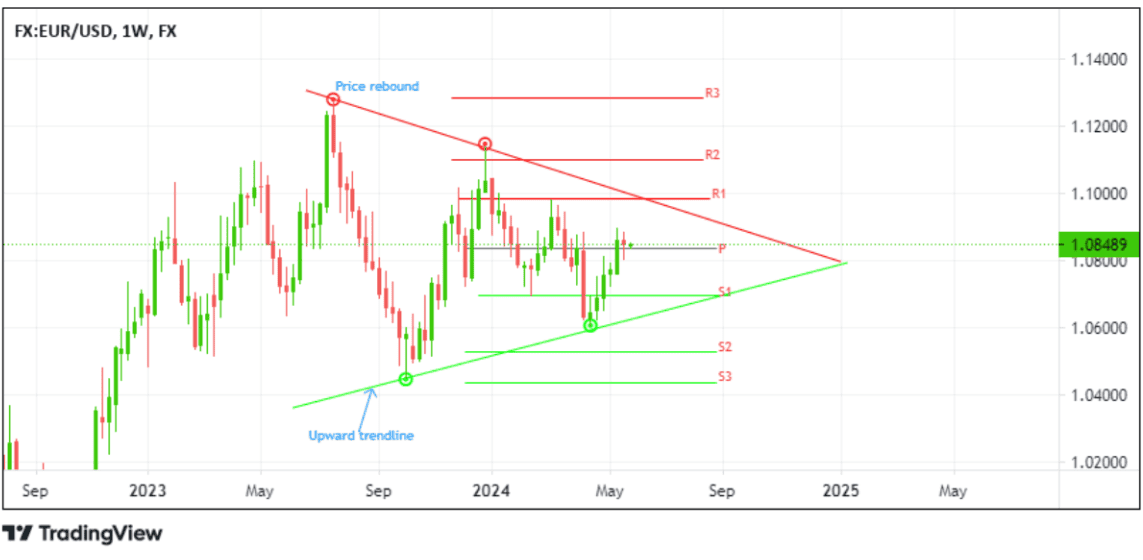

EUR/USD

The euro is expected to continue its slight increase from a two-month high of 1.0895 reached earlier this month and weaken for the second consecutive week. This is due to a generally stronger U.S. dollar, supported by firm expectations of a more aggressive stance from the Federal Reserve following last week's FOMC meeting minutes and recent hawkish commentary. However, the euro is finding support from light trading volumes in the U.S. as the country observes the Memorial Day holiday today. The euro rose above the $1.09 mark on Monday during the Asian session.

Recent data suggesting that the European Central Bank (ECB) may deliver fewer rate cuts this year has supported the euro bulls. Negotiated pay surged 4.7% compared to a year ago in the first quarter, nearing the record levels seen in Q3 2023, prompting an inflation warning for the ECB. Additionally, PMI readings showed that private sector activity grew the most in a year in April amid faster increases in new orders and employment. As a result, investors are now expecting only a 60 basis point cut in ECB rates this year.

Looking ahead, Germany's Ifo Business Climate data report will be released today. This will be followed by the U.S. C.B. Consumer Confidence (May) on Tuesday and Germany's GFK Consumer Confidence and Inflation Rate (YoY) on Wednesday. Thursday will see the release of the U.S. GDP (Q1) and Initial Jobless Claims (previous week), as well as the Eurozone's CPI (YoY) (May) and U.S. Core PCE Price Index (Mom) (Apr) data reports. These reports will influence the euro and U.S. dollar price dynamics and help determine the next direction for the EUR/USD pair.

Based on EUR/USD’s weekly chart, here are the key levels to watch out for this week:

Resistance (R3): 1.12839 | Pivot Point (P.P.): 1.08331 | Support (S3): 1.0695 |

Resistance (R2): 1.10983 | Support (S2): 1.0525 | |

Resistance (R1): 1.09816 | Support (S1): 1.0695 |

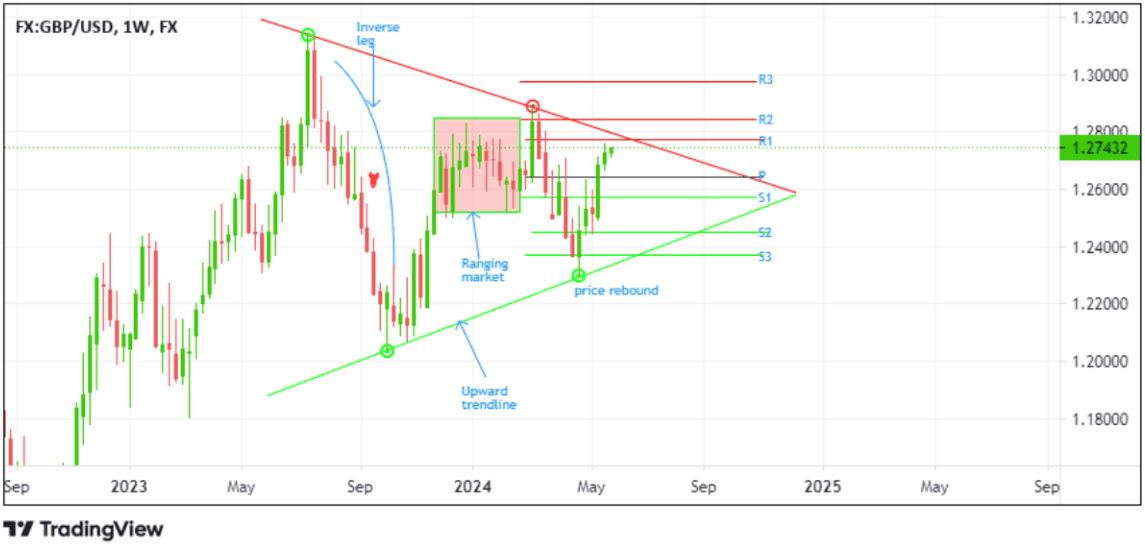

GBP/USD

The British pound seems set to continue its upward trend for a seventh consecutive week against the dollar, despite a generally stronger U.S. dollar supported by expectations of a more aggressive Federal Reserve. This follows the release of last week's FOMC meeting minutes report and recent hawkish commentary. The pound rose above the $1.27400 level on Monday during the Asian session, starting the week positively and remaining at its highest level in two months. Despite light trading volumes, the U.K. observes a Bank Holiday today, while the U.S. celebrates the Memorial Day holiday.

Data from last week showed a 2.3% fall in U.K. retail sales, the most significant drop so far this year, and worse than expected. Additionally, the annual inflation rate in the U.K. eased to 2.3%, nearing the Bank of England's 2% target but above the estimated 2.1%. As a result, investors are now less likely to expect a rate cut in June, with a slight majority anticipating the first cut in September. Meanwhile, Prime Minister Rishi Sunak announced that the U.K. will hold national elections on July 4th. Polls indicate a preference for a change in government to one led by the Labour Party, adding political risk and uncertainty to the U.K.'s volatile borrowing levels in recent times.

Looking ahead this week, both the U.K. and U.S. markets are closed on Monday for the Bank and Memorial Day Holidays. On Tuesday, the U.S. will release the C.B. Consumer Confidence data for May, followed by the U.S. GDP (Q1) and Initial Jobless Claims reports on Thursday, along with a speech by BoE Governor Andrew Bailey. Friday will feature the release of the Fed's preferred inflation gauge, known as the Core Personal Consumption Expenditure (PCE) Price Index for April.

Based on GBP/USD’s weekly chart, here are the key levels to watch out for this week

Resistance (R3): 1.2975 | Pivot Point (P.P.): 1.2641 | Support (S3): 1.2443 |

Resistance (R2): 1.2843 | Support (S2): 1.2508 | |

Resistance (R1): 1.2775 | Support (S1): 1.2570 |

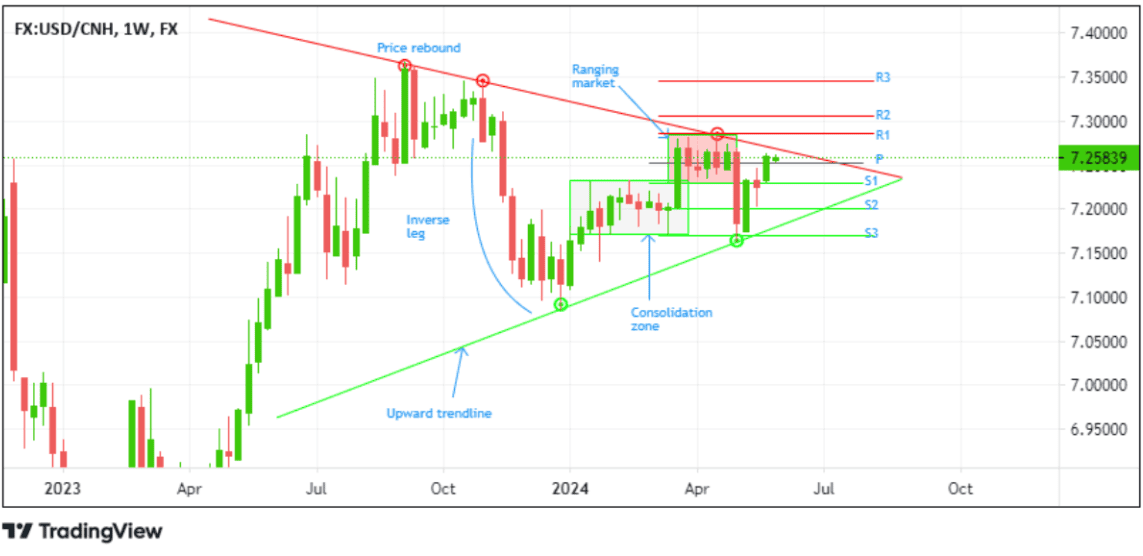

USD/CNH

The offshore Yuan will likely record a fourth consecutive weekly loss against the U.S. dollar this week. This is due to the stronger U.S. dollar, supported by firm hawkish Fed expectations following last week's FOMC meeting minutes report and recent hawkish commentary. Despite this, the Yuan started the week below 7.25800 against the U.S. dollar but remained close to its one-month low. Strong U.S. economic indicators pointing to prolonged higher interest rates and escalating geopolitical tensions in the Taiwan Strait continue to weigh on the Yuan.

Last week's FOMC meeting minutes and hawkish commentary indicated the likelihood of prolonged higher interest rates. S&P figures suggest a surge in U.S. business activity to its highest level in over two years in May, while the latest weekly jobless claims fell more than expected, indicating strength in the labor market. Ongoing regional tensions intensified as China conducted consecutive military exercises around Taiwan, showcasing its capability to "seize power" and control strategic areas. China positioned these maneuvers as a punishment to Taiwan's President, Lai Ching-te. Further movements around the USD/CNH cross will depend on incoming U.S. and China macro data releases this week.

The U.S. C.B. Consumer Confidence (May) data report is headlining markets on Tuesday, ahead of Thursday's U.S. GDP (QoQ) (Q1) and U.S. Initial Jobless Claims (previous week) data report. Friday will feature China's Manufacturing PMI (May) data report and the Fed's preferred inflation gauge, popularly known as the Core Personal Consumption Expenditure (PCE) Price Index data report for April.

Based on USD/CNH’s weekly chart, here are the key levels to watch out for this week

Resistance (R3): 7.3452 | Pivot Point (P.P.): 7.5222 | Support (S3): 7.1695 |

Resistance (R2): 7.3066 | Support (S2): 7.2012 | |

Resistance (R1): 7.2855 | Support (S1): 7.2293 |

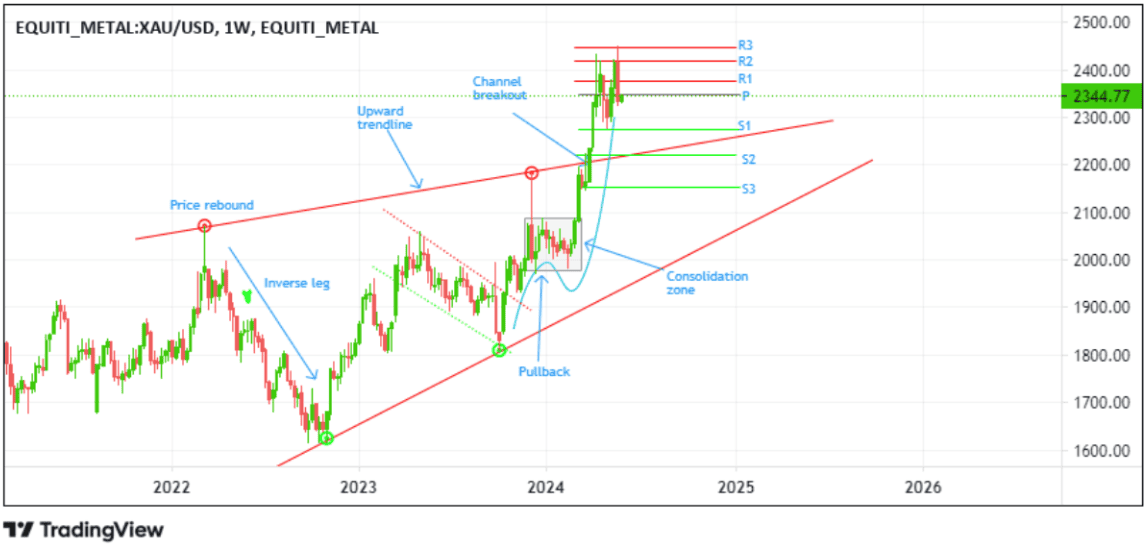

XAU/USD

The price of Gold (XAU/USD) futures is expected to continue falling below the $2400.00 mark for the second consecutive week, mainly due to a stronger U.S. dollar. This is supported by increased speculation that the Federal Reserve may maintain higher interest rates for longer. Last week's FOMC meeting minutes and hawkish commentary indicated the likelihood of higher interest rates, leading to a rise in U.S. Treasury bond yields and negatively impacting the safe-haven precious metal. Furthermore, S&P figures revealed a surge in U.S. business activity in May and a larger-than-expected drop in weekly jobless claims, indicating strength in the labor market.

The U.S. markets will be closed on Monday for the Memorial Day holiday. However, crucial U.S. macroeconomic data throughout the week will influence the trajectory of Gold. Tuesday will feature the release of the U.S. C.B. Consumer Confidence (May) data report, while Thursday will see the release of U.S. GDP (Q1) and U.S. Initial Jobless Claims (previous week) data. The week will conclude with the release of the Core Personal Consumption Expenditure (PCE) Price Index data for April on Friday.

Based on XAU/USD’s weekly chart, here are the key levels to watch out for this week

Resistance (R3): 2499.28 | Pivot Point (P.P.): 2347.01 | Support (S3): 2152.24 |

Resistance (R2): 2418.74 | Support (S2): 2219.50 | |

Resistance (R1): 2380.20 | Support (S1): 2275.28 |

U.S Index

The three main U.S. stock futures indexes are expected to continue the rally inspired by A.I. technology from last week. This rally helped offset concerns about the Federal Reserve maintaining higher interest rates for longer.

Last week's report from the Federal Open Market Committee (FOMC) meeting and the hawkish comments indicated the possibility of prolonged higher interest rates, leading to an increase in U.S. Treasury bond yields and a negative outlook for stock indexes. However, the tech rally, fueled by Nvidia's strong earnings, boosted the market towards the end of last week despite worries that the Fed may not reduce rates this summer, as indicated by the FOMC meeting minutes and hawkish commentary. The S&P 500 closed at 5,304.72, up 0.7%, and the Nasdaq Composite (Nas100) ended at 16,920.79, up around 1.1% on Friday. The Dow Jones Industrial Average (US30) rose 4.3 points, or 0.01%, to finish at 39,069.59 on Friday.

Looking ahead, a range of important U.S. macroeconomic data is scheduled to be released this week. These data will impact the dynamics of the U.S. dollar price and, subsequently, help determine the next movement for the three major U.S. stock indices.