New Zealand Dollar Climbs To An Almost Ten-Week High Above 0.61500

Key Takeaways:

- The New Zealand dollar rose to an almost ten-week high, supported by the latest RBNZ interest rate decision

- The RBNZ held its OCR rates steady at 5.5% for the seventh consecutive time but offered a hawkish outlook on monetary policy

- A stronger U.S dollar across the board might help limit further gains around the NZD/USD cross

- Markets now await the release of the May FOMC Meeting minutes report

The New Zealand dollar climbed above $0.61500 on Wednesday during the mid-Asian session, rising to its most substantial level in nearly ten weeks as the Reserve Bank of New Zealand held interest rates steady and offered a hawkish outlook on monetary policy than the market anticipated.

On Wednesday, the Reserve Bank of New Zealand announced it had kept its official cash rate (OCR) steady at 5.5% during its May 2024 policy meeting, extending the rate pause for the seventh consecutive time and confirming market expectations. Policymakers noted that the restrictive monetary policy has alleviated capacity pressures and reduced consumer price inflation. Although the country's headline inflation eased to a nearly three-year low of 4% in Q1 of 2024, it remained above the target range of 1% to 3%. Additionally, the RBNZ raised its forecast for a peak in rates to 5.7% from 5.6% and now expects to begin cutting the rate in the third quarter of 2025, later than its previous forecast for the second quarter.

Meanwhile, the U.S. dollar index, which measures the greenback against a basket of currencies, rose above the 104.650 level on Wednesday during the Asian session, extending gains for the third consecutive day. The risk-off market mood combined with the recent hawkish Fed remarks continue to underpin the safe-haven greenback and should help limit further gains around the NZD/USD cross.

On Tuesday, Atlanta Fed President Raphael Bostic said it would take time before the central bank is confident that inflation will return to 2%, reiterating that only one rate cut will be necessary this year. He added, "Our new steady state is likely to be higher than what people have known over the last decade, maybe back to where we were in the 1990s and 2000s."

That said, traders still hold onto bets over the timing and extent of Fed rate cuts this year, seeing rate reductions in September and November. A September rate cut looks more likely at this juncture following last week's U.S. inflation and retail sales data report.

CME's Fed watch tool shows the probability of a 25bps September rate cut is higher at 51.9% compared to 46.8% in November.

Investors look forward to the U.S. docket featuring the release of the Existing Home Sales (Apr) data report. Traders will look for cues from releasing the May FOMC Meeting minutes report, which will help guide the interest rate outlook further.

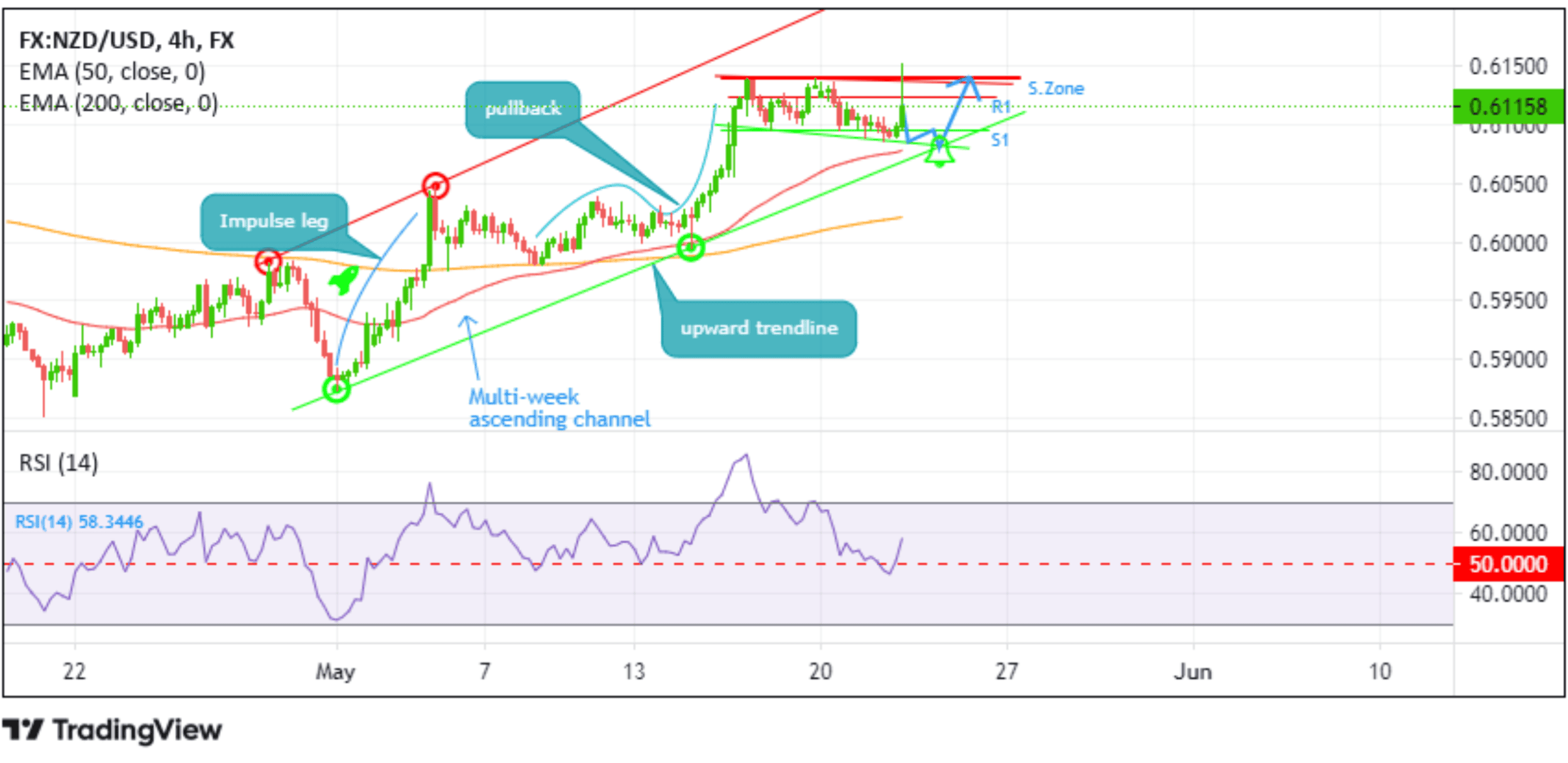

Technical Outlook: Four-Hour NZD/USD Price Chart

Looking at the NZD/USD four-hour price chart, after breaking above the 0.61238 resistance level (R1) followed by the trendline resistance and subsequently moving above the supply zone ranging from 0.61406 - 0.61395, the price failed to maintain its bullish momentum and retreated toward 0.61100's. At the lower time frames, the price seems to be moving within a descending channel about which, if the current pullback persists, the cost could drop toward the 0.60953 level (S1), below which the price now could extend a leg down toward the lower limit of the descending channel pattern. Traders should expect a break below this support level and later a rejection on the critical support level of the multi-week ascending channel pattern(upward trendline) to signal a "Buy" trade. A subsequent up move could confront immediate resistance at the 0.60953 support level, which has now turned resistance level. A clean move above this level, followed by a breach above the 0.61238 resistance level, would set the stage for a move towards the target zone (0.61406 - 0.61395 supply zone).

On the flip side, if the pullback extends in the coming sessions and is followed by a breach below the 0.60953 level (S1). The price could drop toward the lower limit of the descending channel (in lower time frames). If this level fails to hold, the price could descend further toward the critical support level of the multi-week ascending channel pattern(upward trendline). A subsequent break below this level would negate the near-term bullish outlook and stage for further losses around the NZD/USD pair. The NZD/USD could accelerate its fall toward the 0.60471 crucial support level. A breach below this level would catapult a drop toward 0.6300's.