What is the FOMC Press Conference?

Key Takeaways:

- The FOMC Press Conference is a platform for the Fed Chair to communicate crucial monetary policy decisions to the public. It offers a glimpse into the state of the U.S. economy

- The FOMC comprises twelve voting members, seven Board of Governors of the Federal Reserve System and five Reserve Bank presidents

- The primary way in which FOMC meetings impact the Forex market is through decisions related to interest rates and monetary policy

In the intricate world of finance and economics, few events capture the attention of investors, policymakers, and the general public quite like the Federal Open Market Committee (FOMC) Press Conference. Held periodically throughout the year, this press conference has become a pivotal moment on the economic calendar, where the Chair of the Federal Reserve provides insights into the nation's monetary policy decisions and offers a glimpse into the state of the U.S. economy.

As an institution shrouded in mystery for many, the Federal Reserve plays a critical role in shaping the economic landscape of the United States. The FOMC, in particular, holds significant influence over the nation's financial markets, interest rates, and overall economic stability. But what exactly is the FOMC Press Conference, and why does it matter so much to both Wall Street and Main Street?

What is the FOMC?

The FOMC, which stands for Federal Open Market Committee, is a crucial entity within the United States central banking system and is comprised of twelve voting members, including the seven members of the Board of Governors and five regional Federal Reserve Bank presidents. The committee meets eight times yearly to discuss and analyze economic data and make decisions on key policy matters. The FOMC's primary function is to maintain price stability and promote sustainable economic growth by adjusting interest rates, which impacts borrowing costs, consumer spending, and overall market conditions. The decisions made by the FOMC have far-reaching effects on financial markets domestically and globally, making them a subject of great interest and importance to economists, investors, and policymakers alike.

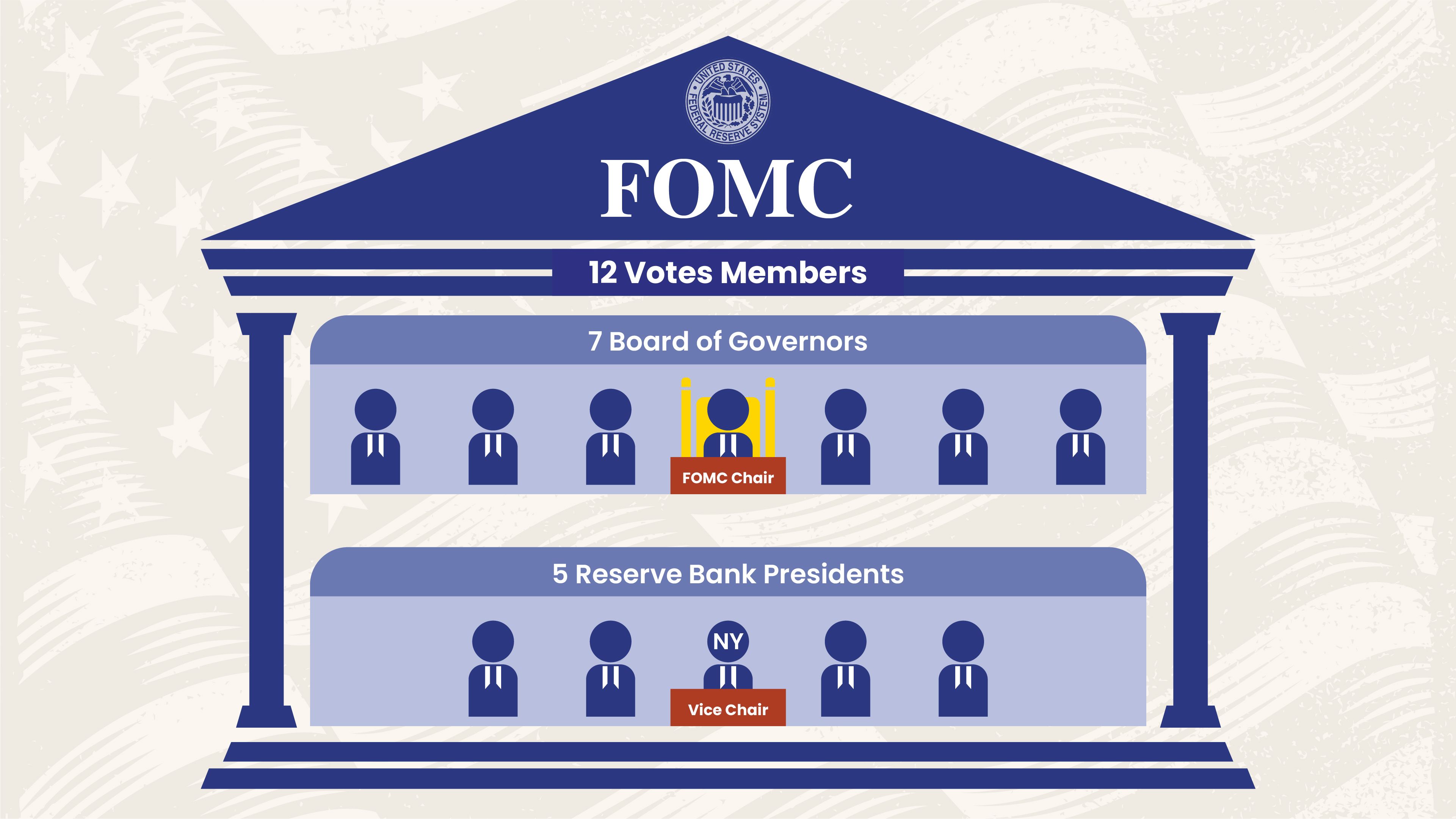

Structure of the FOMC

Understanding the structure and functioning of the FOMC is crucial for anyone seeking insight into the decision-making processes shaping the country's economic landscape. At its core, the FOMC comprises twelve voting members: the seven Board of Governors of the Federal Reserve System and five Reserve Bank presidents. This unique structure ensures representation from various regions nationwide, enhancing the committee's diversity of perspectives. The Chair of the Board of Governors also holds the critical position of the FOMC chair, playing a pivotal role in guiding the committee's discussions and deliberations. Additionally, the FOMC retains a unique process whereby the Federal Reserve Bank of New York president serves as the committee's Vice Chair, providing additional stability and coordination. Overall, the structure of the FOMC exemplifies a well-balanced framework, fostering collaboration and facilitating informed decision-making in monetary policy.

How do FOMC meetings affect the forex market?

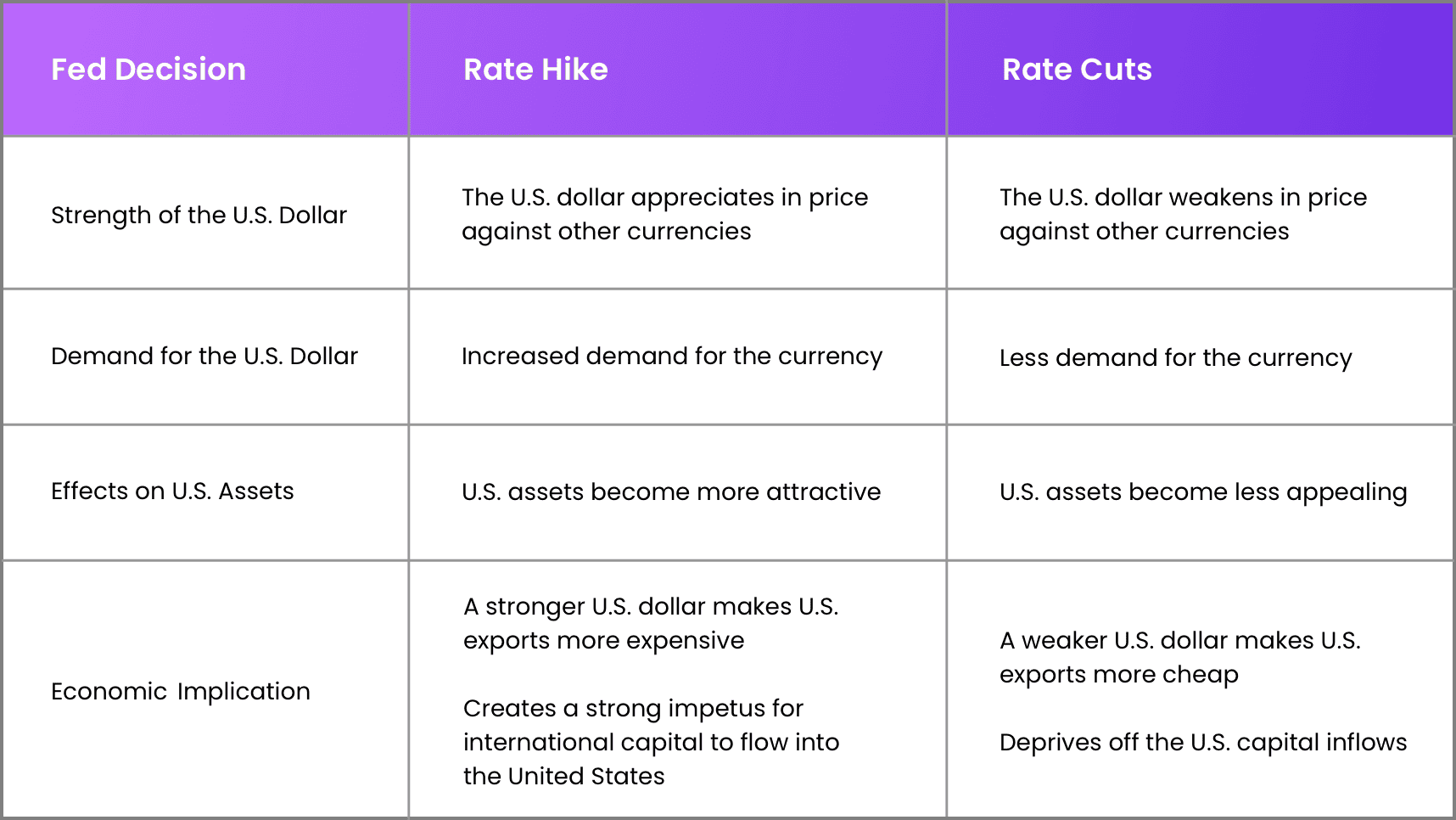

The primary way in which FOMC meetings impact the Forex market is through decisions related to interest rates and monetary policy. During these meetings, the FOMC reviews economic data, assesses the state of the U.S. economy, and makes decisions about the federal funds rate. This benchmark interest rate affects borrowing costs throughout the U.S. financial system. Any changes in interest rates or signals about future rate movements can profoundly affect currency valuations.

Besides the actual interest rate decisions, FOMC meetings are known for the statements and guidance the committee provides. The language used in these statements can offer valuable insights into the future path of monetary policy. Additionally, reports in these meetings suggest a more hawkish stance (favoring higher rates) can boost the dollar, while a more dovish stance (favoring lower rates) can weaken it.

Furthermore, the FOMC signals concern about the economy. In that case, it may lead to risk aversion, causing investors to flock to safe-haven currencies like the U.S. dollar and Japanese yen while selling riskier currencies.

Lastly, FOMC meetings are typically associated with increased volatility in the forex market. As traders react to interest rate decisions and interpret the committee's statements, currency pairs can experience rapid price movements. For experienced traders, this volatility can present trading opportunities to profit from short-term price swings. However, it also poses risks, as market sentiment can change quickly.

Case example

For instance, during the FOMC's June 2022 meeting, the Federal Reserve rose the target range for the federal funds rate by 75bps to 1.5%-1.75%, beating market expectations of 50bps after the inflation rate unexpectedly accelerated last month to 41-year highs. It was the most significant rate increase since 1994, and Chair Powell signaled a similar move could come at the next meeting, but he does not expect 75bps activities to be common.

The immediate implication of the Fed rate hike saw wild swing price movements, with the U.S. dollar strengthening by as much as 40 pips against other currencies before later paring gains and closing with modest losses below the 105.000 mark. On the other hand, the U.S. equity markets rallied by as much as 2.5% to one of their best days in more than two weeks following the announcement before reversing to close with heavy gains.

Conversely, currencies and assets pegged to the U.S. dollar fell following the announcement before retracing to close the day with modest gains, while global equity markets rose to one of their best days tracking U.S. stocks.

In conclusion, the Federal Open Market Committee (FOMC) Press Conference plays a significant role in providing valuable insights into the decisions made by the United States central bank. This highly anticipated event allows the Federal Reserve Chairman to communicate crucial details about monetary policy, including interest rate changes, economic forecasts, and the reasoning behind their decisions. By addressing a wide range of pressing economic issues, the FOMC Press Conference helps investors, businesses, and the general public better understand the Federal Reserve's plans and its impact on the economy. The transparency provided through this conference fosters a sense of trust. It enables stability in financial markets, allowing individuals and organizations to make informed decisions based on the insights shared during this event. Ultimately, the FOMC Press Conference is a vital forum for open communication and ensures that policymakers are held accountable while guiding the United States toward a healthy and prosperous economy.

Are you looking to start trading in the Forex Market? You can Enjoy FREE USD 10,000 Virtual Funds for trading by Signing Up on Pocket Trader. With Pocket Trader, You can invest in multiple markets, including currencies, indices, and commodities, learn from experienced traders and share ideas with pocket trader’s social features to build wealth together.