Gold Rises Further Above $1900.00s Amid Weak U.S. Dollar As Markets Eye Powell’s Remarks At Wyoming

Key Takeaways:

- Gold price gained positive traction for the fourth successive day on Thursday

- Declining U.S. Treasury Bond Yields undermine the greenback and extend support to the XAU/USD cross

- Softer U.S. PMI readings and worsening Chinese economic conditions support the precious yellow metal

- Markets await Fed Chair Jerome Powell’s remarks at the Jackson Hole Symposium in Wyoming

Gold price extended the recovery momentum from the 1884.59 level, or a four-week low touched last week on Thursday, and for now, is trading with heavy gains above the mid 1919.00 levels. Today marks the fourth day of a positive move in the last five, supported by sustained U.S. dollar selling.

Retreating U.S. Treasury Bond Yields and a weaker risk tone undermined the safe-haven greenback, which in turn was a key factor that helped drive flows toward the precious yellow metal. Additionally, signs of stability in the U.S. equity markets further undermine the greenback and help exert upward pressure on the XAU/USD cross.

Further weighing on the buck is the fresh round of disappointing U.S. macro data released on Wednesday, which showed the S&P Global U.S. Services PMI fell to 51 in August of 2023 from 52.3 in the previous month, missing market expectations of 52.2 to reflect the slowest expansion in the U.S. services sector in six months. The S&P Global U.S. Manufacturing PMI fell to 47 in August 2023 from 49 in July, below market expectations of 49.3, preliminary data showed. To a greater extent, the weaker-than-expected PMI readings overshadowed a much more upbeat U.S. New Home Sales data report, which showed a surge in the number of new single-family homes sold last month.

Additionally, market sentiment remains fragile in the wake of growing concerns about worsening economic conditions in China, which lend support to the dollar-denominated gold and help exert upward pressure on the XAU/USD cross.

Furthermore, investors seem to have decided to stay on the side lines ahead of today’s Jackson Hole Symposium in Wyoming, where the Fed Chair, Jerome Powell, is expected to make remarks concerning future monetary policy actions. Despite the combination of negative factors, further uptick seems elusive in the wake of firming market expectations that the Federal Reserve (Fed) will hike interest rates one more time by 25 basis points (bp) either during the September or November meeting. This comes after August’s FOMC Meeting Minutes report released last week on Wednesday showed Federal Reserve officials expressed concern at their most recent discussion about the pace of inflation and said more rate hikes could be necessary unless conditions change.

It is worth recalling that discussions during a two-day July meeting resulted in a quarter percentage point rate hike in August that markets generally expected to be the last of this cycle. However, recent data pointing to a modest rise in inflation both at the consumer and producer levels, cooling job growth but a resilient job market, and stronger-than-expected U.S. GDP growth have, to a greater extent, reversed hopes that the Fed may refrain from tightening monetary policy further this year.

As we advance, investors will look for cues from the release of the July Core Durable Goods Order report and the Initial Jobless Claims data report for the previous week. The main focus, however, remains on Fed Chair Jerome Powell’s remarks at the Jackson Hole Symposium in Wyoming later today.

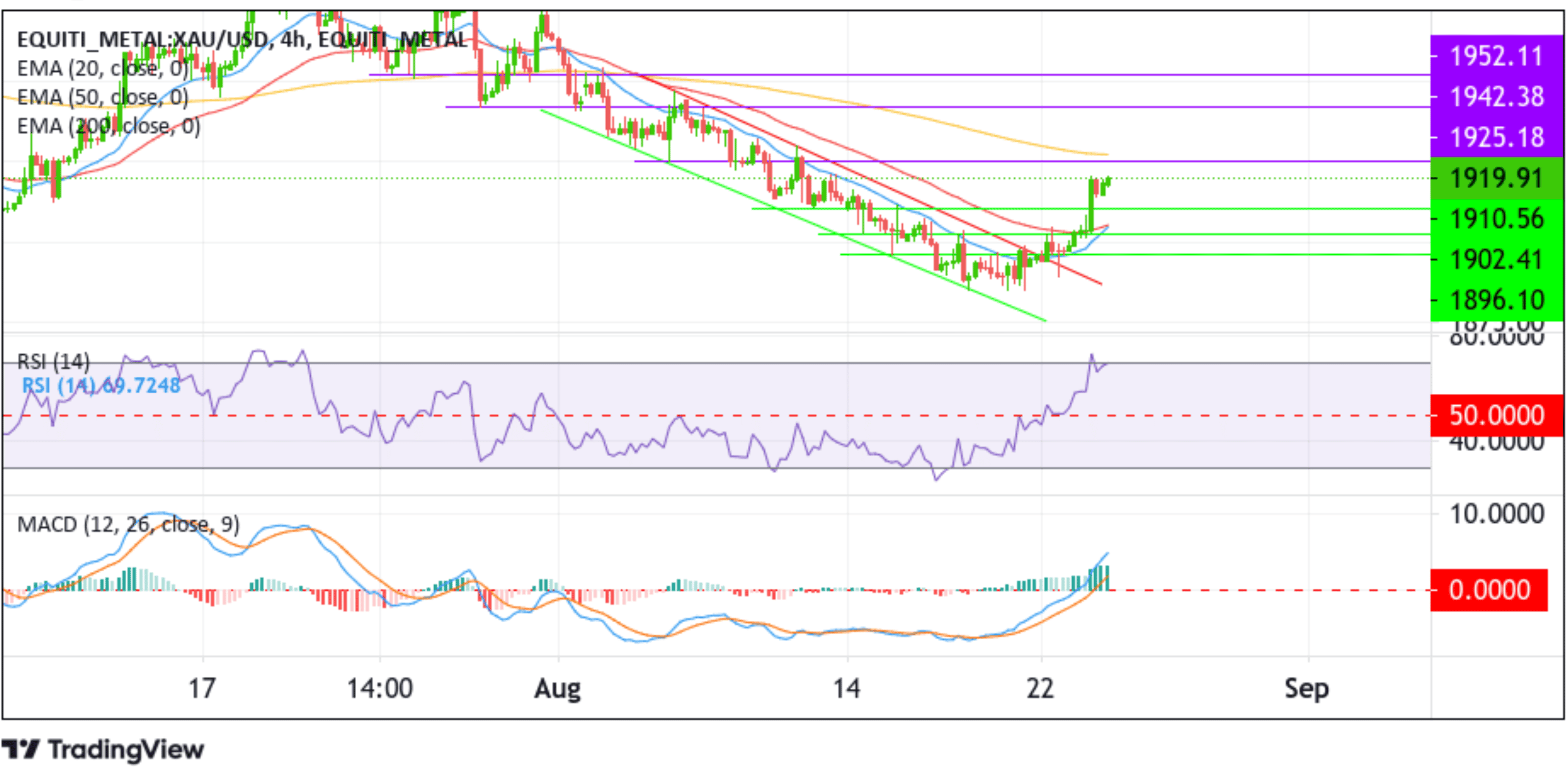

Technical Outlook: Four-Hours Gold Price Chart

From a technical perspective, the price’s ability to break above the upper limit of the descending channel pattern supported the case for further northside moves. A further increase in buying pressure from the current price level will face initial resistance at the 1925.18 level. On further strength, the price would re-encounter stuff resistance at the technically strong 200-day EMA level at the 1927.17 level. A convincing move above this hurdle would provoke an extended rally toward the next relevant resistance level at the 1942.38 level. A four-hour candlestick close above this level could pave the way for an extended rally toward the confluence level due to the 50 (red) and 200 (yellow) days EMA level crossover at the 1951.74 level. If the price finds acceptance above this barrier, it could pave the way for a further northward rally.

On the other hand, if sellers resurface and spark a bearish turnaround, initial support comes in at the 1910.56 support level. On further weakness, the price could drop to tag the 50-day EMA level at the 1906.04 level, which sits above the 1902.41 horizontal level. Sustained weakness below these barricades will pave the way for a move toward the 1902.41 support level, about which, if the price breaches this key floor, downside pressure could accelerate toward the upper limit of the descending channel now turned support level.