Gold Rises Above $2000 An Ounce As Fed's Kashkari Flags Recession, US CPI In Focus

- XAU/USD pair gains positive traction on Wednesday for the third consecutive day, rising above the $2000 psychological mark

- Minneapolis Federal Reserve President Neel Kashkari flags recession potential this year; Treasury Bond yields dip as a result

- Growing acceptance of a FED cautious stance in the next meeting, plus investors' decision to stick on the sidelines, lend support to the yellow metal

- Markets await the release of key catalyst data; US CPI data is expected to slow down U.S. inflation further

Gold prices extended the strong bullish momentum for a third consecutive day on Wednesday, boosted by safe-haven buying due to hawkish comments by top Fed officials as the focus turns to today's key inflation data. The non-yielding yellow metal continued its steady climb on Wednesday, rising by over 0.75% to $2018.69, just shy of the monthly record last touched on 5th April amid general weakness in the U.S. Dollar.

On Tuesday, dovish comments by Minneapolis Federal Reserve President Neel Kashkari spooked the markets into believing the Fed's interest rates could be coming to a near end. This, in turn, saw the treasury bond yields fall in the previous trading session as traders fled to safe-haven assets, benefitting gold and weighing down heavily on the U.S. Dollar. In a speech at Montana state university, Neel Kashkari flagged a potential recession this year after he commented that rising interest rates and a slowdown in lending after the collapse of several U.S. banks could trigger a possible recession this year. But he also opined that allowing inflation to stay high would likely be worse. In that same line, Chicago Fed President Austan Goolsbee said on Tuesday that the central bank should be cautious about raising interest rates in the face of recent banking stress.

The Fed official's comments further cemented investors growing acceptance that the FED will adopt a less hawkish stance in its next monetary policy meeting. This was evident from the increase in the probability of a 25 bps interest rate hike from 27.8% early this week to 30.2% on Wednesday.

Additionally, investors' decision to stay on the sidelines ahead of today's key inflation data has also weighed down on the greenback. Furthermore, last month's global banking crisis and rising crude oil prices have also tempered investors' appetite for riskier assets and driven flows away toward the haven of the precious yellow metal. Additionally, the current mood remains sour amid the ongoing Russia-Ukraine, which has entered its 413th day and has threatened to disrupt global economic growth. Elsewhere, the US-China jitters continue contributing to the sour mood around riskier assets. Furthermore, the news of U.S. allies creating a new mode of payment to reduce the dependency on the U.S. dollar as the Reserve currency further contributed to limiting the greenback.

That said, bets for further rate hikes by the Federal Reserve continue to support the greenback and should cap a lid on any further losses for the greenback and help limit further gains for the XAU/USD pair, at least for the time being. Additionally, IMF chief economist Pierre-Olivier Gourinchas's encouragement for Central Banks not to halt their fight against inflation because of financial stability risks continues to support bets for further rate hikes,

As we advance, today's Key inflation would ultimately set the tone for the next monetary policy decision, which, according to preliminary estimates, is expected to show a further downshift in inflation in the U.S. If the actual data matches the market expectations, we should expect the U.S. dollar to weaken further and the precious yellow metal to strengthen beyond the current level. Any surprises would cause the XAU/USD pair to rebound and drop below the $2000.00 psychological mark.

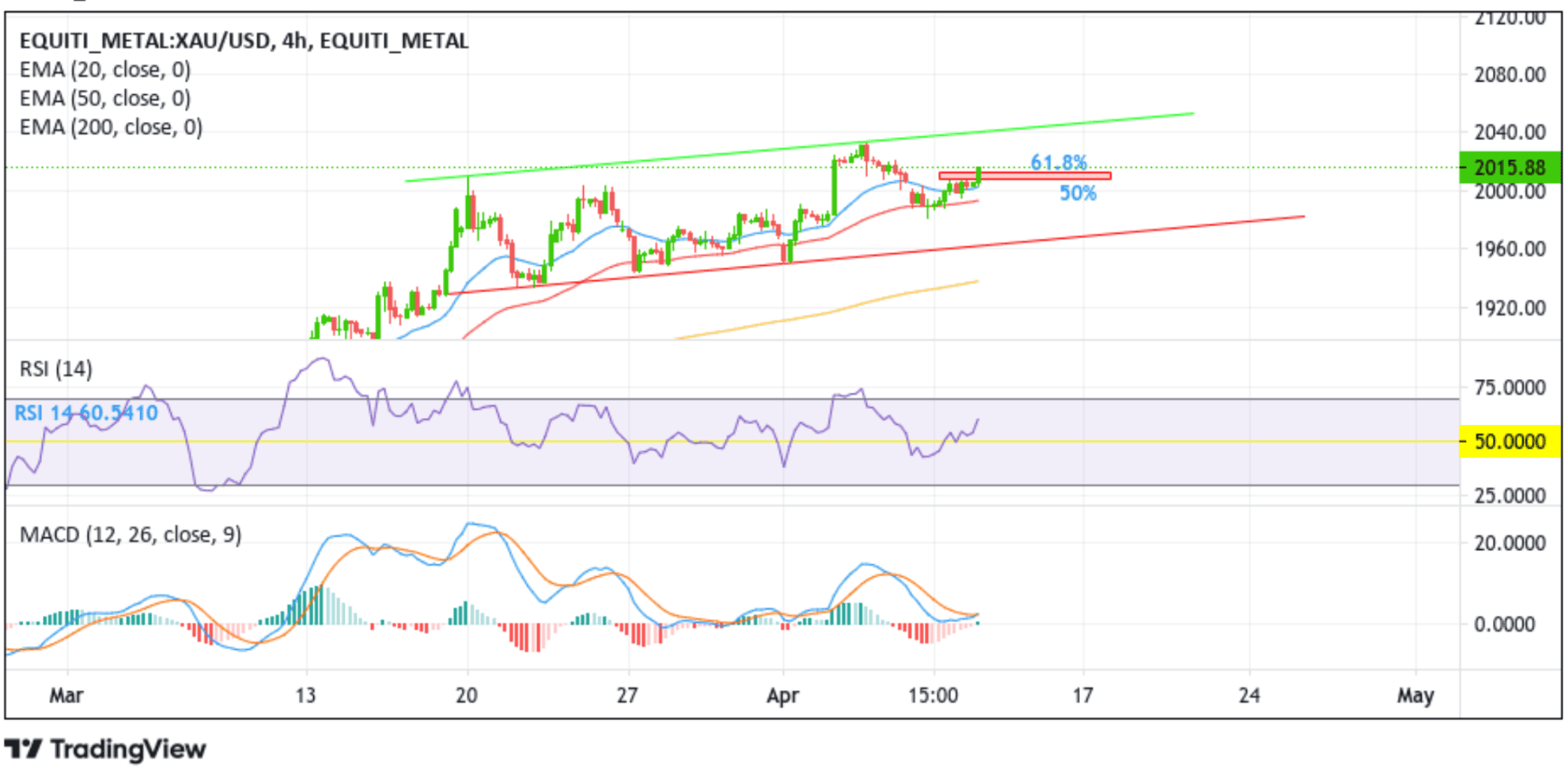

Technical Outlook: Four-hours XAU/USD Price Chart

From a technical perspective, the gold price is trading above the 61.8% Fibonacci Retracement level/$2013.09 level, a crucial resistance level. Further, an increase in buying pressure beyond the current level could see gold prices rise to retest the key resistance level plotted by an ascending trendline extending from the late-March 2023 swing high. A convincing move above this resistance level (a bullish price breakout) would negate any near-term bearish outlook and pave the way for aggressive technical buying around the XAU/USD pair.

All the technical oscillators are holding in the bullish territory as both the RSI (14) at 60.5410 and the MACD crossover is above their signal lines, showing traders heeded the call to BUY gold. Further convincing traders to BUY gold was the presence of a four-hour Doji candlestick that formed at 17:00 UTC +3 on Monday before the big move up. Additionally, the acceptance of price above the technically strong 200 EMA at $1846.75 level, followed by a 50 and 200 EMA crossover (Golden cross) at the $1850.61 level, must have also enticed bullish traders to place bullish bets.

On the flip side, if traders start taking their profits early, the non-yielding yellow metal could descend to confront the 50% and 61.8% Fibonacci Retracement levels now turned support levels. A breach of these support levels could pave the way for a drop toward the next relevant support level at $1982.21. A four-hour decisive flip of this support level into a resistance level could open the floodgates for more losses around the XAU/USD pair. The bearish trajectory could then be extended toward retesting the key support level plotted by an ascending trendline extending from the late-March 2023 swing low. Sustained weakness below this support level (bearish price breakout) could pave the way for aggressive technical selling around the XAU/USD pair.