US WTI Crude Oil Eases From Monthly High As Surprise OPEC+ Output Cuts Reignites Fresh Supply Concerns

- US WTI Crude oil futures slip back below $79.00 per barrel after opening with a $5 gain to reach a monthly high of $81.51 per barrel

- OPEC+ on Sunday announced surprise Oil cuts to support market stability; U.S. calls move inadvisable

- U.S. Crude production rose in January, beating market expectations according to the latest EIA data

US WTI Crude oil futures prices slipped back below $79.00s per barrel during the mid-Asian session after jumping from the previous session by about $5 a barrel on the Tokyo session opening, jolted by a surprise announcement by OPEC+ to cut production further to support the market stability.

On Sunday, Saudi Arabia and other OPEC+ oil producers announced further oil output cuts of around 1.16 million barrels per day, in a surprise move that analysts said would cause an immediate rise in prices and the United States called inadvisable. The pledges bring the total volume of cuts by OPEC+, which groups the Organization of the Petroleum Exporting Countries with Russia and other allies, to 3.66 million bpd according to Reuters calculations, equal to 3.7% of global demand.

Saudi Arabia, which leads OPEC, accounts for the most significant portion of the latest cut, at 500,000 bpd, followed by a 211,000 bpd cut by Iraq and a 144,000 bpd cut by the United Arab Emirates. According to an OPEC source, Russia and Gabon also communicated further voluntary cuts at 500,000 and 8,000 bpd, respectively, until the end of 2023. As a result, Goldman Sachs (NYSE:G.S.) lowered its end-2023 production forecast for OPEC+ by 1.1 million bpd and raised their Brent price forecasts to $95 and $100 a barrel in 2023 and 2024, respectively, its analysts said in a note.

"Today's surprise cut is consistent with the new OPEC+ doctrine to act pre-emptively because they can without significant losses in market share," the bank said. "The risks around cutting production have become asymmetric given how short positioning has become, and because price increases in response to tightening events can be stronger when the market is short."

That said, the surprise move caused Crude oil prices to rise, with the West Texas Intermediate crude futures rising 6.3% or $4.8 to $80.45 a barrel and trading close to levels seen in late-January by 20:01 E.T. (00:01 GMT). On the other hand, its counterpart Brent oil futures jumped 6.2% or $5 to $84.19 a barrel, reaching its most substantial level in nearly a month. Both contracts have now managed to reverse the steep losses seen through March.

The move, which was unexpectedly announced on Sunday, comes ahead of a virtual meeting of the Joint Ministerial Monitoring Committee of the OPEC on Monday, which media reports had suggested was likely to result in steady production. "Today's move, like the October cut, can be read as another clear signal that Saudi Arabia and its OPEC partners will seek to short circuit further macro sell-offs and that Jay (Jerome) Powell is not the only central banker that matters," RBC Capital analyst Helima Croft said. Crude Oil prices last month fell towards $70 a barrel, the lowest in 15 months, on concern that a global banking crisis and rising interest rates would hit demand despite lower OPEC oil output in March due to oilfield maintenance in Angola and a halt in some of Iraq's exports. Still, further action by OPEC+ to support the market was not expected after sources downplayed this prospect and crude recovered towards $80.

It is worth noting, last October, OPEC+ had agreed to an output cut of 2 million bpd from November until the end of the year, a move that angered Washington as tighter supply boosts oil prices. Sunday's move might have further infuriated Washington, with the Biden administration terming the unexpected as unwise. "We don't think cuts are advisable at this moment given market uncertainty - and we've made that clear," a spokesperson for the National Security Council said. The voluntary cuts will start in May and last until the end of the year. In other news, U.S. crude production rose in January to 12.46 million barrels per day (bpd), the highest since March 2020, according to Energy Information Administration (EIA) data on Friday.

As we advance, Oil markets are awaiting today's OPEC meeting to gauge the likelihood of continuous supply cuts and the severity of yesterday's unexpected move. In the meantime, the U.S. Treasury bond yields and the general risk sentiment would continue to influence oil prices and provide trading opportunities around the US WTI crude oil futures.

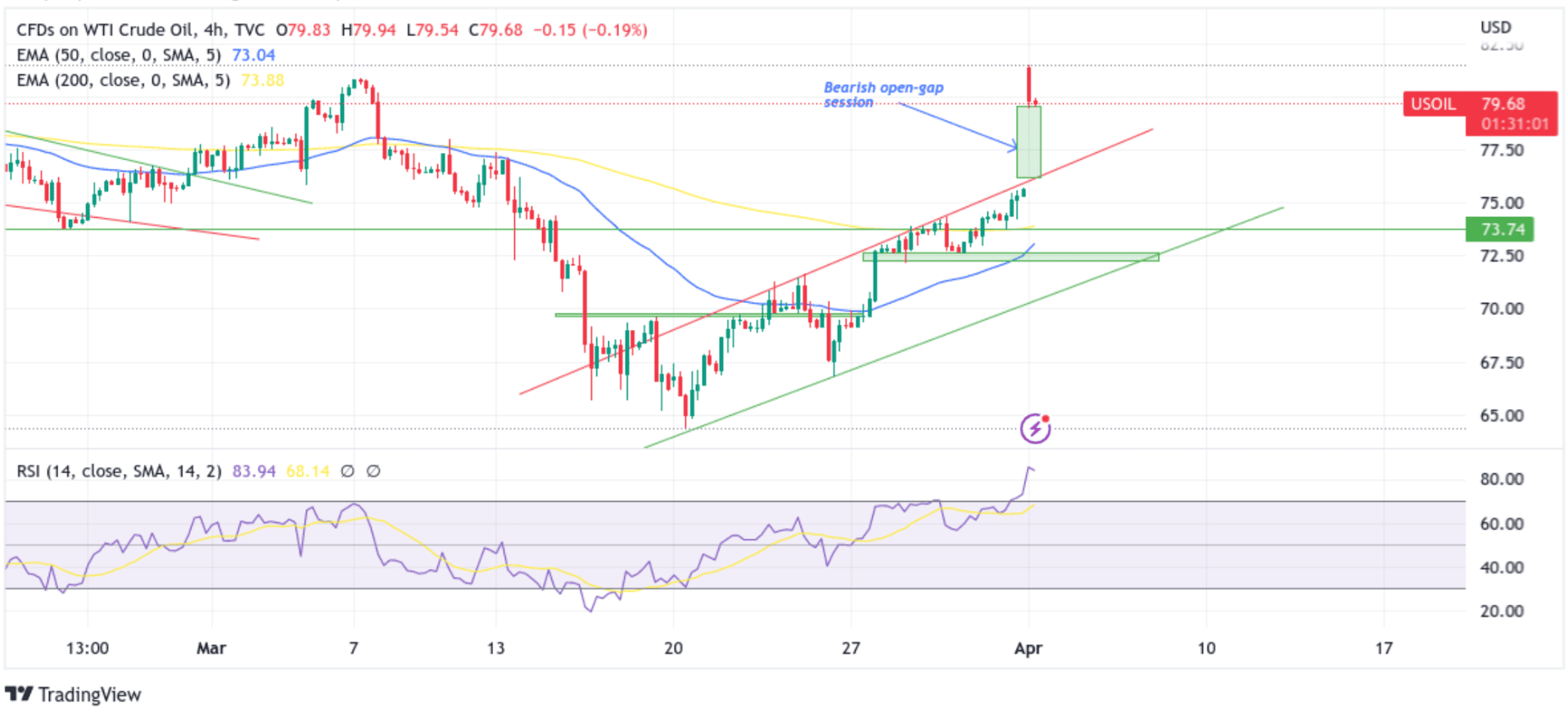

Technical Outlook: Four-Hours US WTI Crude Oil Futures Price Chart

From a technical standstill using a four-hour price chart, US WTI Crude Oil future prices opened on Monday in a firmer responsive bearish move by market participants after a gap-up (bullish open gap) which denoted a bargain buy for investors caused crude oil prices to open higher at $81.51 per barrel in the early Tokyo session. Sustained weakness will drag spot prices toward the support level at $78.19 level. If sellers flip this hurdle into a resistance level, downside pressure could accelerate further toward the key support level plotted by an ascending trendline extending from the late March 2023 swing high. A convincing break below this level would pave the way for additional losses around the U.S. contract.

All the technical Oscillators are holding in the bullish territory as both the RSI (14) and MACD crossover are above their signal lines, indicating a bullish sign of price action this week. However, the RSI (14) at 83.94 displays extreme overbought conditions and warrants caution to traders against submitting aggressive bullish bets for the time being and waiting for a further corrective move before positioning for a further extension of the bullish move above the key resistance level. That said, the overall bullish outlook is validated by the acceptance of the price above the technically strong 200 EMA (yellow) at the $73.86 level. Additionally, the 50 and 200 EMA Crossover (Golden cross) at the $70.09 level adds credence to the bearish thesis.

On the flip side, if dip-buyers and tactical traders jump back in and trigger a bullish reversal, initial resistance appears at the January 2023 resistance level of $82.60. A four-hour candlestick close above this level would negate any near-term bearish bias. Afterwards, the focus could shift higher toward the next relevant barrier at the $85.79 resistance level.