US WTI Crude Oil Rises Slightly Higher Despite Concerns Of Slowing Economic Growth And Weakening Demand

- US WTI crude oil futures rose slightly higher Tuesday during the mid-Asian session, supported by a weaker dollar

- Further oil uptick seems elusive as the global economic backdrop continues to outweigh supply-cut output

- Mixed Fed talk might hold back oil traders from placing aggressive bearish bets around the safe-haven buck and might benefit the precious black liquid

US WTI Crude oil futures rose slightly higher on Tuesday during the mid-Asian session after ticking down the last three consecutive sessions as optimism over crude oil supply cuts by Saudi Arabia seems to have been largely overshadowed by concerns of slowing economic growth and weakening demand. As per press time, US WTI crude futures rose 34 cents/0.47% to trade at $71.90 per barrel and has so far managed to regain most of its earlier losses. On the other hand, Brent crude futures also rose by 37 cents/0.49% to trade at $76.50 per barrel.

Crude oil prices started the week on the right foot. They rallied significantly to post one of their best days of the year after top OPEC+ producer Saudi Arabia announced further Oil production cuts over the weekend.

Saudi Arabia, in a surprise announcement over the weekend during the OPEC+ meeting in Vienna, announced through their Minister of Energy, Prince Abdulaziz bin Salman that the gulf country would cut production by a further 1 million barrels per day (bpd) from July to counter macroeconomic headwinds that have depressed markets. The Voluntary cut, as reported by Reuters, is on top of a broader deal by the Organization of the Petroleum Exporting Countries (OPEC) and allies, including Russia, to limit supply into 2024 as OPEC+ seeks to boost flagging oil prices.

Noteworthy, the recent announcement by Saudi Arabia comes as no big surprise to global oil markets as comments by Saudi Arabia's Energy Minister Prince Abdulaziz bin Salman on short sellers one week earlier during a summit in Doha Qatar had sparked optimism among bullish traders who interpreted them as production cuts were on the way.

Data on Monday showed the U.S. service sector barely grew in May but pointed to the fifth consecutive month of expansion as business conditions stabilized in May. However, concerns over a slowing economy continued to act as a headwind. Additionally, New orders for manufactured goods in the U.S. increased by 0.4% from the previous month in April of 2023 amid strong defence spending, but slowing from the downwardly revised 0.6% increase in the prior month and missing market forecasts of a 0.8% jump.

To a greater extent, the combination of negative U.S. macro data was seen as a key factor that undermined the greenback, which in turn supported the goodish crude oil rebound on Tuesday. However, further uptick seems limited amid firm expectations that the Fed will remain hawkish in its quest to bring inflation to its target. The bets were cemented after job numbers in May exceeded expectations suggesting the labor market in the U.S. continued to remain resilient. The upbeat job numbers combined with stronger-than-expected US PCE figures released in early May further reinforce a hawkish Fed outlook in June. Notably, markets have been pricing a higher chance of a 25bps interest rate hike in the next Fed meeting for the better part of last month. However, the odds were slashed late last week after an influential FOMC member backed the case for skipping hiking interest rates in June. This, in turn, might hold back oil traders from placing aggressive bearish bets around the safe-haven buck and might benefit the precious black liquid.

As we advance, this week's focus is on China's Trade Balance data, which provides more information on oil imports from the world's top oil importer. In the meantime, the U.S. bond yields and broader market risk sentiment will influence the U.S. dollar and allow traders to grab some trading opportunities around the US WTI Crude oil futures.

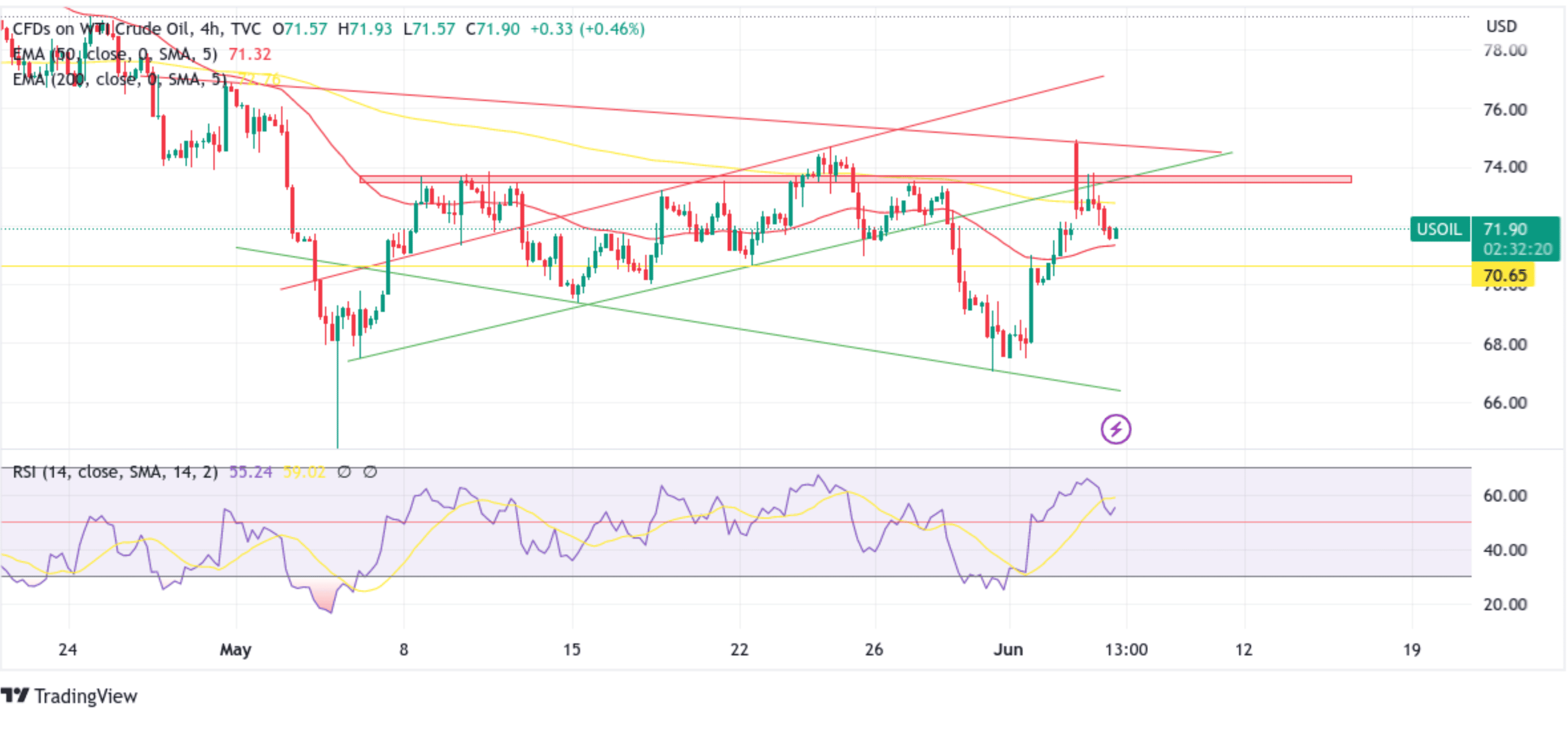

Technical Outlook: US WTI Crude Oil Futures Price Chart

From a technical standpoint, increasing buyer momentum could cause US WTI crude oil prices to tag the technically strong 200-day (yellow) Exponential Moving Average (EMA) at $72.78. A convincing move above this level could see sidelined buyers jump in and provoke a strong rally toward the supply zone ranging from $73.73 - 73.48. The aforementioned zone coincides with an ascending trendline now turned resistance level off which, if bullish traders manage to breach above these barricades, buy-side momentum could increase, paving the way for a move toward retesting the next key resistance level plotted by a descending trendline. A break above this level (bullish price breakout) could see crude oil prices extend the bullish trajectory further toward the next relevant resistance level plotted by an ascending trendline.

On the other hand, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, the price will move lower toward tagging the 50-day (red) EMA at the $71.33 level. A four-hour candlestick close below this level could pave the way for a drop toward confronting the $70.65 support level. If oil sellers manage to breach this key floor, downside momentum could pick up the pace, paving the way for a decline toward retesting the key support level plotted by a descending trendline.