USD/JPY Slides Back To Early 133.000s Amid Retreating Treasury Bond Yields, US CPI In Focus

- USD/JPY pair attracted some selling during the early Asian session to force a minor rebound toward the early 133.000s level

- Retreating treasury bond yields along with a weaker risk tone undermined the safe-haven greenback

- Negative Japan macro data gets overshadowed by investors decision to stay on the sidelines ahead of key inflation data

- Markets focus remains on Wednesday's Key inflation data

USD/JPY Cross witnessed some selling during the early Asian session and extended the intraday rebound from 133.870/monthly high amid weakened U.S. Dollar demand. As per press time, the USD/JPY pair is down over 20 pips for the day and looks set to maintain its bid tone heading into the European session.

Retreating treasury bond yields and a weaker risk tone undermined the safe-haven greenback, a key factor that acted as a headwind to the USD/JPY pair. Apart from this, a goodish rebound in the U.S. equity markets undermined the greenback and helped cap the USD/JPY pair against further uptick. A stronger-than-expected labor report released last Friday, along with easing stresses in the banking system, supported bets for more rate hikes by the Federal Reserve Bank. These factors triggered the treasury bond yields to rise higher and helped revive the U.S. dollar demand. Fed fund futures traders have seen pricing in a 71.3% probability that the Fed will hike interest rates by 50 bps to 5.25%, up from 57.2% last week, according to CME's Fedwatch tool.

Last week, the Labor Department released nonfarm payroll data for March, showing the U.S. economy created 236K jobs in March, the least since December of 2020, and compared to forecasts of 239K, after unusually mild weather and seasonal factors led to solid employment gain in the first two months of the year. Although the reading showed a gradual cooling in hiring as the economy normalized after the pandemic shocks and high borrowing costs and prices forced companies to cut costs, it still pointed to a strong labor market. Commenting on the jobs report, "The March jobs report was good news, but take it with a grain of salt. Other labor market indicators have deteriorated in the last few months... Revisions to this jobs report are more likely to be negative than positive," wrote Bill Adams, chief economist at Comerica Bank.

The stronger jobs data report came days after disappointing U.S. macro data pointed out that the Federal Reserve is nearly done with its tightening cycle. Along with the jitters between the U.S. and some of its close allies, this has acted as a headwind to the U.S. dollar, capping further upside movement. In an interview published on Sunday by Les Echos Newspaper, France's President Emmanuel Macron said, "Europe has become more dependent on the United States in recent years, but it must strengthen its strategic autonomy and not depend on the extraterritoriality of the dollar. Macron's comments came days after a report emerged that the BRICS nations (Brazil, Russia, India, China, and South Africa) are in the process of creating a new medium for payments in a move to dupe the U.S. Dollar.

As reported by Indiatimes newspaper, Babakov, the deputy chairman of Russia's State Duma, reportedly indicated that gold and other commodities, such as rare-earth elements, would secure the new currency. The BRICS countries are working on creating a new form of currency with a plan to present its development at the BRICS leaders' summit this year; he said on the sidelines of the India-Russia Business Forum in New Delhi last week.

Shifting to the Japanese docket, a Ministry of Finance report on Monday showed Japan posted a current account surplus of JPY 2,197.2 billion in February 2023, shifting from a record deficit of JPY 1,976.6 billion in January but missing expectations of a JPY 2,535.7 billion surplus. The downbeat macro data combined with the monetary policy divergence adopted by the Federal Reserve and the Bank of Japan continues to act as a headwind for the yen, hence warranting some caution for aggressive bearish traders against positioning for an extension of the recent bearish downtick. Additionally, the widening of the US-Japan rate differential, underpinning the U.S. Treasury bond yields, contributes to driving flows away from the Japanese yen.Despite the combination of negative factors, the decision by USD bulls to stay on the sidelines ahead of this week's crucial inflation data has favored the Yen bears, who capitalized on that move to force a minor rebound.

As we advance without significant economic news data from both dockets, the broader market risk sentiment and U.S. Treasury bond yields will continue to influence the U.S. dollar and provide short-term trading opportunities around the USD/JPY pair. The focus, however, remains on the key U.S. inflation data set for release on Wednesday. March's CPI data is lower at 0.2%, down from 0.4% the previous month. Every year, March's CPI is seen lower at 5.2%, down from 6.0%. Excluding food and energy, Core CPI last month was also lower at 0.4%, down from 0.5% the previous month.

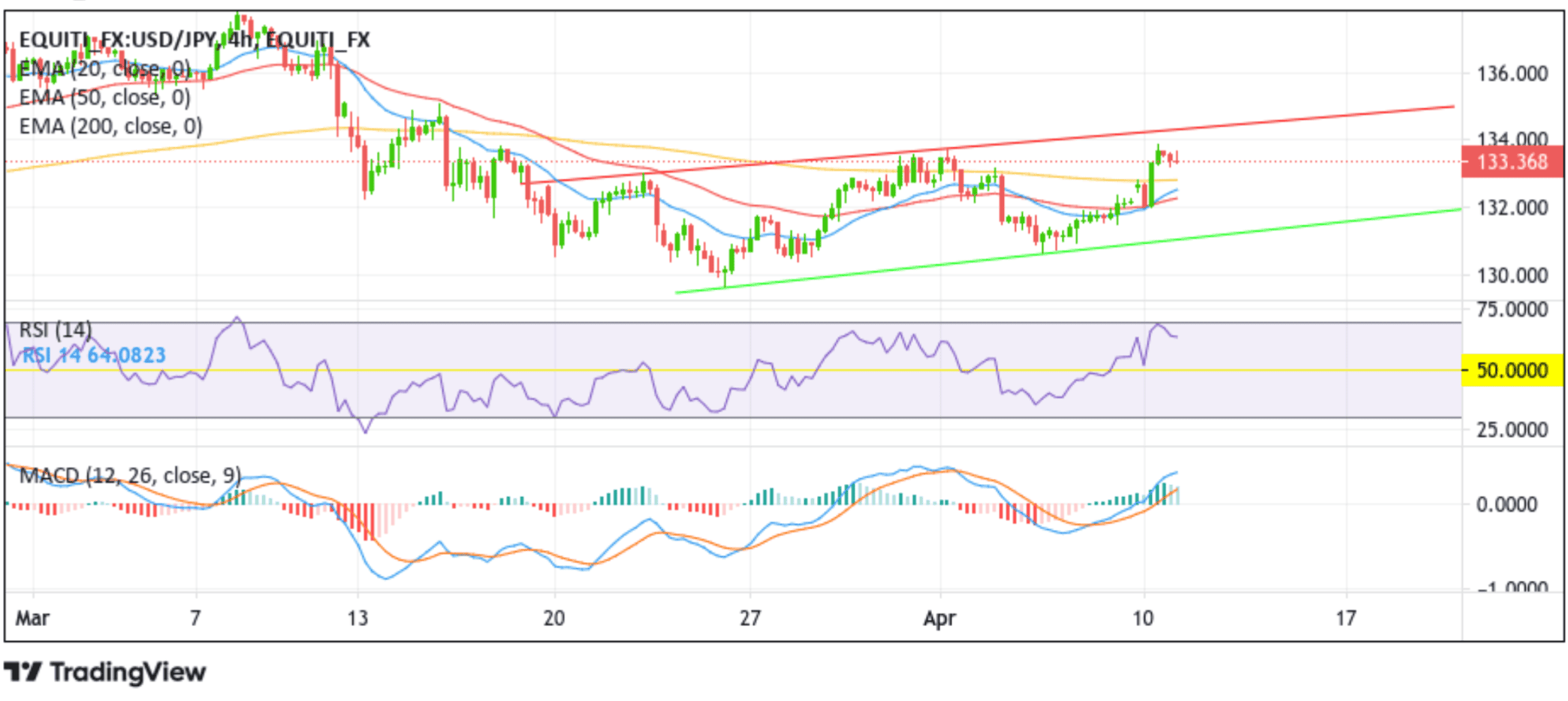

Technical Outlook: Four-Hours USD/JPY Price Chart

From a technical standstill, a further increase in selling pressure below the current level could see the shared currency price drop to tag the technically strong 200 EMA (yellow) at the 132.798 level. A four-hour candlestick close below this level could negate any near-term bullish outlook and pave the way for a further downside move. The USD/JPY cross could then fall further to confront the 20 and 50 EMA support levels at 132.586 and 132.304, respectively. Flipping these support levels into resistance levels would pave the way for more bloodshed around the USD/JPY pair toward retesting the key support level plotted by an ascending trendline from the early 2023 swing low. A break below this support level (bearish price breakout) would pave the way for aggressive technical selling around the USD/JPY pair.

All the technical Oscillators in the chart hold bullish dip territory as both the RSI (14) and MACD crossover are above their signal lines, indicating a bullish sign of price action this week. Accepting a price above the technically strong 200 EMA (yellow) at the 132.798 level validates the bullish outlook. Additionally, the 20 (blue) and 50 (red) EMA Crossover at the 132.072 level adds credence to the bullish thesis.

On the flip side, if dip-buyers and tactical traders jump back in and trigger a bullish reversal, the USD/JPY pair could ascend toward retesting the key resistance level plotted by an ascending trendline extending from the late-March 2023 swing high. A breach of this support level (a bullish price breakout) would pave the way for solid gains around the USD/JPY pair. The bullish trajectory could then accelerate toward confronting the 135.173 resistance level. A decisive flip of this resistance level into a support level would pave the way for more gains around the USD/JPY pair.