Silver Dips Further Below $24.00 Per Ounce Amid Sustained USD Strength, NFP Data In Focus

- XAG/USD pair witnessed some selling and drifted lower below $24 per ounce

- Hawkish Fed Mester Comments trigger treasury bond yields to rebound and rise higher, in turn, underpins the greenback

- Prospects for additional interest rate hikes by the Federal Reserve are a headwind to the XAG/USD pair. In turn, it overshadows the latest round of weak U.S. data

- Markets await the release of the U.S. initial jobless claims data report; the focus remains on the NFP Data report on Friday

XAG/USD cross-edged lower during the early Asian session, moving further below the 2022 record high despite more signs of slowing economic growth, which fed into safe-haven demand for the silver metal. As per press time (06:00 UTC+3), the precious silver metal is down 0.88%/2189.2 points for the day to trade at $24.724 an ounce amid sustained USD Buying bolstered by inflation concerns and hawkish remarks from Top Fed official on Tuesday.

On Tuesday, Federal Reserve Bank of Cleveland President Loretta Mester said that U.S. interest rates would keep rising despite weakness in the economy. Mester also suggested that rates remain above the 5% mark for longer. Her comments triggered the treasury bond yields to rebound and rise higher, offering support to the safe-haven greenback. Apart from this, a generally weaker tone around the U.S. Equity markets was also seen as another factor that helped to drive flows away from the precious silver metal toward the greenback.

Mester's Comments came after the latest ADP private payrolls report showed slowing job growth in March. That followed Tuesday's job openings report that suggested the Federal Reserve's efforts to cool the labor market might finally be having an effect. Last month Private businesses in the U.S. created 145K jobs in March of 2023, below an upwardly revised 261K in February and forecasts of 200K according to data from ADP.

The latest jobs report comes on the backheel of a weaker than expected U.S. Manufacturing PMI data released last Friday. Additionally, last Friday, Fed's Preferred inflation gauge showed that inflation in the U.S. had started to slow down after increasing by 5% year-on-year in February of 2023, the lowest since September 2021 and easing from a downwardly revised 5.3% rise in the previous month.

Elsewhere, more weak data from the U.S. on Wednesday further reinforced investor bets that the Federal Reserve is nearly done with its tightening cycle. The trade deficit in the U.S. increased to $70.5 billion in February of 2023, the highest in four months and slightly above forecasts of $69 billion, according to data by BEA. Additionally, The US ISM Servilow forecasts that 5ces PMI fell to 51.2 in March of 2023 from 55.1 in February and will be 4.5, according to a final reading by the U.S. Institute for Supply Management.

As we advance, fears of a recession in the U.S. continue to support the greenback, which should cap the XAG/USD pair against further downtick for the time being. Additionally, inflation concerns resulted from the Suprise OPEC+ Cuts move, which sent crude oil prices soaring and raised market expectations that this could prompt the U.S. Federal Reserve to lift interest rates at its next meeting. Fed fund futures traders are now pricing in a 43.6% probability of a 50bps interest rate hike, up from 40.6% last week. A 25bps interest rate hike is also seen at 56.4%, down from 59.4% last week. That said, the backdrop still seems tilted in favor of the USD Bears hence signalling more losses around the silver metal are inevitable shortly.

In the meantime, the risk sentiment plus the U.S. Treasury Bond yields will continue to influence the U.S. Dollar sentiment as investors look forward to releasing the U.S. initial jobless claims report data later today, seen higher at 200K, up from 198K the previous week. However, the immediate attention remains on Friday's NFP report data for March, which has seen a lower at 240K, down from 311K the previous month.

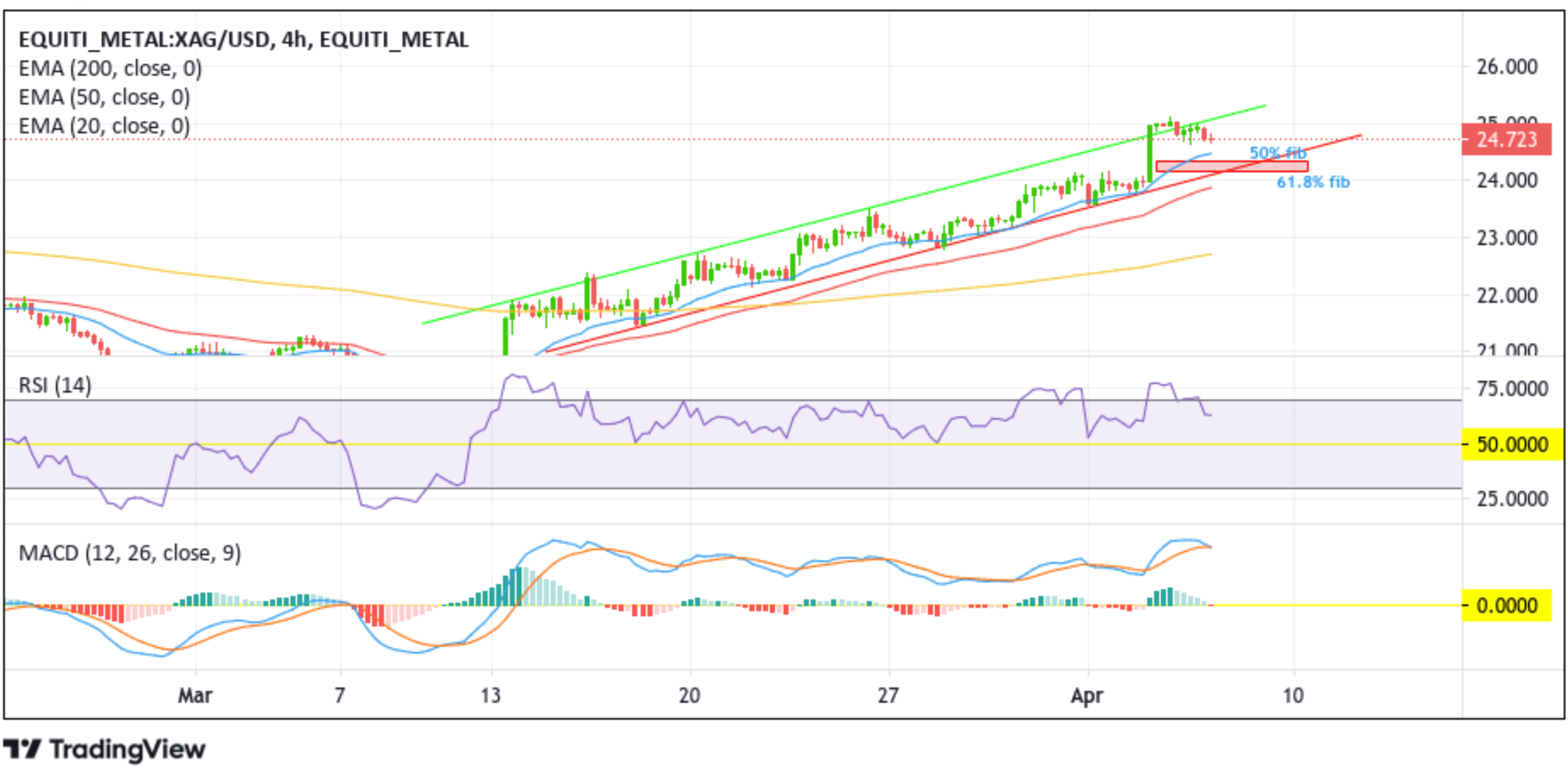

Technical Outlook: Four-Hours XAG/USD Price Chart

From a technical standpoint, an increase in selling momentum below the current level could see the silver metal price fall to tag the 20 EMA (blue) at the 24.474 level. Beyond this level, the precious metal could dip lower to confront the 50% and 61.8% fib levels resistance zone. The latter group coincides with the key support level plotted by an ascending trendline extending from the mid-March 2023 swing low. In highly bearish cases, we will see a break below the aforementioned support level to pave the way for additional losses around the XAG/USD Pair.

All the technical Oscillators in the chart hold bullish dip territory as both the RSI (14) and MACD crossover are above their signal lines, indicating a bullish sign of price action this week. The bullish outlook is validated by accepting the price above the technically strong 200 EMA (yellow) at the 21.739 level. Additionally, the 50 (red) and 200 (yellow) EMA Crossover at the 21.840 level adds credence to the bullish thesis.

On the flip side, if traders start cutting down losses early, the precious silver metal could ascend, first breaching the key support level plotted by an ascending trendline extending from the mid-March 2023 swing high. A four-hour candlestick close above this level will pave the way for additional gains around the XAG/USD pair. The bullish momentum could be further extended toward November 2021 swing high at the 25.398 level, which would act as a barrier against further uptick.