USD/JPY Moves Back Below Mid 151.000's But Remains Confined In A Familiar Territory, BoJ Core CPI Data Eyed

Key Takeaways:

- The Japanese yen strengthened past 151.300 per dollar on Tuesday but remained confined in a familiar territory

- Speculations of BoJ intervention fuelled by top Japanese currency diplomat comments lend support to the yen

- The downside, however, seems limited amid expectations that the BoJ will not hike rates again this year and that the Fed will leave rates unchanged at the May meeting

- Markets look forward to the release of the BoJ Core CPI Data for fresh USD/JPY directional impetus ahead of U.S. macro data in the afternoon

The Japanese yen strengthened past 151.300 per dollar on Tuesday during the Asian session, moving away from three-month lows (151.870). Overnight, hawkish comments by a top Japanese currency diplomat boosted the currency.

Masato Kanda, Japanese vice finance minister for international affairs, speaking on Monday at an ad hoc news conference, warned against speculators trying to sell off the yen, saying its weakness did not reflect fundamentals.

"Looking at currencies, the dollar/yen pair has experienced big fluctuations of 4% over only the past two weeks," Kanda told reporters. It has not reflected fundamentals, and I feel something strange about it."

Kanda described the recent yen moves as "speculative." He said he wouldn't rule out any measures but stands ready to respond appropriately to the currency's move.

The generally softer U.S. dollar further contributes to the USD/JPY pair sentiment. The U.S. Dollar index (DXY), which measures the greenback against a basket of currencies, struggled to gain meaningful traction on Tuesday and edged lower below the 104.160 mark. The post-US CPI rally has thoroughly dried out, acting as a tailwind to the USD/JPY cross.

That said, the downside seems limited amid expectations that the BoJ will not hike rates again this year despite hiking rates for the first time in 17 years during the March meeting. The bets were reaffirmed after the Minutes of the Bank of Japan Monetary Policy Meeting on January 22 and 23, which showed that the Bank pledged to continue its quantitative and qualitative monetary easing (QQE) with yield curve control.

Furthermore, it will continue expanding its monetary base until the year-on-year increase in the observed consumer price index (CPI, all items less fresh food) exceeds 2% and stably stays above the target.

In contrast, the Fed is expected to leave rates unchanged during the May meeting and start cutting rates during the third quarter of 2024, presumably during the June meeting, which remains supportive of the greenback and suggests the path of least resistance for the USD/JPY pair is to the upside.

Markets seem convinced of a March rate hike after a U.S. Bureau of Labor Statistics (BLS) report released mid-this month showed back-to-back hot U.S. consumer and wholesale inflation readings pointing to sticky inflation in the U.S. and suggested that the Fed will now have to wait further before starting to cut rates.

Moreover, a U.S. Department of Labor report released last Thursday showed that the number of people claiming unemployment benefits in the U.S. fell by 2,000 to 210,000 in the week ending March 16th, 2024, below market expectations of 215,000. The substantial job numbers match previous job data, including this month's NFP numbers, underscoring tightness in the U.S. labor market. This aligns with the Federal Reserve's latest assessment, adding leeway for the central Bank to delay the start of rate cuts.

CME's Fed watch tool now shows that Fed fund futures traders have priced in an 89.1% chance that the Fed will leave rates unchanged at 5.25 – 5.5% during the May meeting, up from an 85.5% chance one week ago. The watch tool reveals a greater chance of the first-rate cut during the June meeting, with the probability currently at 67.4%.

As we advance, investors look forward to the Japanese docket, which will feature the BoJ Core CPI (YoY) data release during the late-Asian session. Investors will also look for cues from the release of the U.S.CB Consumer Confidence (Mar) and Durable Goods Orders (MoM) data reports.

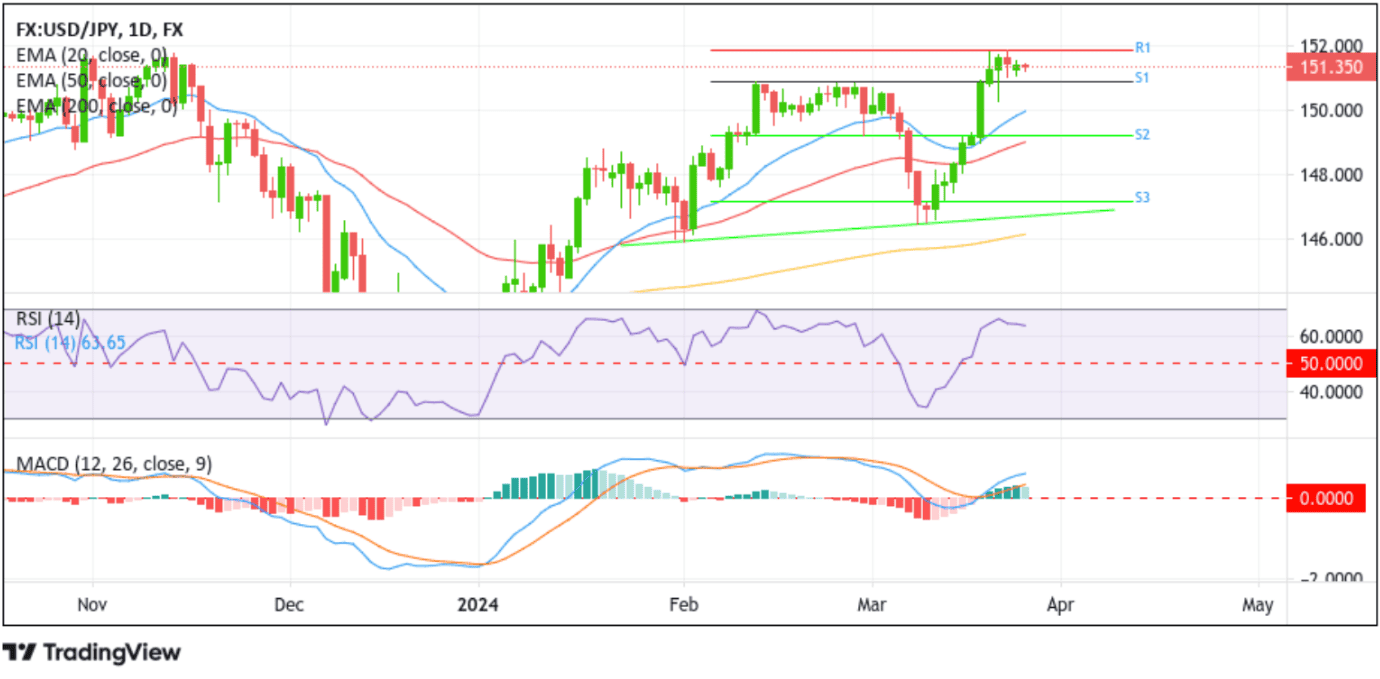

Technical Outlook: One-Day USD/JPY Price Chart

Looking at the broader picture, the major currency pair has been trading within a familiar range (151.846-150.873 levels) for the last six days or so. The aforementioned range has been protecting both the pair's upside and downside. However, the technical oscillators on the chart (RSI14 & MACD) and the Exponential Moving Averages (20,50 &200) portray a bullish outlook and support prospects for an eventual break above the upper limit of the range.

However, it is prudent to wait for sustained strength above the trading range resistance before positioning for any meaningful upside. The following relevant resistance is seen at the 151.903 level, above which the price could rise further toward the 2022 record high/All-time high at the 151.948 level.

On the flip side, immediate support is seen at the lower limit of the range (150.873 level). A convincing move below this level could turn the USD/JPY pair vulnerable to a fall towards the 149.215 level (S2). On further weakness, the USD/JPY pair could accelerate the fall toward the 147.166 level (S3). Failure to defend this level would pave the way for a further extension of the downward trajectory toward the key support level plotted by an upward ascending trendline extending from the early February 2024 swing lower-lows.