Japanese Yen Strengthens Past 153.050 Per Dollar On BoJ Intervention Speculations To Reach A Three-Week High, U.S. NFP Data Looms

Key Takeaways:

- The Japanese yen strengthened past 153.050 per dollar on Friday during the Asian session to reach a three-week high

- Speculations of intervention by Japan's financial authorities for the second time this week lend heavy support to the Japanese Yen (JPY)

- Subdued U.S. dollar price action acts as a tailwind to the USD/JPY pair

- Markets await the U.S. NFP data report for fresh USD/JPY directional impetus

The Japanese yen strengthened past 153.050 per dollar on Friday during the Asian session, moving away from over a thirty-two-year low touched on Monday. Suspected intervention by the Bank of Japan on Thursday, the second time this week to prevent further free fall of the domestic currency, lent further support to the yen. The momentum lifts spot prices to a three-week high and within the vicinity of a move toward the 152.000s ahead of the key U.S. jobs data.

Despite speculations of intervention by Japan's financial authorities for the second time this week, the BoJ is yet to confirm or comment on this, with Japan's top currency diplomat, Masato Kanda, on Thursday declining to directly confirm that intervention had occurred saying that the Ministry of Finance will disclose data at the end of this month.

However, local data released on Thursday showed that Japanese officials may have spent around ¥3.66 trillion on Wednesday to boost the domestic currency, which turns out to be a contributing factor to the prevalent tone around the USD/JPY pair.

Shifting to the U.S. docket, the USD Index, which measures the greenback's performance against a basket of currencies, extended its bearish slide from a six-month high and fell below the 105.200 level on Friday during the Asian session, which turned out to be a contributing factor helping exert downward pressure on the USD/JPY pair.

The decline in U.S. Treasury bond yields continues to weigh further on the greenback as investors digest the Federal Reserve's move to reduce the speed of its quantitative tightening starting from June 1st. The central bank's chairman, Jerome Powell, ruled out a rate hike shortly, stating that he believes the current policy is sufficiently restrictive to achieve the 2% inflation target.

The Treasury yield moves came despite the Federal Reserve keeping the target range for the federal funds rate unchanged at 5.25% - 5.50% during its May meeting for the sixth consecutive time. Wednesday's decision was widely expected as inflation remains stubborn in the U.S. Meanwhile, the U.S. labor market continues to be tight, indicating a stall in progress toward bringing inflation back down to its 2% target this year.

The downbeat mood surrounding the greenback saw upbeat U.S. initial jobless claims and trade balance data reports released on Thursday get greatly overshadowed. The number of people claiming unemployment benefits in the U.S. was unchanged from the prior week at 208,000 on the period ending April 27th, remaining at the lowest level in two months and firmly below market expectations of 212,000. Additionally, the trade deficit in the U.S. remained almost unchanged at a ten-month high of 69.4 billion in March 2024, compared to an upwardly revised 69.5 billion in February and forecasts of a 69.1 billion deficit.

That said, the downside for the U.S. dollar seems limited amid firm market expectations that the Fed may not move to lower interest rates as soon as the June meeting but instead have to wait further before starting cutting rates, probably toward late 2024 in the face of stubborn inflation and a tight labor market. This thus suggests the path of least resistance for the major currency pair is to the upside.

Going forward, investors look forward to the U.S. docket featuring the release of the monthly jobs report for April, popularly known as non-farm payroll data. This report is expected to show that the U.S. economy created 238K jobs in April compared to 303K jobs in March. Additionally, the average hourly earnings for employees in the U.S. are expected to have remained unchanged from March.

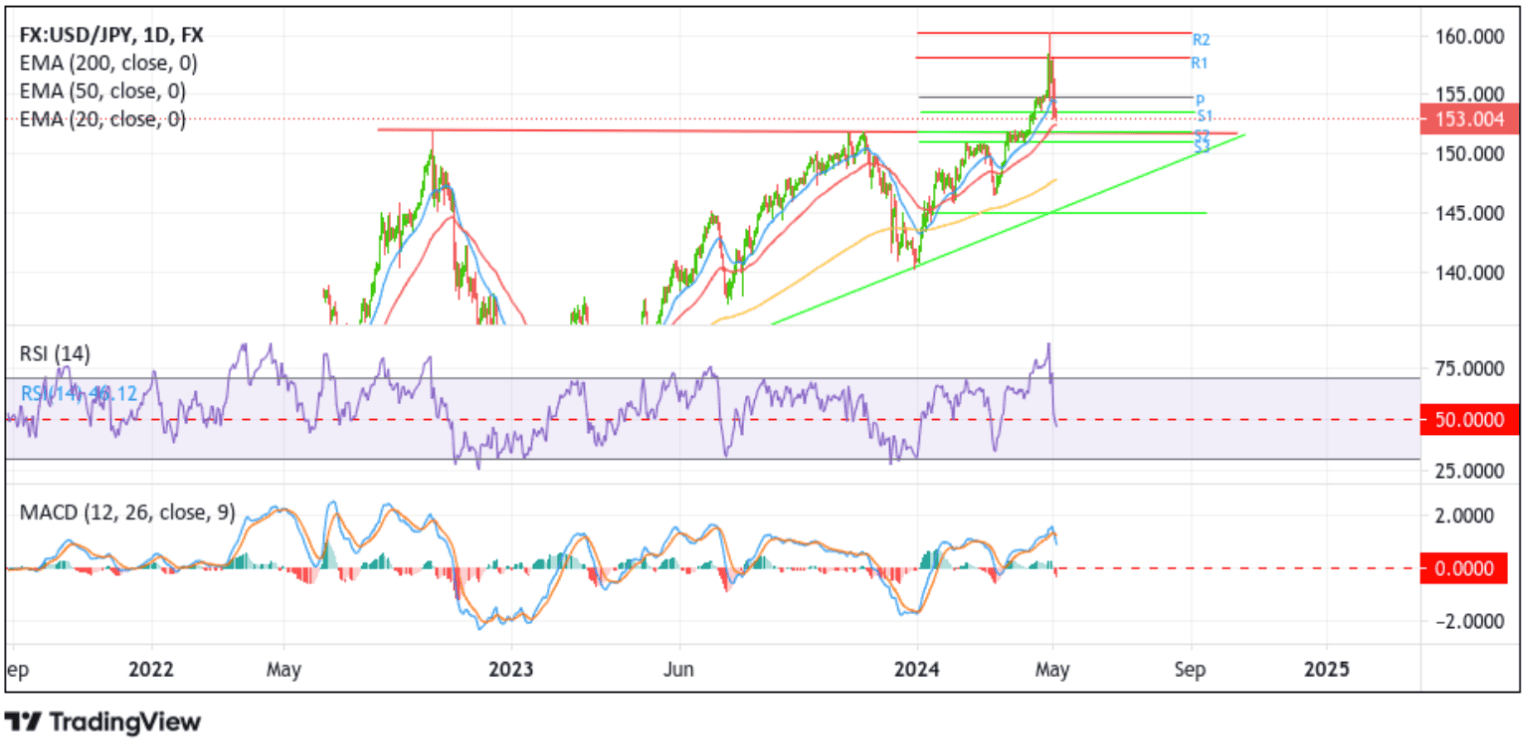

Technical Outlook: One-Day USD/JPY Price Chart

From a technical standstill, a subsequent move below the 152.000 round mark in the coming sessions will pave the way for an accelerated drop toward the 151.935 support level (S2), which coincides with the critical resistance level now turned support level plotted by a horizontal trendline extending from the late-October 2022 swing lower-lows. A clean break below this crucial level will pave the way for more profound losses around the USD/JPY pair. The shared currency could then drop toward the 150.952 support level (S3), about which, if this level fails to hold, the price could decline further toward the 150.000 psychological mark. In highly bearish cases, the USD/JPY pair could extend a leg down to tag the technically strong 200-day (yellow) Exponential Moving Average (EMA) at the 147.791 level.

On the flip side, if dip-buyers and tactical traders jump back in and spark a bullish reversal, initial resistance comes in at 153.555 (S1), now turned resistance level. A decisive move above this level will pave the way for a rise toward the 154.764 pivot level (p). A convincing move above this level will act as a fresh trigger for new buyers to jump in, paving the way for more gains around the USD/JPY cross. The next resistance level is 158.177 (R1), followed by the 160.235 (R2).