USD/JPY Rises Toward 150.000 Psychological Mark Following Bank Of Japan's Latest Interest Rate Decision, U.S. Fed's Decision Awaited

Key Takeaways:

- The Japanese Yen weakened past 149.90 per dollar on Tuesday during the Asian session on a less hawkish outlook by the Bank of Japan

- Bank of Japan abandons its negative interest rate policy for the first time in 17 years; raises its short-term interest rates to around 0 to 0.1%

- Sustained U.S. dollar buying helps exert upward pressure on the USD/JPY cross

- Markets look forward to the U.S. Fed's interest rate decision slated for Wednesday

The Japanese Yen weakened past 149.90 per dollar on Tuesday during the Asian session as the Bank of Japan announced a less hawkish outlook on monetary policy despite hiking rates for the first time in 17 years.

The Bank of Japan (BoJ) announced on Tuesday, after its two-day March monetary policy meeting, that it had raised its short-term interest rates (uncollateralized overnight rate call) to around 0 to 0.1% from -0.1%, ending the world's last negative rate regime.

The bank further announced the abolition of its radical yield curve control policy for 10-year Japanese government bonds, which the central bank has employed to target longer-term interest rates by buying and selling bonds as necessary, part of the monetary policy statement (MPS) showed.

Moreover, the MPS showed the BoJ would discontinue purchases of exchange-traded funds (ETF) and Japan real estate investment trusts (J-REITS). Additionally, the bank will gradually reduce the purchases of C.P. and corporate bonds and will discontinue the purchases in about one year.

However, the MPS revealed that the BoJ doesn't see further rate hikes this year after it stated, "Given the current outlook for economic activity and prices, the Bank anticipates that accommodative financial conditions will be maintained for the time being."

Markets seem to have perceived the BoJ monetary policy statement as somewhat dovish, a key factor that saw the Japan bond yields weaken significantly. This weighed heavily on the Yen and led it to drop to a fresh two-week low against the greenback.

It's worth noting that Tuesday's decision was widely expected following a series of hawkish comments from influential BoJ officials in the past few weeks. Moreover, the results of this year's annual spring labor-management wage negotiations showed Japanese workers from different firms are poised to receive a salary increment of between 5.28% and 14.2% in the new financial year starting in April, a case that fully heightened expectations that the Bank of Japan (BoJ) would shift from its ultra-loose monetary policy stance in its next monetary policy meeting in March.

Shifting to the U.S. docket, the U.S. dollar index, which measures the greenback against a basket of currencies, rose for a fourth consecutive day on Tuesday to trade firmly above the 103.700 mark and turned out to be a contributing factor, helping exert upward pressure on the USD/JPY cross.

The catalyst behind the greenback's impressive performance lately is the firming market expectations that the Fed will leave rates unchanged during the March and May meetings and start cutting rates during the third quarter of 2024.

This comes after a U.S. Bureau of Labor Statistics (BLS) report released last week showed back-to-back hot U.S. consumer and wholesale inflation readings pointing to sticky inflation in the U.S. and suggested that the Fed will now have to wait further before cutting rates.

Moreover, a U.S. Department of Labor report showed that the number of people claiming unemployment benefits in the U.S. fell by 1,000 to 209,000 in the week ended March 8, 2024, below market expectations of 218,000. The substantial job numbers match last week's NFP numbers in underscoring the historical tightness of the U.S. labor market, adding leeway for the Federal Reserve to prolong its hawkish stance into 2024, if necessary, to lower inflation.

That said, CME's Fed watch tool also shows that Fed fund futures traders have priced at a 99.0% and 85.5% chance, respectively, of the Fed leaving rates unchanged at 5.25 – 5.5% during the March and May meetings.

As we advance, traders now look forward to second-tier U.S. economic news data featuring Housing Starts (MoM) (Feb) and Building Permits (Feb) data reports. The data might influence the USD price dynamics, which, along with the broader market risk sentiment, should allow traders to grab some short-term opportunities around the major currency pair. The main focus, however, remains on Wednesday's Fed interest rate decision.

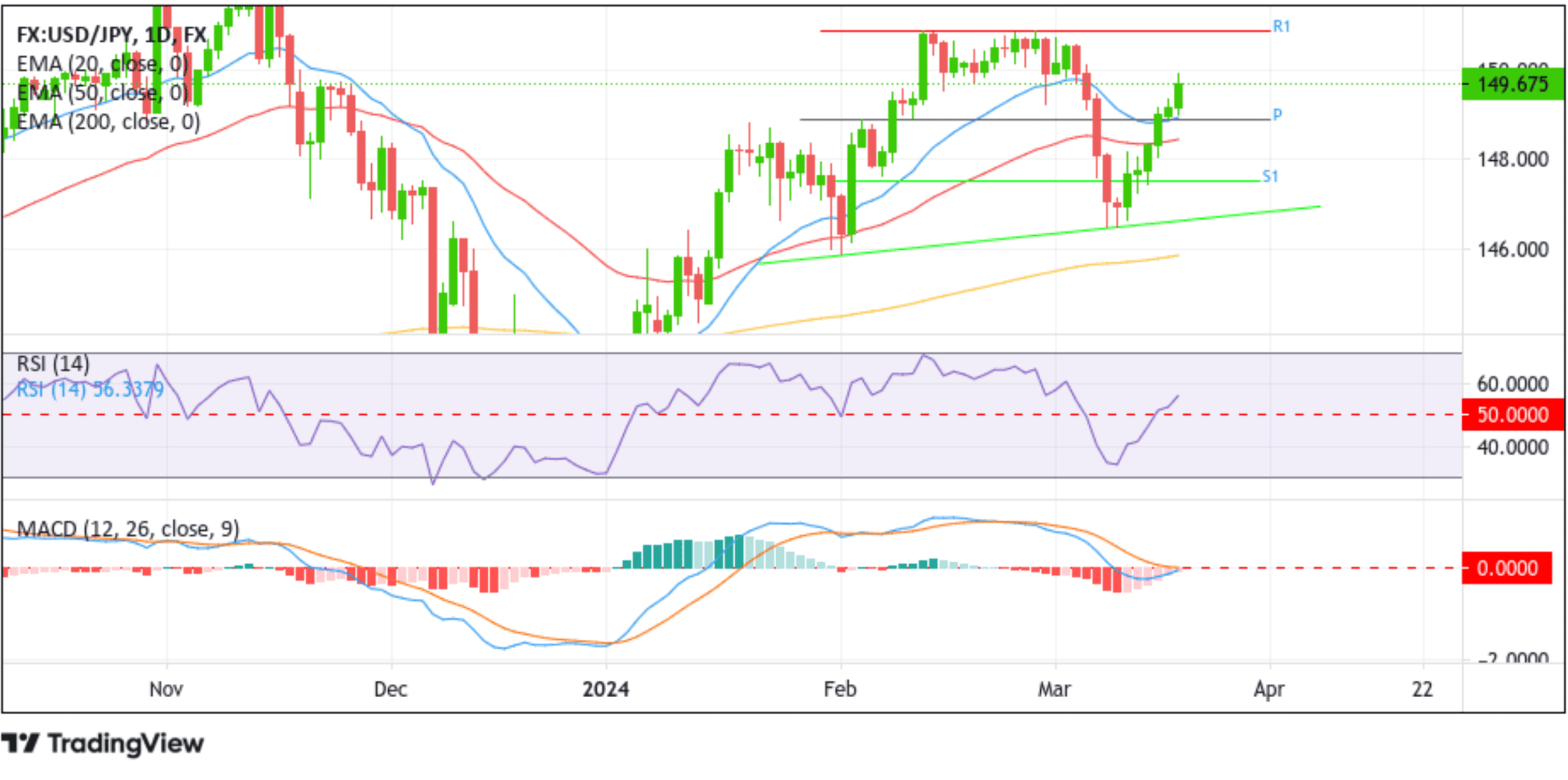

Technical Outlook: One-Day USD/JPY Price Chart

From a technical standstill, the pair confirmed a breakout above a crucial resistance level/148.886 level on Friday, and the subsequent rise adds credence to the positive outlook. A further increase in buying momentum from the current price level will uplift spot prices back toward the 150.000 psychological mark, above which the price could ascend further toward the 150.852 resistance level. A convincing move above this level will pave the way for aggressive technical buying around the shared currency, paving the way toward the 151.891 – 151.698 supply zone.

On the flip side, the 20-day (blue) EMA level is at 148.973, followed by the crucial resistance level, which is now turned into a support level (pivot level), protecting the downside for the pair. Acceptance below the aforementioned EMA level, followed by a one-day candlestick close below the pivot level, will pave the way for a drop toward the 50-day (red) EMA level at 148.453, followed by a further decline toward the 147.619 (S1) and 147.088 (S2) support levels, and in highly bearish cases, the shared currency could extend a leg down toward the key support level plotted by an upward ascending trendline extending from the late-January 2024 swing lower-lows.

💥Trade USD/JPY NOW!💥