Japanese Yen Registers Modest Strength Against The Greenback Despite A Heavy U.S. Dollar Bullish Backdrop

Key Takeaways:

- The Japanese Yen strengthened past $157.300 per dollar on Wednesday during the mid-Asian session

- BoJ officials' somewhat hawkish lends some support to the Japanese Yen

- Tokyo Inflation Hits 2-Year Low in April, suggesting that the Bank of Japan (BoJ) could stick to its ultra-loose monetary policy

- Despite the modest pullback, the fundamental backdrop seems firmly tilted in favor of U.S. dollar bulls

The Japanese Yen strengthened past $157.300 per dollar on Wednesday during the mid-Asian session, moving away from a four-week low touched earlier in the session as investors continued to digest the latest remarks from Bank of Japan officials and the latest Japanese inflation data report and its potential impact on the Bank of Japan's policy trajectory.

Bank of Japan (BoJ) Governor Kazuo Ueda, speaking at a BOJ-hosted conference in Tokyo on central banking on Monday, said, "To achieve 2% inflation sustainably and stably, the BOJ "will proceed cautiously, as do other central banks with inflation-targeting frameworks." Meanwhile, BOJ Deputy Governor Shinichi Uchida said the end of the battle against deflation was in sight, adding that wages are likely to continue increasing.

A Statistics Bureau of Japan report released earlier today showed the core consumer price index for the Ku-area of Tokyo in Japan fell sharply to 1.6% year-on-year in April 2024, hitting its lowest level since March 2022 and coming in way below forecasts of 2.2% due largely to distortions from the start of education subsidies. Tokyo's inflation rate also went below the Bank of Japan's 2% target for the second time this year, reducing pressure on the Bank of Japan to raise interest rates again.

The better-than-expected Tokyo inflation data report comes days after another local data showed that Japan's core inflation rate slowed to 2.2% in April from 2.6% in March due to milder food inflation, which aligns with expectations. The headline rate also fell to 2.5% in April from 2.7% in March, easing for the second month.

These data, to a greater extent, signal that the Bank of Japan (BoJ) would not hike rates again this year and reaffirm market bets that the Bank of Japan (BoJ) could stick to its ultra-loose monetary policy despite a Reuters survey showing that 37% of Japanese firms wanted the central bank to hike rates again to counter the Yen's slide. In comparison, 34% of respondents wanted the government to intervene in the foreign exchange market.

In contrast, the Fed is expected to stick to higher rates for longer, which remains supportive of rising Treasury bond yields and further buying around the USD/JPY cross and suggests the current price action runs chances of fizzling out sooner or later. The bets were raised after The minutes of the Fed's last policy meeting held between April 30 and May 1, released on Wednesday, revealed Fed officials grew more concerned over stubborn inflation. The minutes further showed "various participants" willingness to hike rates if inflation didn't keep moving lower toward the Fed's 2% goal, denting sentiment around interest rate cuts. The odds for rate cuts in September and November have now eased significantly to around 40% and 56.1%, respectively, from 60% and 72.5% earlier this month.

The meeting minutes come after a series of Fed officials urged patience regarding rate cuts this week as inflation remains above the Fed's 2% target.

Notably, Atlanta Fed President Raphael Bostic last week said that it will take time before the central bank is confident that inflation will return to 2%, reiterating that only one rate cut will be necessary this year. He added, "Our new steady state is likely to be higher than what people have known over the last decade, maybe back to where we were in the 1990s and 2000s."

Minneapolis Federal Reserve President Neel Kashkari told CNBC on Tuesday that it would require "many more months of positive inflation data" to convince him that the Fed should cut rates once or twice this year.

That said, a fresh round of positive U.S. macro data further helps dent sentiment around the Yen and helps lift USD/JPY prices. The Conference Board's Consumer Confidence Index rose to 102.00 from 97.5 in April, signaling improved Consumer sentiment in the U.S. in May. Additionally, the Expectations Index climbed to 74.6 from 68.8 in April.

As we advance, in the absence of any significant market-moving economic news data, Treasury bond yields and general market risk sentiment will continue to influence U.S. dollar dynamics and ultimately provide directional impetus to the USD/JPY cross.

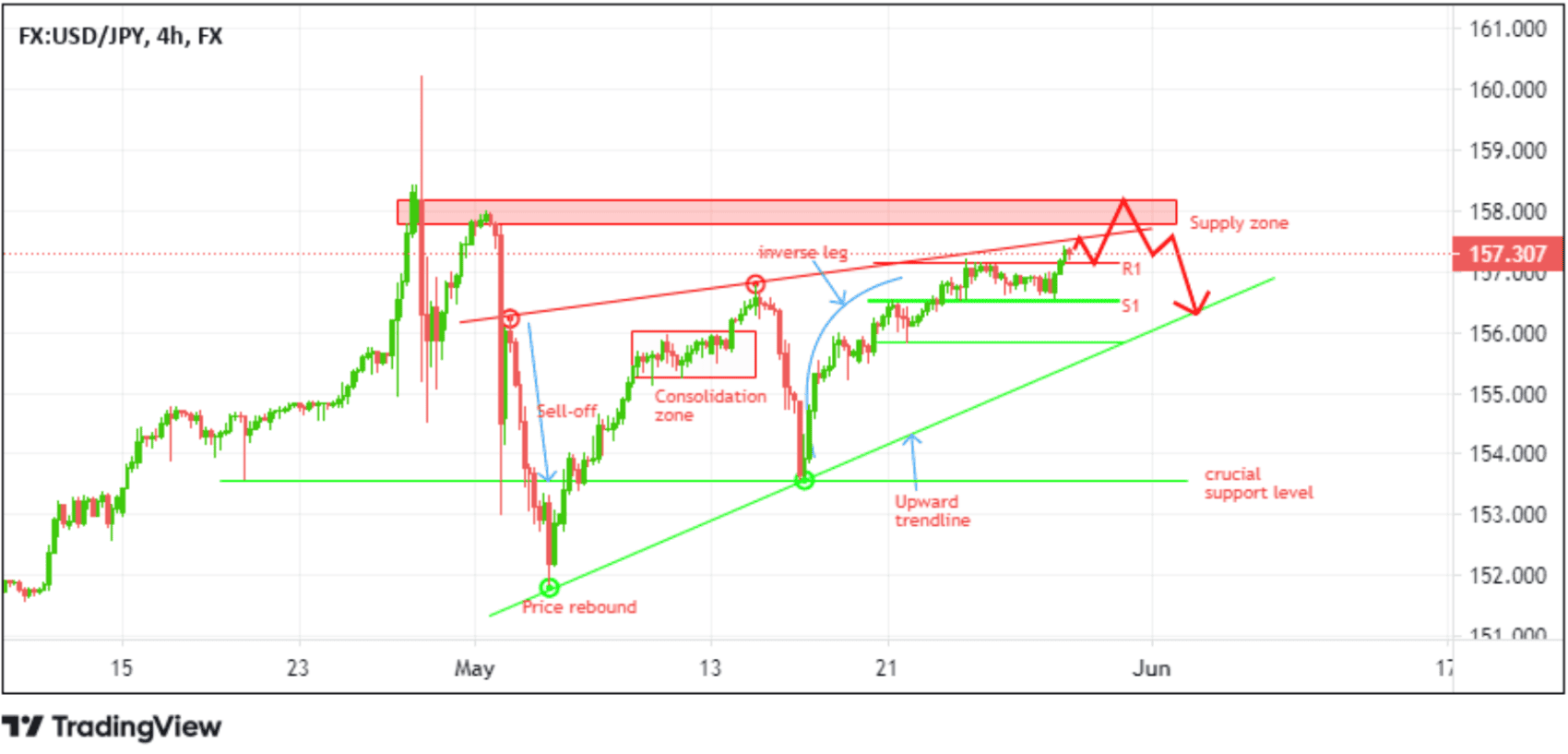

Technical Outlook: Four-Hour USD/JPY Price Chart

From a technical standpoint, Tuesday's break above the $157.133 resistance level followed by today's earlier session liquidity sweep above the $157.199 favors buyers and supports the case for further buying around the USD/JPY cross. Some follow-through selling followed by a rejection from the resistance above level should pave the way for a move back toward the upper-most upward trendline. A subsequent breach above this level would pave the way for an extension of the bullish momentum toward the supply zone, ranging from 158.203 to 157.804 levels. Failure to find acceptance above the zone above should pave the way for an accelerated decline toward 157.000s and 156.000s, about which traders should expect a series of corrective moves before the price moves further downwards to retest the key support level (upward trendline extending from the early-May 2024 swing lower lows.

On the flip side, if the price breaks above the upper-most upward trendline and finds acceptance above the 158.203 - 157.804 supply zone, new buyers could jump in, paving the way for a rise toward the 160.200 level record low.