UK 100 Futures Index Recovers From An Overnight Dip Hours After Logging Best Day in More Than Five Months Following BoE's Decision

Key Takeaways:

- The U.K.'s blue-chip FTSE 100 futures index inched slightly higher on Friday in early pre-trading hours

- Bank of England held its overnight lending rates steady during its March meeting and hinted at cuts on the horizon

- 3I Group, Plc. (LON: III) and Hika Pharmaceuticals, Plc. (LON: HIK) led the list of top gainers and losers on Friday before the bell

The U.K.'s blue-chip FTSE 100 futures index inched slightly higher on Friday in early pre-trading hours, supported by slight strength in stocks in the financial and consumer discretionary sectors as well as a muted Great British pound as investors continued to assess the Bank of England's latest interest rate decision.

As per press time, futures tied to the UK100 index rose around 0.02% (1.77 points) to trade at the £7882.36 level. The current price move follows after-hours trading losses that saw the blue-chip index trim part of its intraday gains but still manage to close with heavy gains above the £7880.00 level following a joyous day across European markets as investors cheered the latest Bank of England's interest rate decision and its implications for mortgage rates and the diverse economy.

The Bank of England (BoE) held its benchmark interest rates steady at 5.25% on Thursday during its March monetary policy meeting. Still, it hinted at cuts on the horizon as inflation falls faster than expected. The Monetary Policy Committee voted by an 8-1 margin to keep rates unchanged, with one member advocating for a 25 basis point decrease.

The accompanying monetary policy statement (MPS) showed the monetary policy committee (MPC) maintained that monetary policy "will need to remain restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term."

In a post-meeting news conference, BoE Governor Andrew Bailey hinted at rate cuts but stressed the necessity for greater certainty regarding the economy's control over price pressures after he said, "We've held rates again today at 5.25% because we need to be sure that inflation will fall back to our 2% target and stay there. We're not yet at the point where we can cut interest rates, but things are moving in the right direction."

The BoE decision came a day after local data revealed that the U.K.'s headline annual inflation rate had dropped to 3.4%, its lowest level in almost two-and-a-half years.

That said, the immediate market implication following the BOE's decision saw the Great British Pound (GBP) weaken significantly against other major currencies as the markets interpreted the decision as a dovish pivot, with the two most hawkish MPC members—Catherine Mann and Jonathan Haskel - dropping calls for a further hike. In contrast, after the decision, the UK 100 index rallied to a ten-month high in European equity markets and registered one of its best daily gains in more than five months.

Following Bailey's comments during the post-meeting news conference and the recent inflation data report, markets are convinced the BoE will soften its aggressive monetary policy stance by implementing its first rate cut in June rather than August.

UK 100 Index Movers

Here are the top UK 100 index movers today before the bell. This week, the primary index is on course for its second consecutive weekly gain.

Top Gainers⚡

• 3I Group, Plc. (LON: III) rose 8.70%/220.0 points to trade at £2748.00 per share.

• Next, Plc. (LON: NXT) added 6.68%/568.0 points to trade at £9078.0 per share.

• St, Jame's Place, Plc. (LON: SJP) gained 5.56%/24.30 points to trade at £461.50 per share.

Top Losers💥

• Hika Pharmaceuticals, Plc. (LON: HIK) lost 3.82%/74.50 points to trade at £1873.50 per share.

• British American Tobacco, Plc. (LON: BATS) declined 1.36%/32.5 points to trade at £2362.0 per share.

• Centrica, Plc. (LON: CNA) shed 1.34%/1.70 points to trade at £125.20 per share.

As we advance, the U.K. Gilt yields plus the general market risk sentiment will continue to influence the near-term sentiment surrounding the Great British Pound (GBP) and, in turn, help determine the near-term direction of UK 100 index prices.

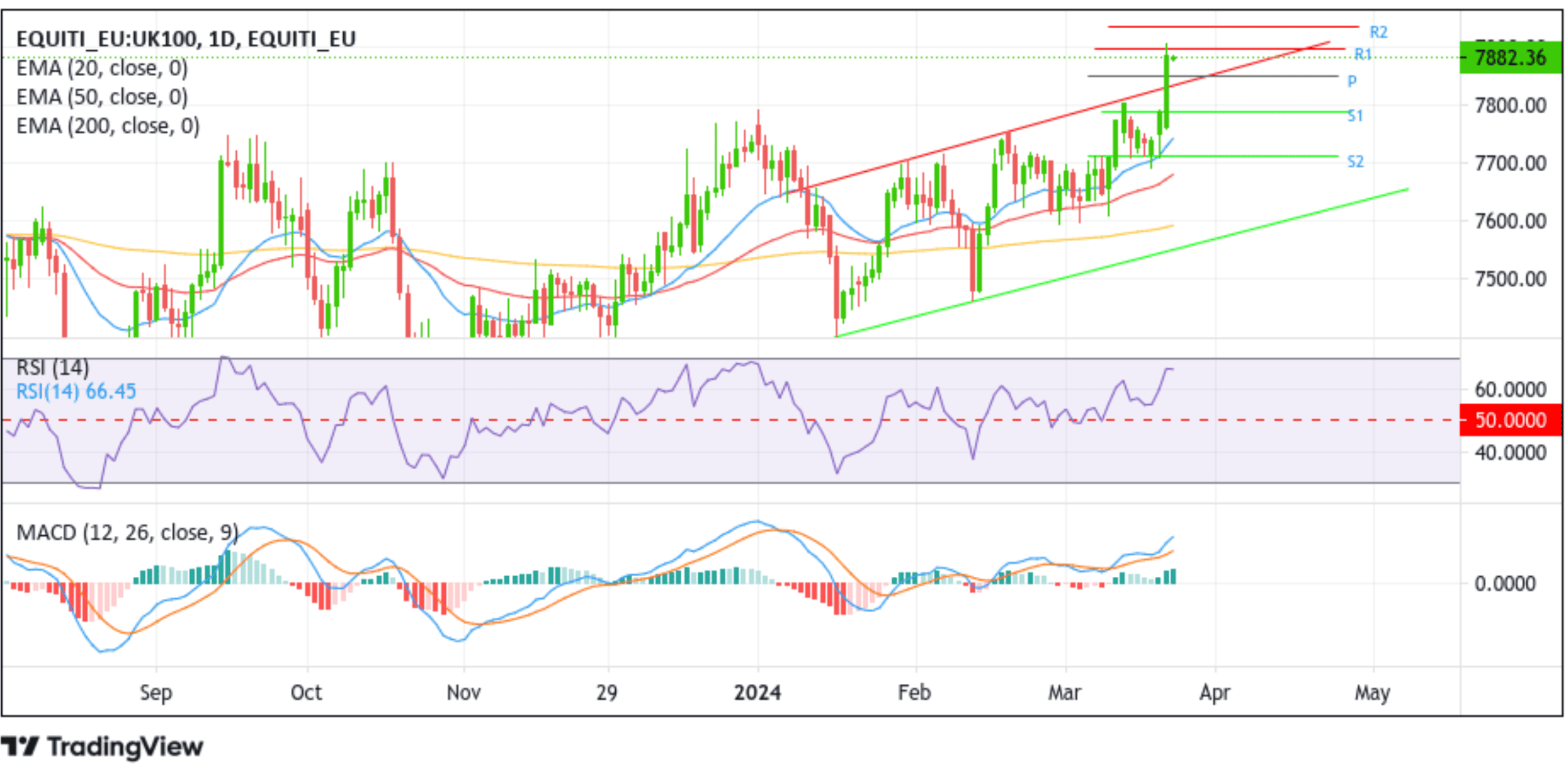

Technical Outlook: One-Day UK 100 Index Price Chart

The UK 100 index one-day price chart shows that Thursday's strong move above a multi-week ascending trend-channel resistance confirmed a fresh bullish breakout. It supported the case for subsequent buying around the primary index. As of press time, the primary index price is currently at £7882.36, down 0.25% from yesterday's swing high of £7901.9, or a ten-month high. Despite this, the index is still under heavy bullish pressure. I foresee further follow-through buying in the coming sessions and, ultimately, an advance toward the £7896.8 hurdle (R1), which sits between the current price and the ten-month high. Sustained strength above the aforementioned barrier, followed by a decisive move above the £7901.9 level (yesterday's swing high), would pave the way for aggressive technical buying around the main index, setting the stage for a rise toward the April 2023 swing higher-high.

Validating the bullish outlook for the primary index is the acceptance of the price above the technically strong 200-day (yellow) Exponential Moving Average (EMA) at the 7520.27 level. Moreover, the 20 (blue) and 50 (red) day EMA levels point upward and add credence to the bullish filter. Additionally, the MACD and RSI (14) technical oscillators are in the dip-bullish territory, suggesting continuing the bullish price action today and in the coming days.

On the flip side, if sellers return and catalyze a bearish turnaround, initial support comes at the pivot level of £7849.06. If sellers manage to breach this floor, downside pressure could gain further momentum, paving the way for a drop toward the key resistance level (multi-week ascending trend-channel resistance), which has now turned a support level. A subsequent break below this key support level would pave the way for an accelerated drop toward the 7789.94 support level (S1), about which, if this level fails to hold, the index price could further downward toward the 7713.06 support level (S2), and in extreme bearish cases, the primary index could decline toward the multi-week ascending trend-channel support.