UK 100 Index Pares BOE-Inflicted Losses And Moves Back Above Mid-£7600.00 Levels

Key Takeaways:

- U.K.'s blue-chip FTSE 100 futures index reversed BoE-inflicted losses and moved back above Mid-£7600.00 levels

- Despite the Bank of England (BoE) holding rates steady at 5.25% during December, MPS revealed further rate hikes are possible

- Ocado Group, Plc. (London: OCDO) and Relx, Plc. (London: REL) led the list of top gainers and losers on Friday before the bell

- Markets await a slew of U.K. macro data for fresh UK FTSE 100 index directional impetus

The U.K.'s blue-chip FTSE 100 futures index inched slightly higher on Friday during the Asian session, extending the post-BoE interest rate announcement reversal from the vicinity of the £7604.1 level and marked a second consecutive session of positive gains as the primary index to reclaim its former lost glory.

As of press time, futures tied to the UK100 rose over 0.25% (19.7 points) to settle above the £7650.00 level. The moves follow a lacklustre day in the European markets, as London stocks fell on Thursday, driven by rate-sensitive financial and industrial stock reactions to the latest Bank of England (BoE) decision, causing the exporter-focused FTSE 100 index to fall sharply from a 12-week high touched earlier on Thursday during the European session but still managed to close the day with modest gains.

The Bank of England voted by a majority of 6-3 to uphold its benchmark interest rate at a 15-year high of 5.25% for the third consecutive time during its December meeting, aligning with policymakers' efforts to combat inflation, even in the face of indications pointing to a deteriorating economic landscape. The remaining three members advocated for a 25-bps rate hike, citing the relatively tight labor market and evidence of persistent inflationary pressures.

The accompanying monetary policy statement (MPS) showed, "The central bank has emphasized the probable necessity for an extended period of restrictive monetary policy to curb inflation, while also highlighting the potential requirement for further tightening should persistent inflationary pressures persist."

The UK's central bank's MPS was interpreted by investors as more hawkish, which underpinned the Great British Pound/Sterling, causing it to rise by as much as 0.75% to a three-month high/1.27932 level against the dollar. On the other hand, the main index fell sharply following the release of the MPS, trimming part of its 12-week or 2-month gains, but still managed to close up 1.86% for the day.

Thursday's decision was widely expected after the inflation rate in the United Kingdom dropped to 4.6% in October 2023, down from 6.7% in September and August, falling short of market expectations of 4.8%. Furthermore, data released this week showed average weekly earnings, including bonuses in the U.K., increased 7.2% year-on-year to GBP 663/week in the three months to September of 2023, the lowest in five months and well below market forecasts of a 7.4% rise.

It is worth noting that the BoE's decision came hours before the ECB also announced it had held its main refinancing operations rate at a 22-year high of 4.5% in line with market expectations and signalled an early conclusion to its last remaining bond purchase scheme, all as part of efforts to combat high inflation. During the press conference, President Lagarde told reporters that policymakers did not discuss rate cuts, reiterating that future decisions would be data-dependent.

Additionally, the BoE's decision came a day after the Federal Reserve (Fed) announced it had held its key interest rate steady for the third straight time during the December meeting in line with market expectations and indicated three cuts were coming in 2024.

UK FTSE 100 Index Movers

Here are the top UK FTSE 100 index movers today before the bell, a week in which the primary index is set to close with heavy gains.

Top Gainers⚡

- Ocado, Plc. (London: OCDO) rose 11.62%/74.80 points to trade at £718.60 per share.

- Ashtead Group, Plc. (London: AHT) added 10.16%/506.0 points to trade at £5486.00 per share.

- Entertain, Plc. (London: ENT) gained 8.67%/73.40 points to trade at £920.00 per share.

Top Losers💥

- Relx, Plc. (London: REL) lost 3.35%/106.00 points to trade at £3063.00 per share.

- Admiral Group, Plc. (London: ADML) declined 3.05%/84.00 points to trade at £2672.00 per share.

- Severn Trent, Plc. (London: SVT) shed 1.89%/51.00 points to trade at £2650.00 per share.

Market participants now look forward to the U.K. docket featuring the Services PMI (Oct) release and the Composite PMI (Oct) data reports. The reports and broader market risk sentiment will influence the Sterling Pound and provide the UK FTSE 100 Index with directional impetus.

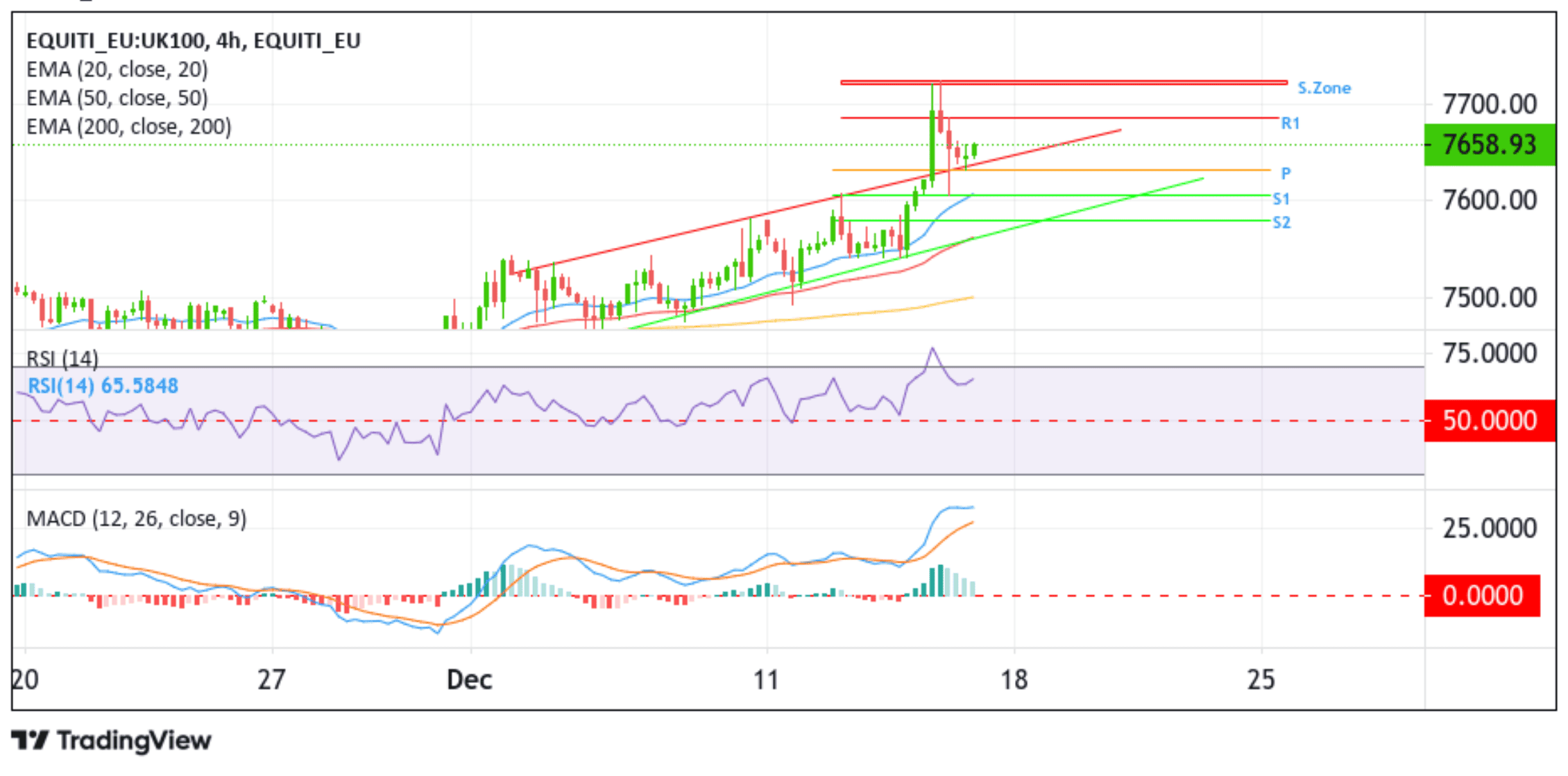

Technical Outlook: Four-Hours UK 100 Index Price Chart

From a technical standpoint, the UK 100 index found some support from the upper trendline channel, now turned support level and built on the subsequent recovery momentum to rise above the £7650.00 level. On further buying, the main index could face resistance at the 7685.86 level (R1). A clean move above this level will pave the way for an ascent towards the supply zone ranging from 7725.23 to 7721.39. Sustained strength above this zone would act as a fresh trigger for new bulls to jump in, helping push the price further upwards.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial support comes in at the upper trendline channel. A subsequent break below this level will pave the way for a drop towards the pivot level (p) at the 7631.40 level. A decisive move below this level could see the main accelerate its downfall toward the 7607.22 support level (S1), which also coincides with the 20-day (blue) Exponential Moving Average (EMA). Acceptance below this level will pave the way for a further decline toward the 7540.76 support level (S2), which sits directly above the lower trendline channel. A convincing move below these barricades will cause the main index to be more vulnerable to further decline.