Gold Holds Above $2030.00 An Ounce As Fed Holds Rates For Third Consecutive Time, Further Uptick Seems Possible

Key Takeaways:

- Gold attracted some buying on Thursday and extended the bullish trajectory above the 2030.00 mark

- The Fed announced on Wednesday that it had held its key interest rates steady for the third consecutive time

- The latest Fed decision saw Treasury bond yields weaken drastically, which undermined the buck and lent support to the metal

- Further monetary policy decision announcements by SNB and BoE might extend support to the non-yielding bullion

Gold (XAU/USD) rose slightly higher on Thursday, building on its recent heavy bullish momentum inspired by the prevalent U.S. dollar selling following

the latest Fed decision. The momentum has lifted spot prices below the $2030.00 mark, posting a 0.28% daily gain. The Federal Reserve held its key interest rate steady on Wednesday for the third straight time in line with market expectations and set the path for multiple cuts in 2024 and beyond.

With the inflation rate easing and the economy holding in, Federal Open Market Committee policymakers voted unanimously to keep the benchmark overnight borrowing rate in a targeted range between 5.25% - 5.5%.

Along with the decision to stay on hold, committee members penciled in at least three rate cuts in 2024, assuming quarter percentage point increments. That's less than the market pricing of four but more aggressive than what officials had previously indicated.

Wednesday's decision was widely expected following softer jobs data reports released last week that pointed to a cooling labor market, solidifying market expectations that the Fed will leave rates unchanged after its two-day policy meeting this week. Moreover, the November Monetary Policy Meeting minutes and the softer October U.S. consumer and producer inflation reports suggested that the Fed will maintain its status quo during the December meeting.

Furthermore, this week's economic data showed that consumer and wholesale prices fell slightly in November, further reinforcing market bets that the Fed would leave rates unchanged yesterday.

That said, the immediate market implication of the Fed decision announcement saw U.S. Treasury bond yields weaken significantly, in turn undermining the U.S. dollar index, which dipped by as much as 0.90% against its peers and was seen as a key factor that drove flows towards the non-yielding bullion, causing it to rise higher and close with heavy gains on Wednesday.

As we advance, gold traders look ahead to the release of the monetary policy decisions by the Swiss National Bank (SNB) and the Bank of England (BoE), which will cause a lot of volatility in the market and provide some impetus to gold. Apart from this, traders will look for cues from the release of the U.S. Retail Sales MoM (Nov) data report.

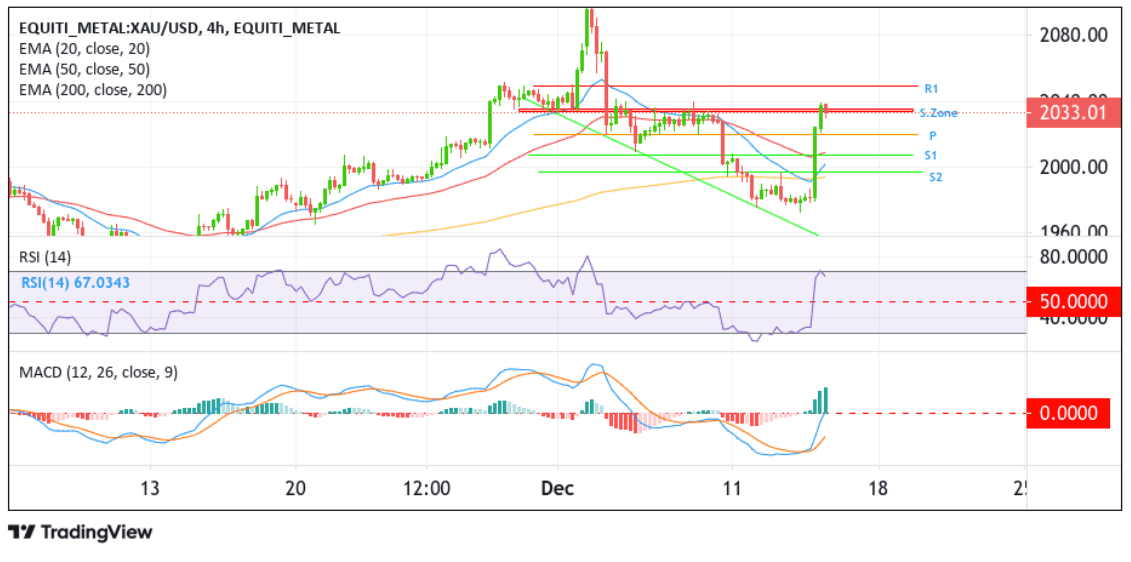

Technical Outlook: Four-Hours Gold Price Chart

From a technical standpoint, the current four-hour candlestick is displaying some slight weakness around the precious yellow metal; however, further downticks seem elusive as gold remains under heavy bullish pressure and the fundamental backdrop is firmly tilted in favor of bulls. The technical oscillators on the chart (RSI (14) and MACD) are in dip-positive territory, suggesting continuing the bullish price action this week. Additionally, the price acceptance above the technically strong 200-day (yellow) Exponential Moving Average (EMA) at the 1993.45 level supports the case for further upside moves. It suggests the current bearish pullback runs the chance of fizzling out sooner or later and that further downtick could still be seen as buying opportunities.

If bulls return and catalyze a bullish reversal, initial resistance occurs at the 2035.54 - 2033.84 supply zone. Sustained strength above this zone would pave the way for a further extension of the bullish momentum toward the 2049.71 ceilings. A clean move above this level could see the precious yellow metal accelerate its ascent toward the 2023 record high at 2126.35 level.

💥Trade XAU/USD NOW!💥