Silver Rises To A Fresh One-Year High As Fed Holds Rates Steady And Signals Multiple Rate Cuts Before End Of The YEAR

Key Takeaways:

- Silver (XAG/USD) rose to $25.76 per ounce on Thursday during the Asian session to record a fresh one-year high

- The Fed held rates steady for the fifth consecutive time, as widely expected, a decision that helped lift silver prices further higher

- Silver continues to draw support from a slew of positive Chinese macro data

- Bank of England (BoE) and the Swiss National Bank (SNB) interest rate decisions might help determine the near-term direction of silver prices

Silver (XAG/USD) rose to $25.76 per ounce on Thursday during the Asian session to record a fresh one-year high and extend gains for the fourth consecutive session. The metal was supported by a muted greenback as investors continued to assess the Fed's latest interest rate decision and its plans to cut rates three times before the end of the year.

On Thursday, the Federal Reserve (Fed) announced that it had left its benchmark overnight borrowing rate unchanged at 5.25% - 5.5% for a fifth consecutive meeting in March, which was in line with market expectations.

Along with the decision, Fed officials penciled in three quarter-percentage-point cuts by the end of 2024. The outlook for three cuts came from the Fed's "dot plot," a closely watched matrix of anonymous projections from the 19 officials who comprise the FOMC. The chart does not indicate the timing of the moves. The plot also indicated three cuts in 2025, one fewer than in December, and three more reductions in 2026.

In a post-meeting news conference, Powell said, "We believe that our policy rate is likely at its peak for this type of cycle and that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year." He added, "We are prepared to maintain the current target range for the federal funds rate for longer if appropriate."

Following the meeting, CME's Fed watch tool showed Fed fund futures traders were pricing in a 67.4% chance of the first-rate cut during the June meeting.

That said, the immediate market implication following the Fed's decision saw the U.S. dollar index (DXY), which measures the greenback against a basket of currencies, slip by more than 0.45%/0.47 points, weighed by retreating Treasury bond yields, to close with heavy losses below the $103.400 mark. In contrast, the U.S. equity and commodity markets rallied to one of their best days this year, with Silver rising by as much as 2.92% before paring gains and slipping slightly lower to close with heavy gains just below the $25.600 mark.

The current price move takes Silver up around 1.8% for the week and is within striking distance of the 2023 record high at $25.91. The current price movement extends earlier this week's gains following upbeat Chinese macro data.

Data on Monday showed China's retail sales increased by 5.5% year-on-year in January-February 2024 combined, topping the market consensus of 5.2% and coming after a 7.4% rise in December. Additionally, China's industrial production expanded by 7.0% year-on-year in January-February 2024 combined, faster than a 6.8% growth in December 2023 and beating market forecasts of 5%. It is worth noting that any development in China, including macro data releases, affects the price of Silver since China is one of the leading producers of Silver in the world.

Rising geopolitical tensions continue to support the dollar-denominated commodity, and any further escalation of the conflicts in the Middle East would help raise silver prices further.

As we advance, investors look forward to interest rate decision announcements by the Bank of England (BoE) and the Swiss National Bank (SNB). They will also look for cues from the release of the U.S. Initial Jobless Claims, Manufacturing PMI (Mar), Services PMI (Mar), and Existing Home Sales (MoM) (Feb) data reports.

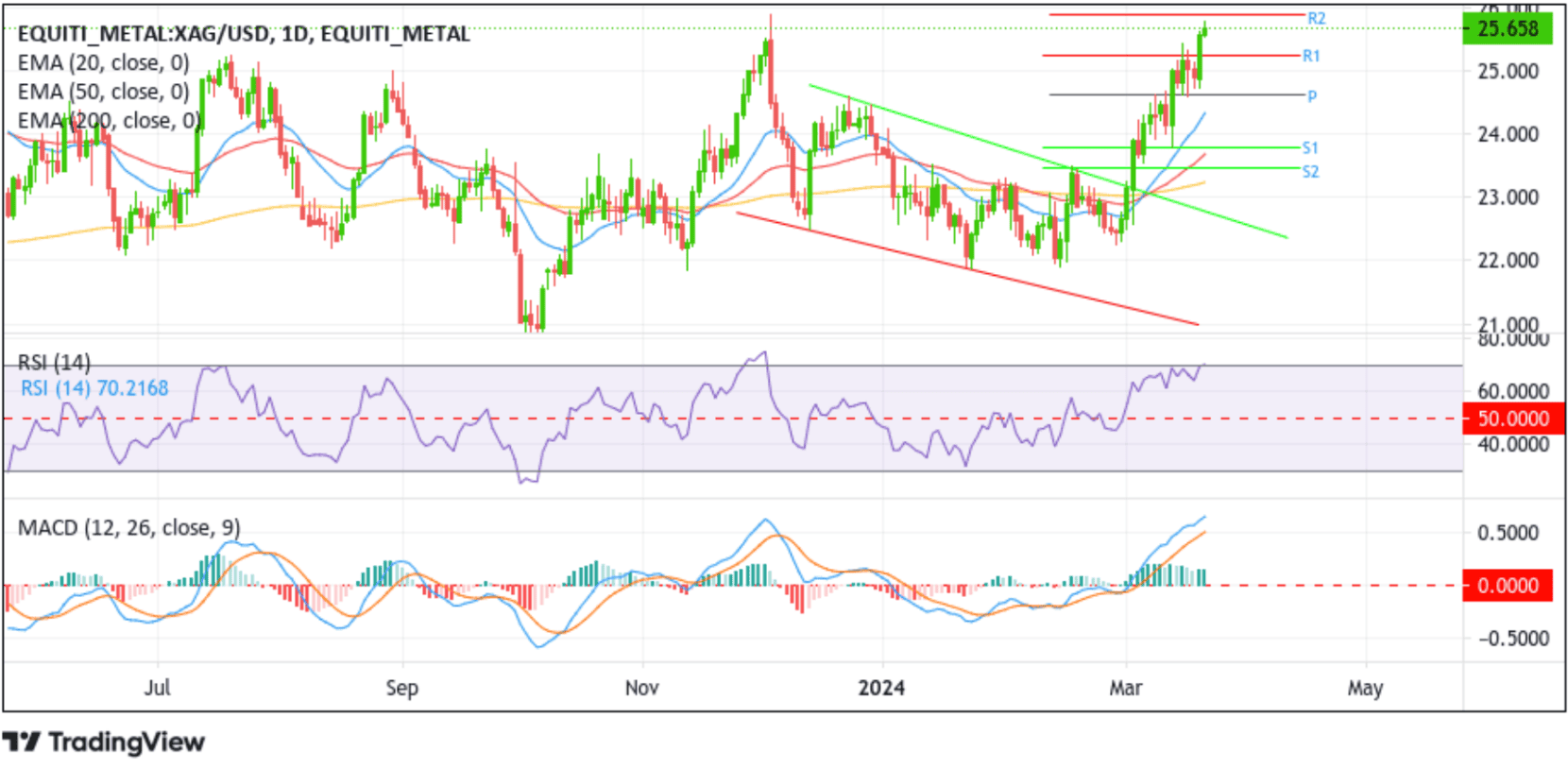

Technical Outlook: One-Day Silver Price Chart

Looking at Silver's one-day price chart, Silver has made a massive comeback in the last 36 days, following a heavy sell-off from early December 2023 until mid-February 2024 to make a re-entry in $25.00 levels and trade within striking distance of the 2023 record high at $25.91. A further increase in buying pressure in the coming sessions would ultimately lift spot prices toward the aforementioned record high. A convincing move above this level would act as a fresh trigger for new buyers to jump, paving the way for further gains around the shared currency. Silver could then rise further towards the 26.000 - 26.212 supply zone.

Supporting my bullish assumption for this precious silver metal is the acceptance of the price above the technically strong 200-day (yellow) Exponential Moving Average (EMA) at the 23.048 level. Moreover, the 20 (blue) and 50 (red) day EMA levels point upwards, adding credence to the bullish bias. Additionally, the MACD technical oscillator is in the dip-bullish territory, suggesting continuing the bullish price action this week. However, the RSI (14) technical oscillator is flashing overbought conditions (70.2168 level), warranting caution from traders against submitting aggressive bullish bets.

On the flip side, the 25.246 level (S1) now protects the downside for the precious commodity. A decisive move, however, below this level will pave the way for increased selling, paving the way for a drop toward the 24.609 pivot level (P). A convincing move below this level will pave the way for an accelerated decline toward the 23.789 level (S2), which coincides with the 50% fib retracement level of the early December to early March recovery. A subsequent move below this level will pave the way for a further drop toward the 23.301 level (S2). If this level fails, the price could drop further to seek support from the key support level plotted by a downward-sloping trendline extending from the late-December 2024 swing lower-high.