Silver Rises Above 23.600 Mark On Mixed U.S. Macro Data, Further Uptick Seems Possible

Key Takeaways:

- Silver (XAG/USD) rose above the 23.600 mark on Thursday, supported by a combination of factors

- Firm market bets that the Fed is done with its rate-hiking cycle weigh heavily on the greenback and help exert upward pressure on the XAG/USD pair

- A fresh round of mixed U.S. macro data weighs on the buck and helps cap the downside for the precious metal

Silver (XAG/USD) extended the overnight bounce from the vicinity of the 23.530 level and rose slightly higher on Thursday, reversing part of its previous day's losses. As of press time, the precious silver metal is trading around the 23.670 region, up 0.20% (4.6 pips) for the day, and looks set to maintain its bid tone heading into the European session amid the prevalent U.S. dollar selling.

Firm market bets that the Fed is done with its rate-hiking cycle continue to undermine the buck and see the safe-haven asset extend its modest bounce from the vicinity of the 104.219 level and decline below the 103.700 mark on Thursday. This comes after minutes of the November meeting revealed that Federal Reserve officials at their most recent meeting expressed little appetite for cutting interest rates anytime soon, particularly as inflation remains well above their goal.

Apart from this, two U.S. Bureau of Labor Statistics reports released last week pointed to cooling inflation pressures at the consumer and producer level, which, together with slowing job and wage growth, fully reinforce market expectations that the Fed is done with its monetary policy tightening campaign. CME's Fed watch tool shows that Fed fund futures traders have priced in a 100% chance that the Fed will leave its Fed Funds rates unchanged at 5.25% - 5.5% during the December meeting.

Further weighing on the buck was the fresh round of mixed U.S. macro data released on Wednesday. A U.S. Department of Labor report on Wednesday showed the number of Americans filing for unemployment benefits fell by 24,000 to 209,000 on the week ending November 18th, dropping sharply from the three-month high in the previous week and well below market expectations of 225,000, indicating that the slowdown in the labor market has not fully materialized yet, allowing the Federal Reserve the flexibility to maintain interest rates at restrictive levels. In that same line, the University of Michigan consumer sentiment for the U.S. was revised sharply higher to 61.3 in November 2023 from a preliminary level of 60.4. However, it has remained at the lowest level since May.

Elsewhere, new orders for manufactured durable goods in the United States plummeted by 5.4% month-over-month in October 2023, reversing a 4.0% surge seen in September and significantly surpassing market expectations of a 3.1% drop. That said, the modest bounce in the U.S. equity markets on Wednesday further weighs on the buck amid reduced recession fears in the U.S. as solid indications continue to point to a second consecutive Fed pause during the December meeting.

As we advance, without any significant economic news data, the broader market risk sentiment and U.S. Treasury bond yields will continue to influence the U.S. dollar and provide short-term trading opportunities around the XAG/USD pair.

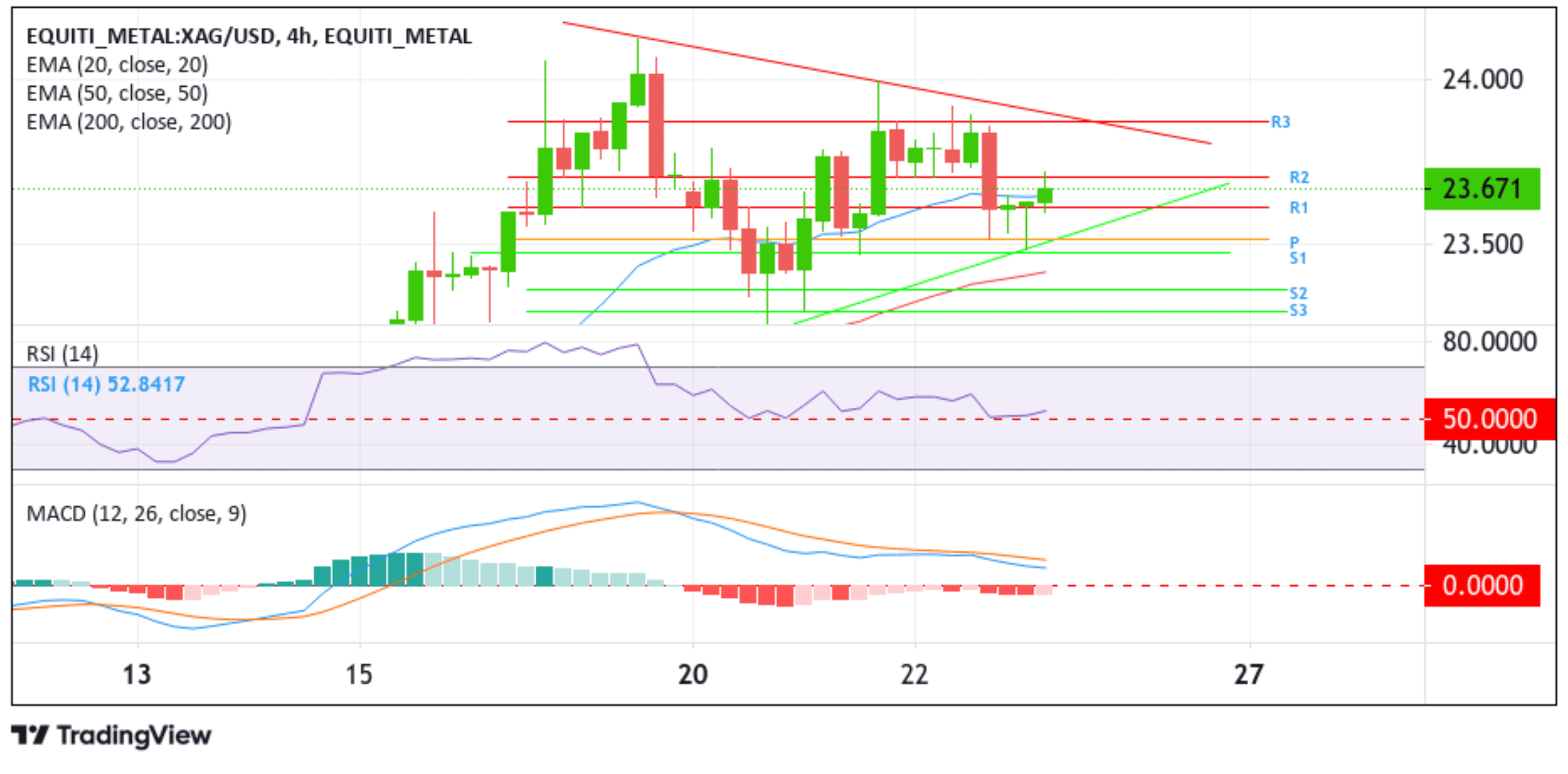

Technical Outlook: Four-Hours Silver Price Chart

From a technical standpoint, the price's ability to find acceptance above the pivot level (p), which corresponds to the 61.8% Fibonacci retracement level (Fib) at the 23.514 level and the subsequent move above the 23.613 level (R1), which coincides with the 50% Fib level, reaffirmed the bullish thesis and supported the case for further upside moves. A further increase in buying pressure from the current price level will face initial resistance at 23.707 (R2). A convincing move above this barrier (second attempt) will pave the way for an ascent toward the next relevant resistance level at 23.873 (R3). A decisive move above this level will pave the way for an ascent toward the key resistance level plotted by a downward-sloping trendline extending from the mid-November 2023 swing to higher highs. A subsequent break (bullish price breakout) above the aforementioned resistance level would act as a new trigger for new buyers to jump in, creating the path for more gains around the XAG/USD cross.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, support comes in at the 23.613 level, followed by the 23.514 level. Acceptance below these levels will pave the way for a drop toward the key support level plotted by an ascending trendline extending from the late-November 2023 swing to lower lows. A clean break (bearish price breakout) below this support level will pave the way for a move toward the 23.471 support level, about which, if sellers manage to breach this floor, silver could accelerate its decline toward tagging the 50-day Exponential Moving Average (EMA) at the 23.427 level before extending a leg down toward the 23.358 support level (S2), followed by the 23.294 support level (S3).