USD/CAD Rebounds From Nearly One-Month High And Retakes 1.35200s On Softer U.S. Dollar, U.S. GDP Data Eyed

Key Takeaways:

- The USD/CAD cross retreats below the 1.35200 mark, weighed by a combination of factors

- Retreating U.S. bond yields, rising crude oil prices, and investors' decision to stay on the side-lines weigh on the buck and help cap the upside for the USD/CAD pair

- Despite the combination of supportive factors, the fundamental backdrop seems tilted in favor of bulls

- The market's focus shifts toward the release of the U.S. quarter-four GDP data report

The USD/CAD cross dropped below the 1.35200 mark on Thursday during the mid-Asian session after attracting fresh selling in the last hour to extend the modest bounce from the vicinity of the 1.35350 level touched earlier in the session. As of press time, the cross has managed to reverse most of its earlier gains and looks set to maintain its offered tone heading into the European session amid the prevalent tone surrounding the greenback.

A fresh leg down in U.S. Treasury bond yields and a weaker risk tone helped revive the U.S. dollar supply, which was a key factor that undermined the USD/CAD cross. Apart from this, a generally upbeat tone around the equity markets further undermines the safe-haven greenback and helps limit further gains for the AUD/USD pair.

Additionally, a goodish pick-up in crude oil prices on Thursday was supported by the latest upbeat EIA data and China's Central Bank decision to cut banks' reserve ratio lent support to the commodity-linked Loonie and was seen as another factor that helped cap the upside for the USD/CAD pair.

Moreover, USD bulls' decision to stay on the side-lines before today's release of the U.S. quarter-four GDP data has favored the Loonie bears, who capitalized on that move to force a minor rebound.

Despite the supportive factors, the fundamental backdrop seems tilted toward bulls. This comes amid increased market bets that the Fed will leave rates unchanged during the March meeting and start cutting rates during the third quarter of 2024, which remains supportive of the greenback.

The bets were reaffirmed after influential FOMC members pushed back the idea of early rate cuts last week, warning that despite progress in tackling inflation, markets have gotten ahead of themselves regarding expectations for spring rate cuts.

Moreover, a string of upbeat U.S. data released last week further suggested that the Federal Reserve might prolong its hawkish stance into the second quarter, helping push back further the idea of early rate cuts and continue to act as a tailwind to the USD/CAD cross.

Furthermore, a fresh round of upbeat U.S. data released on Wednesday further supports the buck. An S&P preliminary report released on Wednesday showed the Global U.S. Manufacturing PMI unexpectedly jumped to 50.3 in January 2024 from 47.9 in December 2023, compared to forecasts of 47.9. Additionally, the Global U.S. Services PMI surged to a 7-month high of 52.9 in January 2024, surpassing market expectations of 51.

Additionally, the Loonie continues to be weighed down by the latest Bank of Canada (BoC) decision, in which the central bank held the target for its overnight rate at 5% for the fourth consecutive decision in January 2024, as widely expected, leaving benchmark borrowing costs at a 22-year high.

That said, the combination of factors suggests the path of least resistance for the pair is to the upside, and any further downtick could still be seen as a buying opportunity.

As we advance, investors look forward to releasing the U.S. quarter-four GDP data report, which is expected to show that the U.S. economy contracted by 2.0% in the last quarter of 2023 from 4.9% in the previous quarter. Investors will further look for cues from the release of the Core Durable Goods Order (Dec), the Initial Jobless Claims (previous week), and the New Home Sales (Dec) data reports.

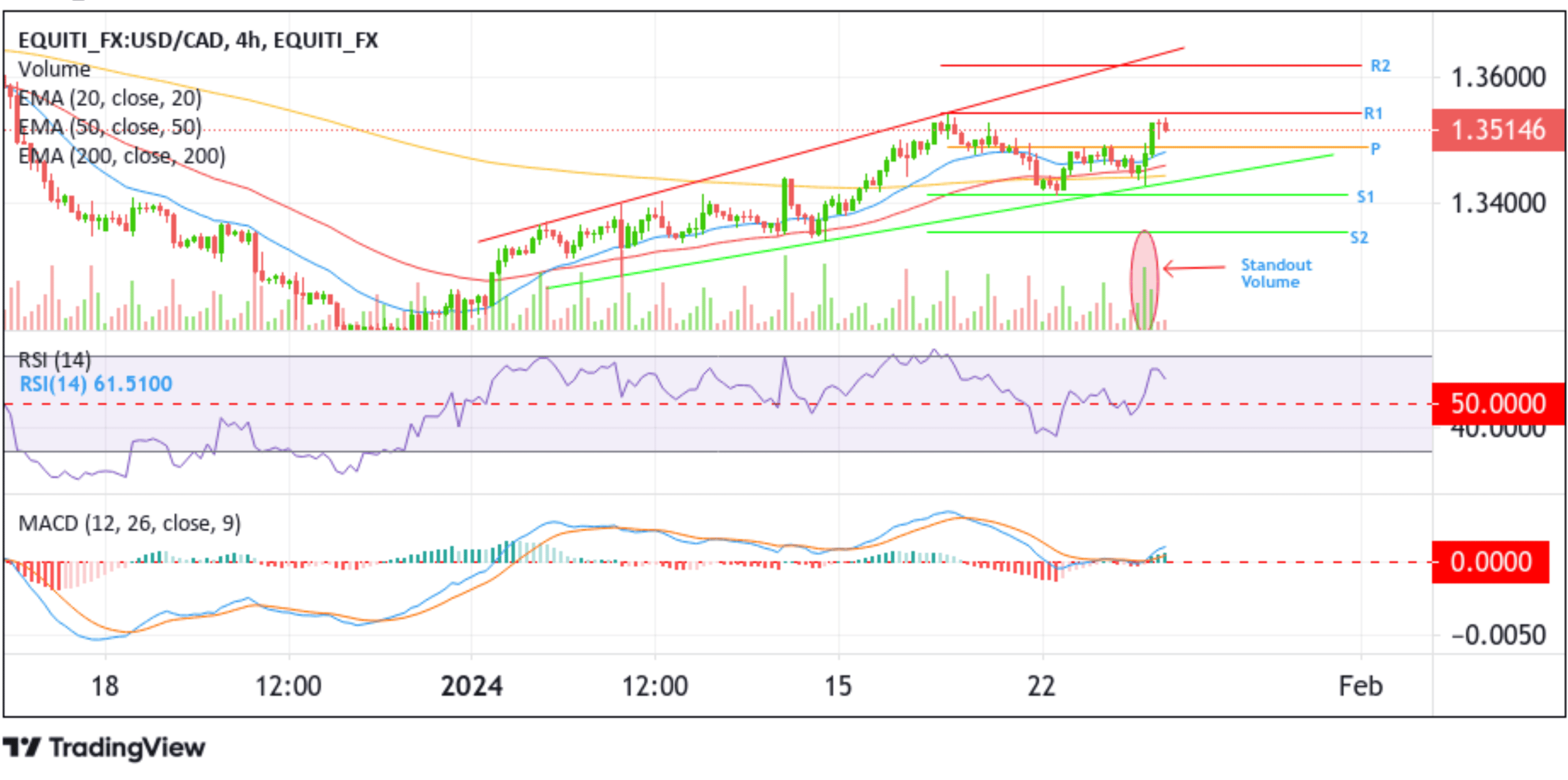

Technical Outlook: Four-Hour USD/CAD Price Chart

From a technical perspective, the USD/CAD price has extended the modest bounce from the vicinity of the 1.35350 level and is currently placed below the 1.35200 mark. However, further selling would still be seen as selling opportunities and risk the chance of fizzling out sooner or later. This comes amid a heavy bullish bias painted by the acceptance of the price above the technically 200-day solid (yellow) EMA level at 1.34451. Additionally, the chart's technical oscillators (RSI and MACD) are holding in positive territory, suggesting continuing the bullish price action this week. Moreover, the volume oscillator displays a standout volume bar, indicating that bulls control the market. Hence, if buyers resurface in the coming sessions and catalyze a bullish reversal, initial resistance comes at 1.35434 (R1). Buying interest could gain momentum if the price pierces this barrier, creating the right conditions for an advance above the 1.36000 round mark toward the 1.36178 ceilings.

On the flip side, if sellers extend the modest pullback further downward, initial support will appear at 1.34901 (P). A convincing move below this level will pave the way for USD/CAD to tag the 20-day (blue) EMA at 1.34843. Some follow-through selling could see the shared currency drop toward the 61.8% fib retracement level at 1.34704 of Wednesday's rally from the key support level. A clean move below this level would see the shared currency descend toward the seller congestion zone due to the 50 (red) and 200 (yellow) day EMA at 1.34633 and 1.34451 levels, respectively. Suppose side-lined sellers join in from this seller congestion zone. In that case, it will rejuvenate the bearish momentum, provoking an extended decline toward the key support level plotted by an upward ascending trendline from the early-January 2024 swing lower-lows. A subsequent break below this level would negate the bullish bias and pave the way for a drop toward the 1.34136 level (S1), followed by the 1.33557 level (S2), and in dire cases, the USD/CAD could extend a leg down toward the 1.33000 round mark.