US WTI Crude Oil Edges Slightly Higher As Recession Woes Continue To Fade, Settles Above $71 Per barrel

- US WTI crude oil futures inch slightly higher, settling above $71 per barrel

- Robust US job data helps squash recession fears and underpins crude oil prices

- Key US and Chinese macroeconomic data this week are set to influence crude oil prices

US WTI crude oil futures edged slightly higher during the mid-Asian session amid the prevalent cautious mood depicted by receding fears of a potential recession in the US, which drove prices down the last three weeks. As per press time, US WTI futures were up 28 cents/0.36% at $71.315 after initially slipping by around 24 cents earlier in the session, while their counterpart Brent crude futures were also up 27 cents/0.36% at $75.21. Concerns of a potential recession in the US, resuming banking fears, rising interest rates, and soft Chinese demand drove crude oil prices down to a 15-month low over the last three weeks.

However, Crude oil prices have rebounded after finding support from oil stocks' comeback on Wall Street last Friday after a stronger than expected US jobs data showed a resilient jobs market and further eased market concerns of a potential recession in the US. Last month, the number of jobs added in the US jumped to 253K against a market forecast of 180K and followed a downwardly revised 165K in March. Professional and business services (43 K combined), health care (40K) and leisure and hospitality (31K) led the list of top sectors that had the highest number of job hires last month.

Further uplifting crude oil prices was the ongoing retreat in Treasury bond yields, contributing to the weaker tone surrounding the greenback. Additionally, signs of stability in the US equity markets further add downward pressure on the greenback, supporting crude oil prices. Additionally, expectations of further supply cuts at the next meeting of the Organization of Petroleum Exporting Countries (OPEC) further contributed to the goodish pickup in crude oil prices.

As we advance, key catalysts this week that are set to drive crude oil prices include China Trade Balance data on Tuesday that is set to provide more information on oil imports from the world's top oil importer. According to a preliminary figure, Chinese imports are expected to have weakened further last month by -5.0%, down from -1.4% in March, amid signs that the post-Covid economic recovery has run out of steam. Additionally, Chinese inflation data is due on Wednesday and is expected to show easing inflation in China as it continues its post-pandemic recovery. The US inflation data due is due on Wednesday and is set to drive crude oil prices and affect the US dollar's strength. The US Bureau of Labor Statistics consumer price inflation (CPI) report is set to provide further clues on interest rate moves amid broad market expectations that the FED is set to pause rate hikes.

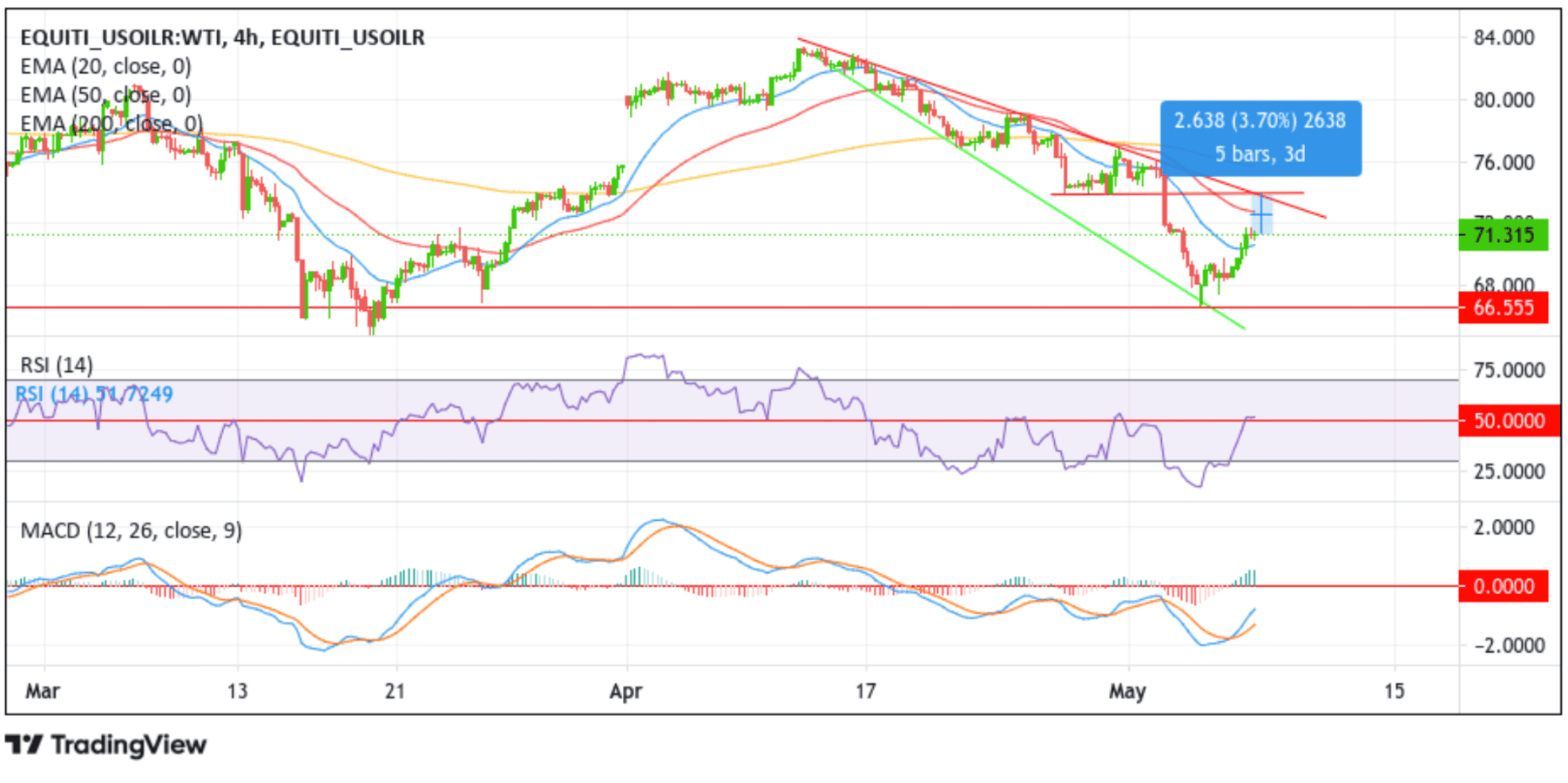

Technical Outlook: Four-Hours US WTI Crude Oil Price Chart

From a technical standstill, if buying pressure increases beyond the current price level, spot prices will encounter resistance at the 50-day (red) Exponential Moving Average (EMA) at 72.707 level. A decisive flip of this resistance level into a support level could pave the way for an ascent toward the 73.870 resistance level, which also coincides with the key resistance level plotted by a descending trendline extending from the mid-April 2023 swing high to denote a 3.7% rally. Sustained strength beyond this confluence level could set crude oil prices for another rally toward confronting the 200-day (yellow) Exponential Moving Average (EMA) at the 75.645 level. A convincing move above this technically strong level could negate any near-term bearish outlook and pave the way for further crude oil gains.

On the flip side, if sellers resurface and spark a bearish turnaround, the price will first find support at the 20-day (blue) Exponential Moving Average (EMA) at the 70.728 level. A decisive flip of this support level into a resistance level could pave the way for a drop toward the 66.555 support level. A break below this support level could pave the way for a decline toward the key support level plotted by a descending trendline extending from the mid-April 2023 swing low. If sellers manage to breach this floor, downside momentum could pick up, paving the way for a drop toward March 2023 swings low at the 64.330 level.