US WTI Crude Oil Price Surges By 4.4% On Report Of Israel Attack on Iran

Key Takeaways:

- US WTI, crude oil price, jumped 4.40% on Friday during the Asian session following news of the attack by Israel against Iran

- Israel's attack on Iran sparks fears of a regional war that would impact the crude oil supply in the oil-rich region

- A generally softer U.S. dollar is also seen as another factor that continues to extend support to crude oil prices

The U.S. West Texas Intermediate (WTI) futures crude oil price rose sharply on Friday during the Asian session, extending gains for the second consecutive day as a surprise attack by Israel on Iran on Thursday evening sparked fears of a regional war underpinned crude oil prices.

As of press time, U.S. West Texas Intermediate (WTI) futures are trading at $84.695 per barrel, almost 1.09% down from a session high of $85.58. The price had jumped 4.40% earlier in the session due to the latest developments surrounding the Middle East war.

Israel Attacks Iran

According to a report by CNBC.com, A U.S. official told NBC News that Israel is conducting an operation in Iran. Earlier, Iran's Fars news agency reported explosions were heard near the airport in the country's central Isfahan city, but the reason was unknown.

Israel's attack on Iran, according to many experts, seems like a retaliatory attack after last weekend. Iran conducted drone and missile attacks on Israel in what was a retaliation to an Israeli strike on its consulate in Damascus, Syria, earlier this month. Iran accused Israel of bombing part of its embassy compound on April 1, killing seven Iranian military personnel, including three senior commanders.

Markets now feel that Israel's attack on Iran would further escalate the Middle East war and impact the crude oil supply in the oil-rich region, which in turn would cause crude oil prices to rise in the coming months.

Softer U.S. Dollar

The U.S. dollar index, which measures the greenback against a basket of currencies, trades with modest losses below the 106.300 mark on Friday during the Asian session, weighed by retreating Treasury bond yields, and was another factor that helped exert upward pressure on crude oil prices.

Despite the combination of supporting factors, crude oil's upside seems limited. The U.S. dollar is still supported by firm hawkish Fed expectations, which suggests the path of least resistance for crude oil prices is to the upside.

Markets feel convinced that the Fed will delay cutting rates and prolong its hawkish stance through 2024 after a U.S. Jobs data report released on Thursday pointed to a tight labor market after the number of people claiming unemployment benefits in the U.S. was unchanged from the prior week at 212,000 for the period ending April 18 below market expectations of 215,000.

Additionally, Fed Chair Jerome Powell on Tuesday said that interest rates could need to stay higher for longer as the battle to return to its 2% target is far from over.

While speaking at the Washington Forum on the Canadian Economy, Jerome Powell said, "More recent data shows solid growth and continued strength in the labor market, but also a lack of further progress so far this year on returning to our 2% inflation goal."

Powell's comments matched closely to those of Fed Governor Michelle Bowman, who said on Wednesday that progress on slow U.S. inflation may have stalled, and it remains an open question whether rates are high enough to ensure inflation returns to the Fed's 2% target.

The central bank officials' comments come days after a U.S. Census Bureau data report showed consumer spending at the retail level rose more strongly than market consensus in March, suggesting resilience in consumer spending even as inflation remains persistent.

The strong U.S. retail sales figure, combined with last week's U.S. inflation numbers and earlier this month's hot job number, reinforced market expectations that the Fed may not move to lower interest rates as soon as the June meeting but rather have to wait further before starting to cut rates, probably toward late 2024.

Markets are now anticipating the first rate cut in July or September rather than June, CME's Fed Watch tool shows. The odds of a June rate cut are currently down to 6.5% from 59.1% one week ago.

As we advance, in the absence of any significant market-moving economic news data, the Treasury bond yields and the general market risk sentiment will continue to influence U.S. dollar dynamics and ultimately provide directional impetus to crude oil prices.

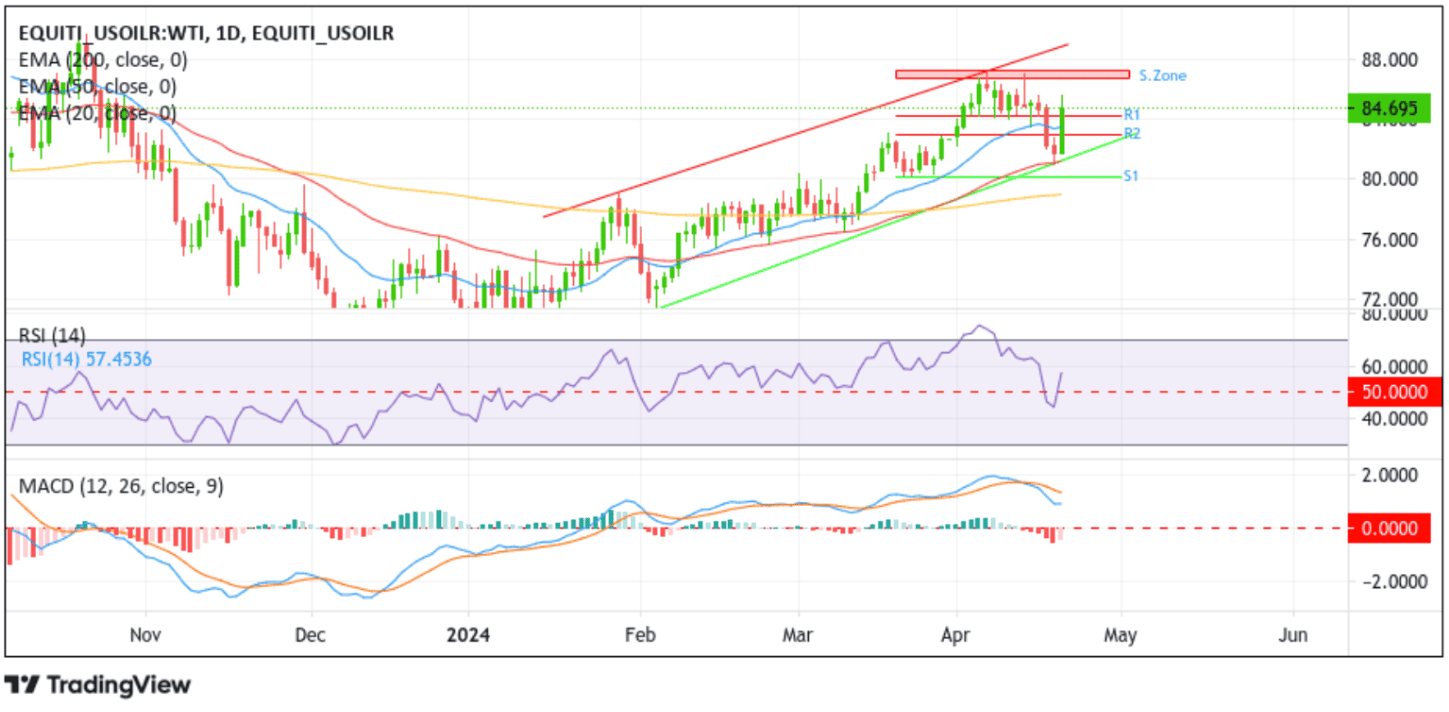

Technical Outlook: One-Day US WTI Crude Oil Price Chart

The U.S. WTI daily price chart shows crude oil price is heading for a further correction after the price found support from the lower limit of the multi-week ascending channel pattern and rebounded modestly, rising aggressively after that and breaking above two levels of resistance (83.008 and 84.116) before rising further to a session high of $85.58 and later pared gains and retraced to $84.000 levels.

That said, a further increase in buying pressure in the coming session would uplift spot prices toward the 86.675 - 87.190 supply zone. Sustained strength above this zone would pave the way for an acceleration of the bullish momentum toward the key resistance level (lower limit of the multi-week ascending channel pattern), about which, if the price pierces this barrier, attention will shift toward the $90.000 psychological mark.

On the flip side, if dip-sellers and tactical traders jump back in and trigger a bearish reversal, initial support comes in at the lower limit of the multi-week ascending channel pattern. A clean break below this level will pave the way for dip-selling around crude oil prices, accelerating the drop toward the $80.176 level en route to the $80.000 psychological mark. In highly bearish cases, crude oil prices could extend a leg down to tag the 200-day (yellow) EMA level at $79.118.