USD/JPY Drops To A New-Record Low Against The Dollar Around 156.000's On Post BoJ Decision Announcement, U.S Core PCE Index Eyed

Key Takeaways:

- The Japanese Yen drops to a new record low following the Bank of Japan Interest rate decision announcement.

- A modest U.S uptick helps exert upward pressure on the USD/JPY cross.

- Markets attention shifts towards the Fed’s preferred inflation gauge-Core PCE Price Index data report.

The Japanese yen weakened past the $156.000 mark on Friday during the Asian session, hitting a new record low as the Bank of Japan held interest rates steady during its April meeting

The Bank of Japan (BoJ) announced earlier today, at the conclusion of its two-day monetary policy meeting, that its Policy Board had voted unanimously to leave its overnight call rate unchanged at around 0% to 0.1% during its April meeting. The bank further confirmed it will continue to conduct bond purchases in accordance with the decisions made at the March meeting.

Friday’s decision was widely expected after the core consumer price index for the Ku-area of Tokyo in Japan fell sharply to 1.6% year-on-year in April 2024, hitting its lowest level since March 2022 and coming in way below forecasts of 2.2% due largely to distortions from the start of education subsidies.

Meanwhile, the U.S. dollar index, which measures the greenback against a basket of currencies, rebounded modestly on Friday during the early-Asian session and retook 105.600’s amid firm hawkish Fed expectations and reversed part of its previous day U.S. GDP-inspired losses.

A U.S. Bureau of Economic Analysis report released on Thursday showed the US economy expanded an annualized 1.6% in Q1 2024, compared to 3.4% in the previous quarter and below forecasts of 2.5%. It was the lowest growth since the contractions in the first half of 2022, the advance estimate showed.

That said, the divergence in monetary policy adoption between the Federal Reserve and the Bank of Japan is set to continue to undermine the Yen in the long run. The Fed is firmly expected to delay cut rates further, with the first cut seen likely during the September meeting.

This comes on the back of robust US economic indicators alongside assertive remarks from multiple Federal Reserve officials in recent weeks, which cemented market bets that the Fed will prolong its hawkish stance through 2024.

Going forward, investors look forward to the post-BOJ interest rate decision announcement press conference for some impetus. The main focus however, remains on the release of the U.S. Core PCE Price Index (MoM)-Fed’s preferred inflation gauge.

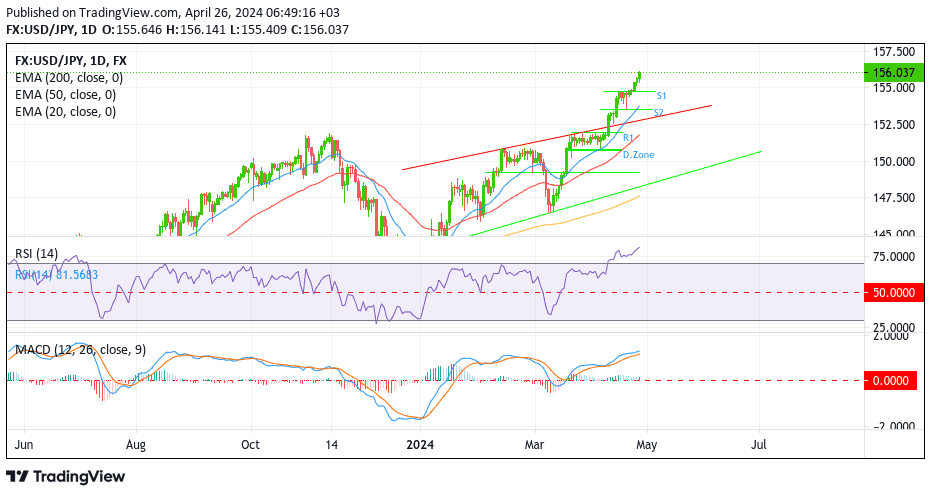

Technical Outlook One-Day USD/JPY Price Chart

From a technical standpoint, today’s earlier breach above the $156.000 psychological mark favours buyers and supports the case for further buying around the major currency pair. However, the RSI (14) technical oscillator on the daily chart is flashing extreme overbought conditions, warranting caution to traders against submitting aggressive bullish bets and wait for retracement moves or near-term consolidation before submitting further bullish bets.