Euro Stoxx 50 Index Rebounds From One-Month Low As ECB Signals More Rate Hikes

- Euro Stoxx 50 Index futures Rebounded on Friday in the aftermath of the latest ECB Interest Rate Decision

- ECB hikes rates see significant increases ahead as it announces plan to shrink the balance sheet

- ECB President Christine Lagarde Confirms they are not pivoting in her ECB Press Conference Speech

- The majority of Stocks in the Euro Stoxx 50 Index suffered heavy losses as a result of the ECB interest rate decision

The Pan-European Stoxx 50 Index futures Rebounded on Friday and edged higher during the Tokyo session in the aftermath of the latest ECB Interest Rate Decision. As per press time, the Euro Stoxx 50 index was up 0.36%/13.9bps at 3847.8 after declining by 3.14%/124.4 to close at 3833.4 after the European Central Bank raised its benchmark rate by 50bps and said significant further rate rises were ahead.

At its meeting on Thursday, the European Central Bank chose to increase its key interest rate by a smaller amount, bringing it from 1.5% to 2%. However, the bank might need to raise rates significantly to control inflation. In addition, the ECB announced that it will start decreasing its balance sheet by an average of 15 billion euros per month beginning in March 2023, continuing until the end of June 2023.

The anticipated increase of 0.50% in the interest rate is the fourth increase by the European central bank this year. This follows increases of 0.75% in October and September and 0.50% in July. These increases have brought the interest rate out of the negative territory for the first time since 2014. One basis point is equal to 0.01%.

We're not Pivoting

At a news conference, ECB President Christine Lagarde stated that the ECB is not changing its course and is determined to continue on its current path. She added that the ECB has more work to do than the Federal Reserve and is in for the long haul. The central bank also announced that it is revising its inflation forecasts for the eurozone upwards and expects inflation to remain above its 2% target until 2025. It predicts average inflation of 8.4% in 2022, 6.3% in 2023, 3.4% in 2024, and 2.3% in 2025. Despite this, the ECB expects the region to experience a relatively short and shallow recession.

It comes after the latest inflation data for the eurozone showed a slight slowing in price rises in November, although the rate remains at 10% annually.

Volkswagen and Italy's Enel Launch Joint Venture for High-Speed Charging

BERLIN (Reuters) - Volkswagen and Italy's Enel (MIL: ENEI) have formed a joint venture to build 3,000 high-speed charging points across Italy for electric vehicles (EVs), investing 100 million euros ($105.38 million) each, Volkswagen (ETR: VOWG_p) said on Tuesday.

The charging points will be accessible to drivers of cars made by all manufacturers at 500 locations by the end of 2023 and will have a capacity of up to 350 kW.

By the end of 2022, the carmaker and its partners will have installed 4,300 of the planned 18,000 fast-charging points in Europe, 3,700 of a planned 10,000 in the United States, and 8,000 of a planned 17,000 in China. That comes to 16,000 fast-charging stations globally, around a third of its goal of 45,000 by 2025.

Adyen NV Stocks Jumps After U.S CPI Falls in November

Dutch Payment firm Adyen NV(AS: ADYEN) jumped by more than 4% after critical U.S. data showed headline inflation in the world's largest economy fell by more than expected in November, boosting hopes that the Federal Reserve will slow its pace of interest rate hikes.

Deutsche Post Eyes Takeover of Deutsche Bahn’s Schenker-Manager Magazin

BERLIN (Reuters) - Deutsche Post (GER: DPWGn) subsidiary DHL is interested in buying Schenker, the logistics subsidiary of German rail operator Deutsche Bahn, Manager Magazin reported on Thursday, citing people familiar with the matter.

The report said Schenker could be sold at a price well below 20 billion euros due to a slowdown in the logistics sector.

In the Euro Stoxx 50 Index, most of the stocks have suffered heavy losses due to the ECB interest rate decision. The Top loser is led by Adyen NV(AS: ADYEN), which fell 8.66%/130.2 points to trade at €1373.80 per share. Kering SA (Paris: PRTP) shed 5.57%/29.20 points to trade €495.50 per share. Hermes International Societe(Paris: HRMS) closed the list after it declined by 5.01%/79 points to trade at €1499.0 per share.

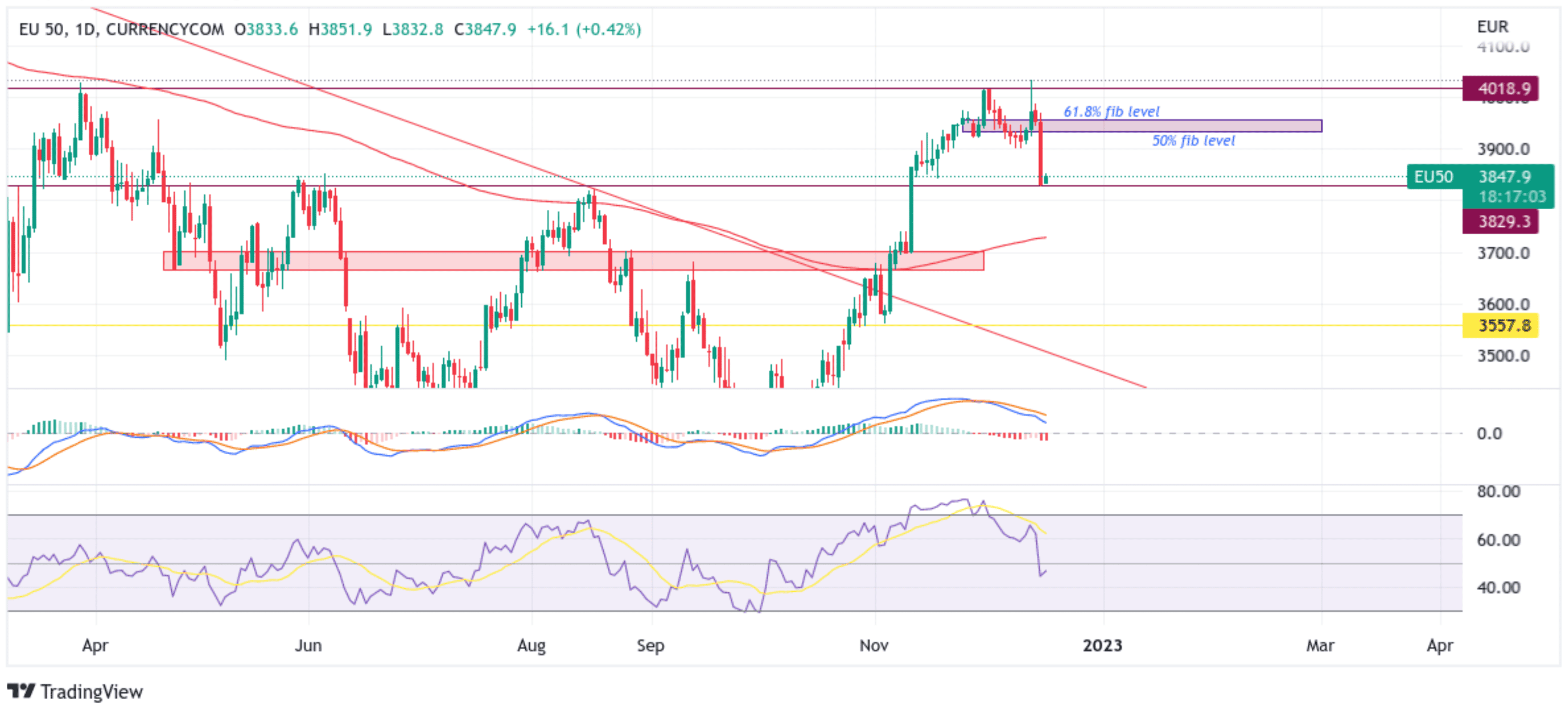

Technical Outlook: One-Day Euro Stoxx 50 Price Chart

From a technical perspective, the price rebounded from the vicinity of 3827.0 key support level. Subsequent follow-through buying would uplift spot prices to the immediate hurdle plotted by 50% and 61.8% Fibonacci retracement levels at 3929.9 and 3956.7, respectively. Sustained strength above this barricade would confirm a bullish momentum, and the Euro Stoxx 50 Index could appreciate further toward the 3997.5 key resistance level en-route the 4000.0 psychological mark. A convincing break above these levels would negate any near-term bearish outlook and pave the way for aggressive technical buying.

The RSI (14) at 45.65 is below the signal line and portrays a bearish filter. It will be prudent to wait for a further upside above the signal line before placing bullish bets. On the other hand, the Moving Average Convergence Divergence (MACD) Crossover is above the signal line, pointing to a bullish sign for price action this week; however, a move below the signal line would act as a trigger for sellers to push down the price.

On the Flipside, if dip-sellers and tactical traders jump in and trigger a bearish reversal, the price will first find support at the 3827.0 key support level. If sellers manage to breach this floor, the Euro Stoxx 50 Index could turn vulnerable and accelerate the downfall toward the key demand zone ranging from 3663.3 - 3704.4 levels. Still, it would need acceptance below the strong 200 Exponential Moving Average (EMA) at the 3727.7 level. On further weakness, the downside pressure could accelerate toward testing the 3568.1 support level.