Nasdaq 100 Index Moves Slightly Back Above 148000.0s But Lacks Bullish Conviction, Powell's Remarks At Wyoming Eyed

Key Takeaways:

- Nasdaq 100 futures rebounded in the early Asian trading session and moved slightly back above 148000.0; however, a further uptick seems elusive

- Firming market expectations of a 25 basis point rate hike by the Fed in its next meeting continue to undermine the Nasdaq100 index

- Autodesk, Inc. (NASDAQ: ADSK) and Dollar Tree, Inc. (NASDAQ: DLTR) led the list of top gainers and losers, respectively, before the bell

- Markets keenly await Fed Chair Jerome Powell's remarks at the Jackson Hole Symposium in Wyoming

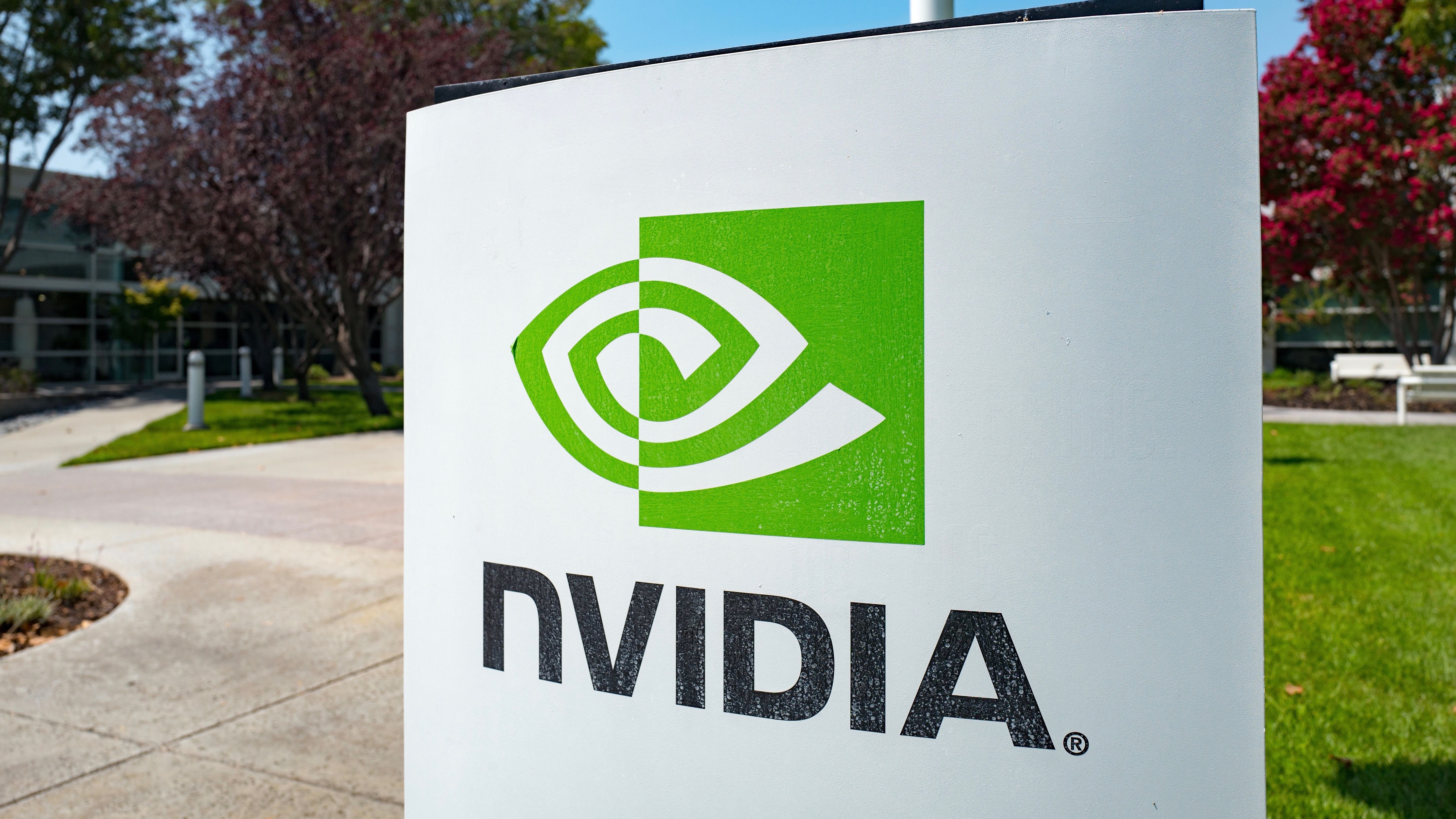

Nasdaq 100 futures edged slightly higher on Friday during the Asian session as investors continued to assess Nvidia's earnings report ahead of Fed Chair Jerome Powell's remarks on the Fed Reserve's Policy stance at the Jackson Hole Symposium in Wyoming.

As of press time, futures tied to the Nasdaq 100 have gained 0.12%/17.63 points to trade at the $14805.68 level. The move follows an overnight rebound from the vicinity of the $14771.35 level in the after-trading hours on Thursday. Additionally, the moves follow a lacklustre day on Wall Street, following a heavy sell-off for the better part of Thursday as the tech rally, sparked by stronger-than-expected Nvidia results, was short-lived. All three major U.S. stock indexes slipped more than 1.0%, erasing all their previous gains and closing with heavy losses.

American Chip company Nvidia shares reached an all-time high in extended trading on Wednesday after the company reported quarterly earnings and revenue that exceeded lofty analyst expectations. The company also raised its guidance, with executives predicting third-quarter revenue would climb to $16 billion, a year-over-year increase of 170%. Following the better-than-expected report, shares of the tech company rose by 0.6 but managed to reverse and close lower as the bullish momentum seems to have been short-lived.

That said, the current uptick can fizzle out sooner or later amid firming market expectations that the Federal Reserve (Fed) will hike interest rates one more time by 25 basis points (bp) either during the September or November meeting. This comes after August's FOMC Meeting Minutes report released last week on Wednesday showed Federal Reserve officials expressed concern at their most recent meeting about the pace of inflation and said more rate hikes could be necessary unless conditions change.

On the economic data front, new orders for manufactured durable goods in the US plummeted by 5.2% in July 2023, following a downwardly revised growth of 4.4% in June and exceeding market expectations for a 4.0% decline. Additionally, the number of Americans filing for unemployment benefits fell by 10,000 from the prior week's upwardly revised value to 230,000 on the week ending August 19th, below market expectations of 240,000. The results consolidated evidence that the US labor market remains historically tight, allowing the Federal Reserve to extend its hawkish momentum to curb inflation.

Gainers and Losers

Here are the top Nasdaq 100 Index movers today before the bell, a week in which the main index is set to close with heavy losses.

Top Gainers⚡

The top performers on the Nasdaq 100 Index were:

- Autodesk, Inc. (NASDAQ: ADSK) rose 2.07%/4.24 points to trade at $208.60 per share.

- Seagen, Inc. (NASDAQ: SGEN) added 1.08%/2.12 points to trade at $197.76 per share.

- Diamondback Energy, Inc. (NASDAQ: FANG) gained 0.53%/0.79 points to trade at $149.01 per share.

Top Losers💥

The worst performers on the Nasdaq100 Index were:

- Dollar Tree, Inc. (NASDAQ: DLTR) lost 12.90%/18.34 points to trade at $123.88 per share.

- AMD, Inc. (NASDAQ: AMD) declined 6.97%/7.63 points to trade at $101.80 per share.

- Marvel Technology, Inc. (NASDAQ: MRVL) shed 6.85%/4.21 points to trade at $57.29 per share.

As we advance, investors look forward to the release of the August Michigan Inflation and Consumer Expectations data reports. The main focus, however, remains on Fed Chair Jerome Powell's remarks at the Jackson Hole Symposium in Wyoming later today.

Technical Outlook: Four-Hour USTECH Price Chart

From a technical perspective, some strong follow-through buying would face initial resistance at the 14964.78 level, which sits below the 20 (blue) and 50 (red) day Exponential Moving Average (EMA) crossover at the 15018.60 level. Acceptance above these barricades will pave the way toward the technically 200-day solid (yellow) EMA level at 15128.20. A convincing move above this EMA level will provoke an extended rally toward the 50 (red) and 200 (yellow) day EMA confluence levels at 15231.09. A subsequent move above this EMA level would reaffirm the bullish bias and pave the way for a further ascent toward the 15367.39 level, about which, if the Nasdaq 100 index price pierces this ceiling, it would pave the way for further gains around the main index.

On the flip side, if sellers resurface and spark a bearish turnaround, initial support comes in at the upward-ascending trendline extending from the mid-August 2023 swing low. A subsequent break below this support level will pave the way for a drop toward the 14553.69 support level. If sellers manage to breach this key floor, downside pressure could accelerate further, paving the way for further losses around the Nasdaq 100 index.