H.K. 50 Index Slides Below 17200.00 Mark As Fears Of More Rates Hikes Weigh On The Markets

Key Takeaways:

- China's main stock index declined below the 17200.00 mark on Friday, extending Powell's Speech inspired losses

- Fed Chair Powell signalled the Fed is not done with monetary policy tightening but downplayed a November rate hike

- China Vanke Co. Ltd. (Shenzhen: 000002) and China Life Insurance Co. Ltd. (Shanghai: 601628) led the list of top gainers and losers in the current trading session

China's main stock index slid on Friday during the Asian session, extending Thursday's broad sell-off to drop to a fresh weekly low and clinch its worst week in more than a month before paring losses. Hong Kong's Hang Seng Index (H.K. 50) slid over 0.8%/(137.8 points) before paring losses to settle below the 17200.00 level. Today's southside move follows a negative day on Wall Street as Powell's comments and rising bond yields weighed on markets.

During a speech at the Economic Club of New York on Thursday, Federal Reserve Chairman Jerome Powell acknowledged recent signs of cooling inflation but said that the central bank would be "resolute" in its commitment to its 2% mandate. "Inflation is still too high, and a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal," Powell said in prepared remarks. "We cannot yet know how long these lower readings will persist, or where inflation will settle over coming quarters." "While the path is likely to be bumpy and take some time, my colleagues and I are united in our commitment to bringing inflation down sustainably to 2%," Powell added. Powell said he doesn't think rates are too high now. "Does it feel like policy is too tight right now? I would have to say no," he said. Still, he noted that "higher interest rates are difficult for everybody." Powell further said the Fed is "proceeding carefully" in evaluating the need for further rate increases. This remark left expectations that the Fed will keep its benchmark policy rate steady at the current 5.25% to 5.5% range at the November meeting.

Powell's remarks closely match those of his colleagues who have, in the past few weeks, softened their stance on an aggressive approach toward tackling stubborn inflation in the U.S. and have advocated for a second consecutive dovish pause during the November meeting. Noteworthy, Philadelphia Federal Reserve President Patrick Harker stated on Monday that interest rate hikes are likely over and that the U.S. central bank should hold rates steady in the absence of some turn in the data.

Following Powell's remarks, the yield on the 10-year Treasury crossed 5% for the first time since July 20, 2007, when it yielded as high as 5.029%. The 2-year Treasury yield, on the other hand, which is more susceptible to fed rate yikes, fell 6 basis points to 5.16% after hovering at levels last seen in 2006 earlier in the session.

Softer Japanese inflation readings released earlier today were another factor that weighed on the main index. The core consumer price index for the Ku-area of Tokyo in Japan rose 2.5% year-on-year in September 2023, slowing for the third consecutive month and coming in below forecasts of 2.6%, a Statistics Bureau of Japan report showed.

The Japan inflation data report comes on the heels of a better-than-expected Chinese GDP report released on Wednesday, which showed the Chinese economy expanded by 4.9% yoy in Q3 2023, beating market forecasts of 4.4% and offering hopes that it will meet the official annual target of around 5% this year, as sustained stimulus from Beijing offset the impact of a prolonged property crisis and weak trade.

Additionally, the Japan National Core CPI data comes after the People's Bank of China (PBoC) held steady lending rates at the October fixing, as widely expected. The one-year loan prime rate (LPR), the medium-term lending facility used for corporate and household loans, was left unchanged at a record low of 3.45%, and the five-year rate, a reference for mortgages, was maintained at 4.2% for the fourth straight month. That said, the current price action suggests that the main stock index has taken little support from the People's Bank of China move.

Gainers and Losers

Here are the top HK50 index movers at the current trading session, a week in which the primary index is set to close with heavy losses.

Top Gainers⚡

The top performers on the HK50 Index were:

- China Vanke Co. Ltd. (Shenzhen: 000002) rose 2.53%/0.29 points to trade at ¥11.75 per share.

- China Merchants Shekou Co. Ltd. (Shenzhen: 001979) added 1.28%/0.15 points to trade at ¥11.82 per share.

- Baoshan Iron & Steel Co. Ltd. (Shanghai: 600019) gained 0.69%/0.04 points to trade at ¥5.88 per share.

Top Losers💥

The worst performers on the HK50 Index were:

- China Life Insurance Co. Ltd. (Shanghai: 601628) lost 3.64%/1.31 points to trade at ¥34.69 per share.

- China Pacific Insurance (Group) Co.Ltd. (Shanghai: 601601) declined 3.30%/0.97 points to trade at ¥28.41 per share.

- China United Network Comm. Ltd. (Shanghai: 600050) shed 5.84%/0.64 points to trade at ¥4.79 per share.

As we advance, growing fears of rising interest rates following sticky inflations abroad are set to continue to bode poorly for Asian markets, given that they diminish the returns from more risk-driven assets. Tighter monetary conditions also limit foreign capital flows into the region.

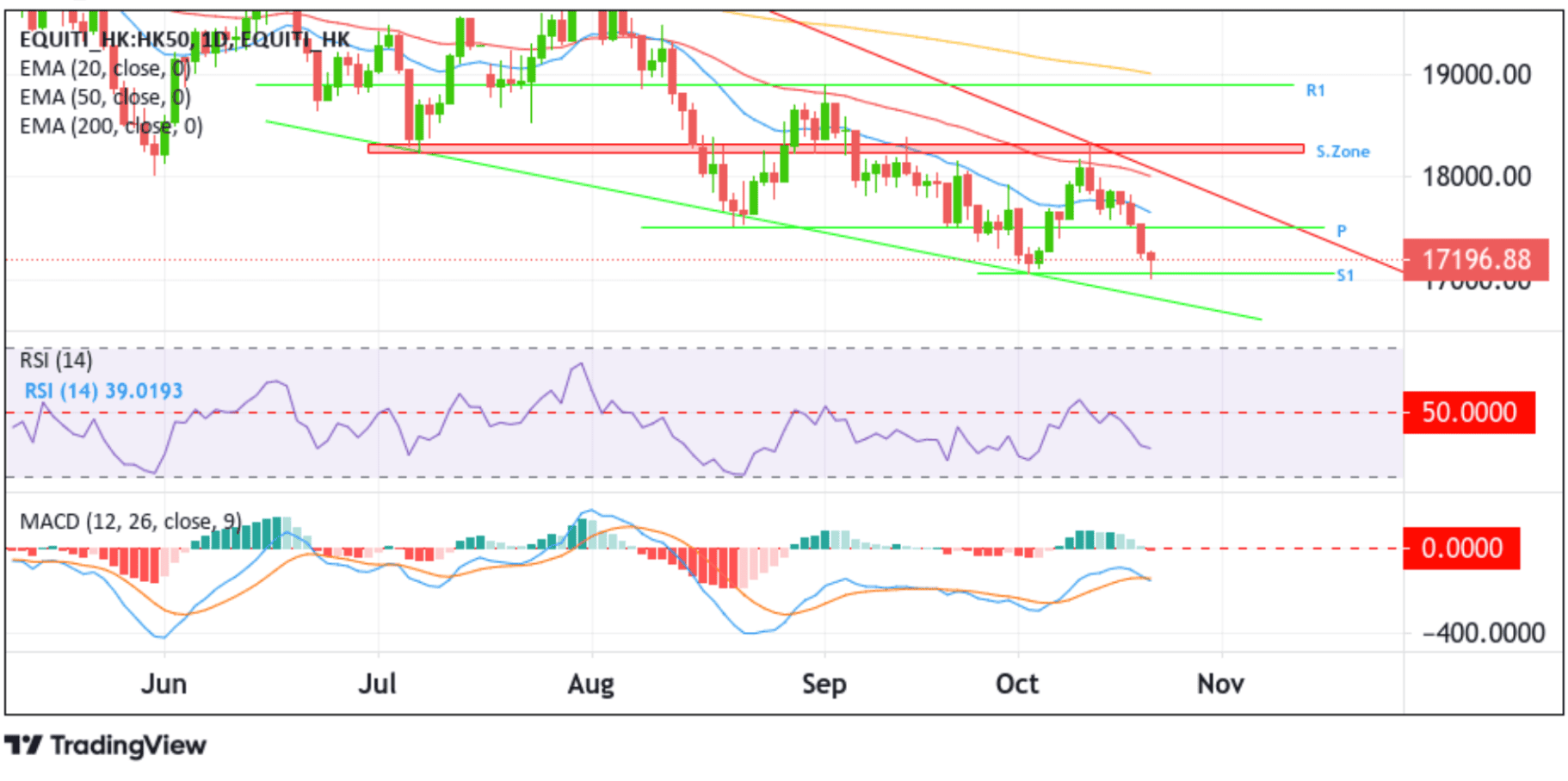

Technical Outlook: One-Day HK50 Index Price Chart

From a technical standpoint, the price's ability to break below the key pivotal level at the 17524.30 level supported the case for a further downside move. Sellers have heeded the call to place further SHORT positions upon receiving confirmation from the technical oscillators (RSI (14) and MACD), which are in deep bearish territory and suggest continuing the bearish price action. Some follow-through selling will drag spot prices back toward the 17064.05 support level (S1). A convincing move below this level will pave the way for an accelerated decline toward the key support level plotted by a downward-sloping trendline extending from the early July 2023 swing low. A subsequent break below this level would reaffirm the bearish bias and pave the way for dip losses around the main index.

On the flip side, any attempted recovery by bulls might face resistance at the 17524.30 level. If the price pierces this barrier, the focus will shift higher toward the key resistance level plotted by a downward-sloping trendline extending from the early-August 2023 swing high, which sits above the 20 (blue) and 50 (red) days EMA levels at 17656.75 and 18012.07 levels, respectively. Acceptance above these barricades will pave the way for an ascent toward the supply zone, ranging from 18240.50 - 18354.71 levels. Sustained strength above this zone will pave the way for an extension of the bullish trajectory toward the next relevant resistance level (R1) at 18887.10.