HK50 Index Extends Losses Below Mid 17000.00 Mark Weighed By Alibaba's 10% Stock Value Plunge

Key Takeaways:

- China's main stock index declined below the 17000.00 mark on Friday, extending Alibaba's stock value plunge inspired losses

- Alibaba announced on Thursday that it would not proceed with the complete spinoff of its cloud group due to U.S. chip export restrictions; this weigh heavily on the main index

- NetEase, Inc. (Hong Kong: 9999) and Alibaba Group Holding. Ltd. (Hong Kong: 9988) led the list of top gainers and losers in the current trading session.

China's main stock index slid lower on Friday during the Asia-Pacific session, extending Thursday's broad sell-off after a solid start to the week as plunging shares of Alibaba in early trading on Friday weighed heavily on the main index. As of press time, Hong Kong's Hang Seng Index (H.K. 50) fell 0.86%/(157.2 points)

to trade at the 17474.38 level. The moves follow after-hours trading losses on Thursday as Asian stocks sold following Alibaba's announcement that it would not proceed with the complete spinoff of its cloud group due to U.S. chip export restrictions as well as tracking U.S. stocks as weaker-than-expected U.S. initial jobless claims pointed to a softening in the U.S. labor market, which weighed on American stocks.

China's e-commerce giant Alibaba, in its earnings release on Thursday, said that it would no longer proceed with a spinoff of its Cloud Intelligence Group — the cloud computing arm of Alibaba that competes with Amazon Web Services and Microsoft Azure. Alibaba had planned to list the division publicly.

Alibaba said U.S. chip export restrictions have made it harder for Chinese firms to get critical chip supplies from U.S. companies. In October, the U.S. barred sales of Nvidia's advanced artificial intelligence-focused H800 and A800 chips.

"We believe that a full spin-off of Cloud Intelligence Group may not achieve the intended effect of shareholder value enhancement," the company said. It would instead focus on developing a sustainable growth model for the unit "under the fluid circumstances."

Following the announcement, Alibaba shares tumbled close to 10% in early Hong Kong trading on Friday. In comparison, U.S.-listed shares of Alibaba closed over 9% lower on Thursday after falling over 10% since the start of this year. Moreover, the broader main index tumbled almost 3.8%, with domestic stocks leading the drop to close on Thursday with heavy losses below the 17700.00 mark.

That said, high-level talks between U.S. and Chinese leaders, to a greater extent, failed to offer any support to the Asian stock markets, contrary to market expectations, as while the countries agreed to reopen military communications, U.S. President Joe Biden referred to his Chinese counterpart Xi Jinping as a "dictator," somewhat dampening sentiment over their meeting.

Gainers and Losers

Here are the top HK50 index movers at the current trading session, a week in which the primary index is set to close with modest losses.

Top Gainers

The top performers on the HK50 Index were:

- NetEase, Inc. (Hong Kong: 9999) rose 2.62%/4.60 points to trade at ¥180.30 per share.

- Hansoh Pharmaceutical Group Co. Ltd. (Hong Kong: 3692) added 0.97%/0.14 points to trade at ¥14.58 per share.

- Xiaomi Corp. (Hong Kong: 600019) gained 0.64%/0.10 points to trade at ¥15.80 per share.

Top Losers

The worst performers on the HK50 Index were:

- Alibaba Group Holding. Ltd. (Hong Kong: 9988) lost 10.08%/8.20 points to trade at ¥73.15 per share.

- Alibaba Health Information Tech.Ltd. (Hong Kong: 0241) declined 7.55%/0.37 points to trade at ¥4.53 per share.

- Baidu, Inc. (Hong Kong: 9888) shed 5.70%/6.20 points to trade at ¥102.60 per share.

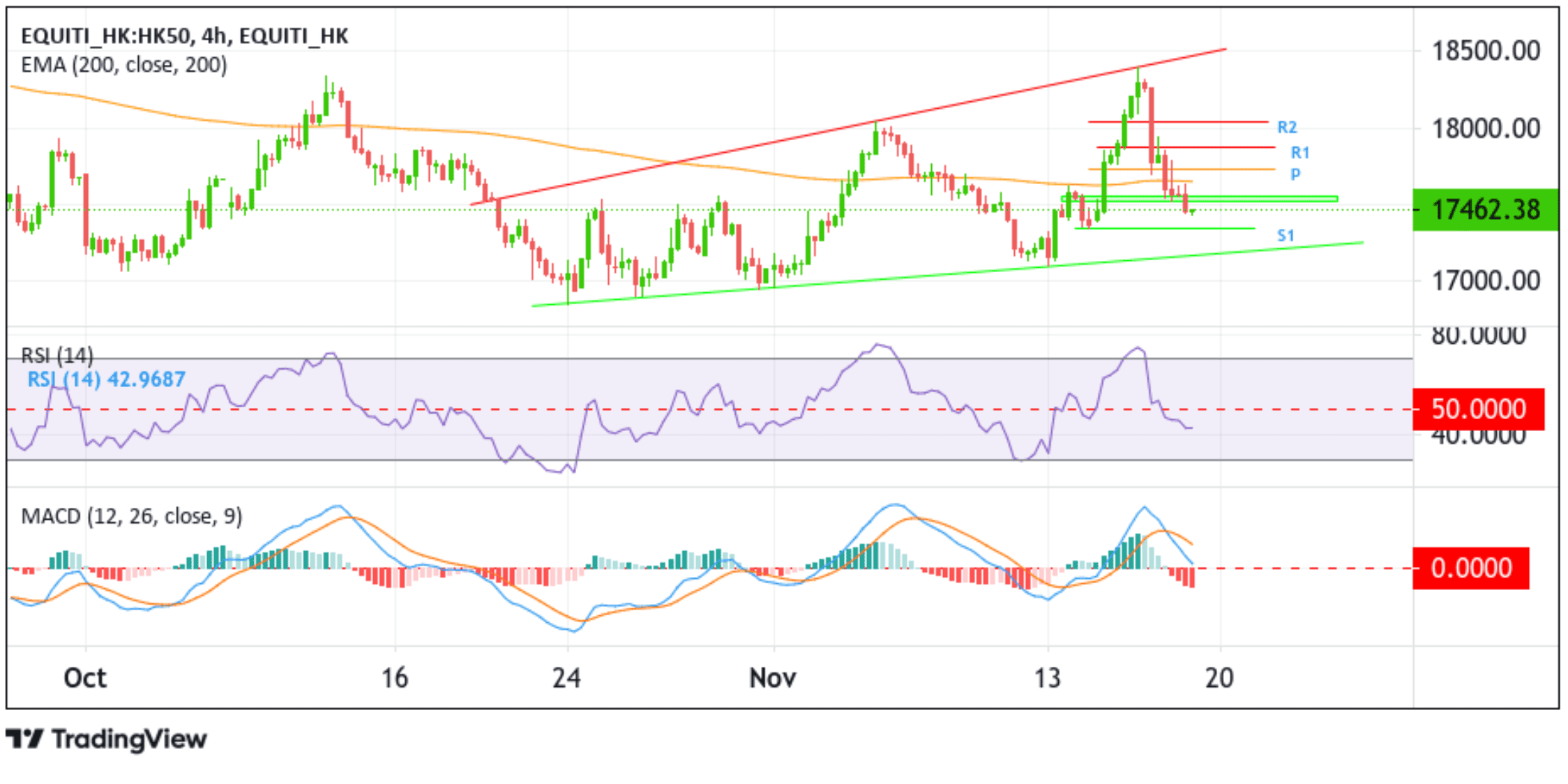

Technical Outlook: Four-Hours HK50 Price Chart

From a technical standpoint, the main index's ability to break below the pivot level (P) at 17740.94, which coincides with the 50% Fibonacci retracement level, followed by acceptance below the technically strong 200-day (brown) Exponential Moving Average (EMA) at 17647.58 level, favored sellers and supported the case for a break below the demand zone ranging from 17557.84-17524.4 levels and the follow-through selling thereafter. A further increase in selling pressure would drag spot prices toward the 17343.87 support level (S1), about which, if sellers manage to breach this floor, downside pressure could accelerate further, paving the way for a drop toward the key support level plotted by an ascending trendline extending from the late-October 2023 swing low. A subsequent break below this level would reaffirm the bearish thesis and pave the way for dip losses around the main index.

On the flip side, if dip buyers and tactical traders jump back in and trigger a bullish reversal, initial resistance comes in at the 17557.84-17524.4 demand zone. Sustained strength above this zone will see the index ascend toward tagging the 200-day (brown) EMA level. Acceptance above this level would negate the bearish outlook and pave the way for a move toward the 50% Fib level. If the price pierces this barrier, buying interest could gain further momentum, paving the way for a rally toward the 17868.58 support level (R1), followed by the 18034.80 resistance level (R2), and in highly bullish cases, the main index could extend the bullish trajectory toward the key resistance level plotted by an ascending trendline extending from the early-November 2023 swing high.