EUR/CAD Bulls Snab Loonie's Attempted Channel Breakout Amid Declining Oil Prices

- EUR/CAD Cross Attracts fresh buying on Thursday to lift off spot prices to a new Daily High.

- Softer European Inflation Figures undermine the Euro and cool expectations for more aggressive interest rate hikes by the European Central Bank.

- ECB President Christine Largade on Monday assured markets they are determined to take the necessary measures to bring inflation to control

- The modest intraday downtick in Crude Oil prices undermine the Loonie

EUR/CAD cross came under renewed buying pressure on Thursday after attracting bullish bets during the early hours of the Asian session to lift off spot prices from the vicinity of the 1.39596 level. At the time of speaking, the pair is up over 30 pips for the day and has recovered part of its lost ground witnessed in the last two days. The shared currency looks set to maintain its offered tone going forward to the European session.

On the Eurozone front, Germany's seasonally adjusted unemployment rate increased to 5.6 percent in November 2022 from 5.5 percent in the previous month to slightly above the market consensus of 5.5 percent. It was the highest jobless rate since July 2021, as the unemployed increased by 17 thousand to 2.538 million.

Furthermore, the Annual inflation rate in the Euro Area eased to 10% in November of 2022 from a record high of 10.6% in October, beating market forecasts of 10.4%, preliminary estimates released by Eurostat on Wednesday showed. However, the Core CPI, which excludes prices for energy, food, alcohol & tobacco, was steady at a record high level of 5% in November of 2022, in line with forecasts, preliminary estimates showed. The data might have cooled expectations for more aggressive interest rate hikes by the European Central Bank, which, in turn, undermines the shared currency and exerts some pressure on the EUR/CAD cross.

ECB President Christine Largade, however, in a speech at the Hearing of the Committee on Economic and Monetary Affairs of the European Parliament on Monday. They are committed to bringing inflation down to their medium-term target and are determined to take the necessary measures. They expect to raise rates further to the levels needed to ensure that inflation returns to their 2% medium-term target in a timely manner". This, in turn, was seen as a key factor that supported the major despite the soft eurozone inflation figures.

That said, the modest intraday downtick in Crude Oil prices weighs down on the Loonie, which tends to undermine the commodity-linked Loonie. Worries that fresh COVID-19 curbs in China will dent fuel demand overshadow speculations that OPEC will announce more supply cuts at its meeting on Sunday. This, in turn, fails to assist the black liquid in capitalizing on this week's solid recovery move from the YTD low.

Additionally, The Canadian economy likely stagnated from the previous month in October of 2022 as expansion in the transportation and warehousing, construction, and wholesale trade sectors offset contractions in manufacturing, mining and quarrying, and oil and gas extraction sectors, according to preliminary estimates released last week by Statistics Canada. In September, the economy had expanded by 0.1%, in line with preliminary estimates, and slowing from the upwardly revised 0.3% advance in August. However, the Canadian economy grew 0.7% on quarter in Q3 2022, a fifth consecutive quarter of growth, following a 0.8% increase in Q2. Growth in exports, non-residential structures, and business investment in inventories were moderated by declines in housing investment and household spending.

As advance investors look forward to the European docket featuring the German Retail Sales (YOY) release, it is expected to show an improved performance in the german retail sector and land at -2.8%, up from -0.9% in October. Traders will further take cues from the release of the S&P Global Manufacturing PMI (NOV) from both dockets and are expected to remain unchanged at 47.3 and 47.6 for the eurozone and Canada, respectively.

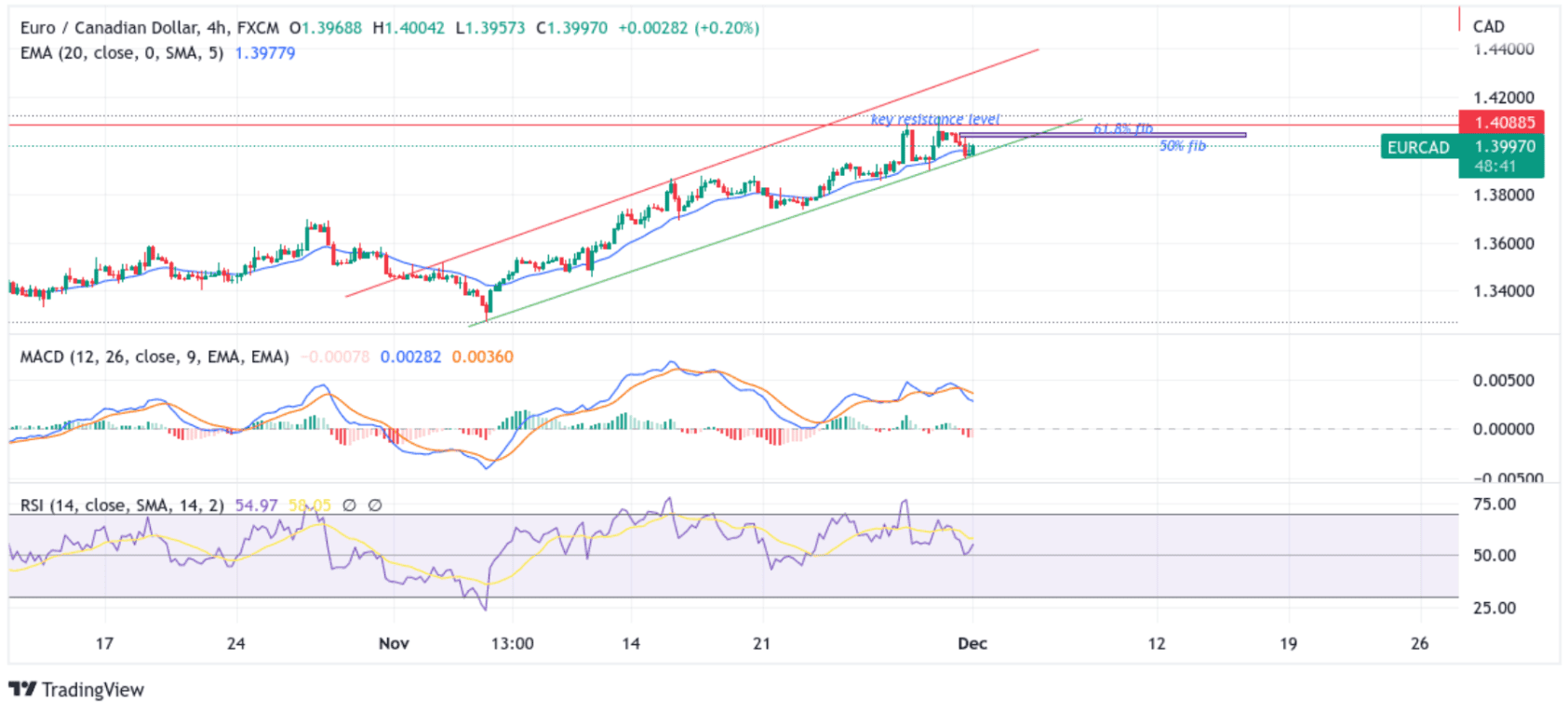

Technical Outlook: Four-Hours EUR/CAD Price Chart

From a technical standstill using a four-hour price chart, the price rebounded modestly from the key support level(lower trendline of the ascending channel pattern formation plotted from the 4th November 2022 swing low). Some follow-through buying would uplift spot prices to the immediate hurdle; the 50% and 61.8% Fibonacci retracement levels at 1.40334 and 1.40552 levels, respectively. Sustained strength above the aforementioned barricades would be a new trigger for bulls to continue pushing up the price and pave the way for additional gains. The upside trajectory could then accelerate toward testing last month's monthly high at the 1.41070 level, which forms a key resistance level.

All the technical oscillators are in positive territory, with the RSI (14) at 54.97 above the signal line portraying a bullish filter, while the Moving average convergence divergence (MACD) crossover is above the signal line adding further credence to the upside bias.

On the flip side, any meaningful pullback now finds some support at the key support level(lower trendline of the ascending channel pattern formation plotted from the 4th November 2022 swing low). If sellers manage to breach this floor(bearish price breakout), downside pressure could accelerate, paving the way for a drop toward the key demand zone ranging from 1.38519 - 1.38730 levels.

On further weakness, the focus shifts downwards toward the 1.37346 support level.